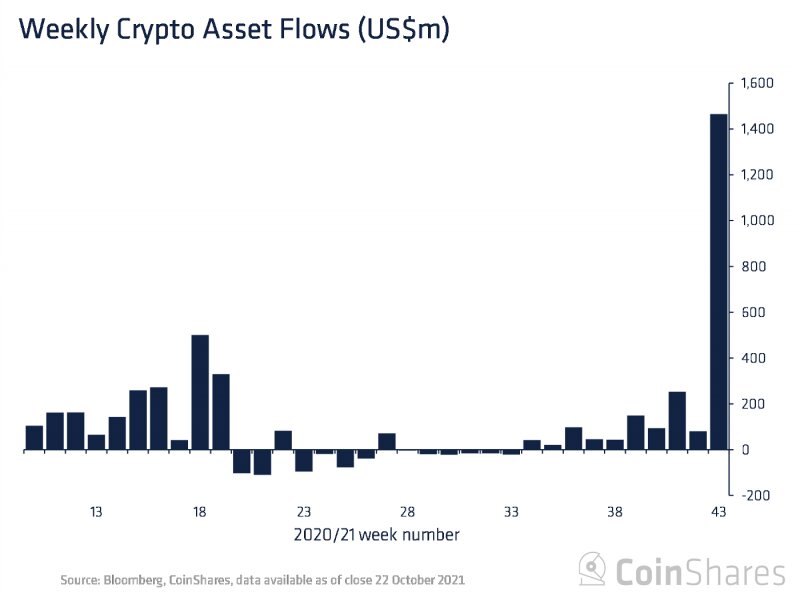

Investors poured a record $1.5 billion into the cryptocurrency market last week, as the first-ever Bitcoin ETF kicked off trading, with the underlying asset itself hitting an all-time high, digital asset manager CoinShares’ report said on Monday.

The 10th straight week of inflows was also the largest ever, far surpassing the prior weekly record of $640 million set in February.

Investments into crypto funds and assets continue to roll with even more impressive strides as investors put a record $1.47 billion into digital asset investment products last week. Moreover, the total crypto assets under management (AUM) also reached a new record of $79.2 billion during the week before closing the weekend at $76.7 billion, according to the data shared in the CoinShares’ weekly report on digital asset fund flows.

As the report said, the surge in investments and AUM has been on the back of all-time high growth witnessed in Bitcoin prices and the US Securities & Exchange Commission (SEC) allowing a Bitcoin Exchange Traded Fund (ETF) and the following consequent listing of two Bitcoin investment products with inflows worth $1.24 billion.

“The cryptocurrency industry has waited for what feels like a very long time,” said Adam James, senior analyst at OKEx Insights, the research arm of crypto exchange OKEx. “Though ProShare’s offering is technically a futures-backed ETF, it still represents a milestone in bitcoin’s history.”

(Source: CoinShares )

With Bitcoin becoming more and more popular among institutional investors, some altcoins are going through outflows. Altcoins, including Solana, Cardano, and Binance, saw inflows totaling $8.1 million, $5.3 million, and $1.8 million, respectively. Litecoin, Polkadot, Ripple, Bitcoin Cash also recorded inflows while Ethereum saw outflows for a third consecutive week totaling $1.4 million.

(Source: CoinShares )

Though the biggest altcoin out there is being dropped by institutions, other altcoins like Solana, Cardano, and BNB are still a popular choice with a total of $15.2 million in funds flow. In total, altcoins bring around $15 million to the cryptocurrency market, which is almost a nonexistent value compared to Bitcoin’s $1.47 billion.

Bitcoin soared above $66,000 at its high point last week, representing a 50% gain in the space of a month while the benchmark S&P 500 has climbed roughly 4%.

Assets under management at Grayscale and Coinshares, the two largest digital asset managers, climbed last week to $54.6 billion and $5.2 billion, respectively.