Once dismissed as a fringe asset of cypherpunks and tech enthusiasts, Bitcoin has climbed through milestone after milestone, from $1 in 2011 to $1,000 in 2013, and now to the coveted six-figure mark in 2024.

Bitcoin’s latest ascent speaks to its evolution from a curious experiment to a legitimate global financial asset.

But the journey to $100,000 was far from a field of green candles. The cryptocurrency has been declared “dead” more times than one can count, yet it rose from its grave every time.

“We have two to three good years to prove that crypto can change the world for the better. This is the final chance, and this time, we have a tailwind,” Mikko Ohtamaa, co-founder of algorithmic trading firm Trading Strategy, told Cointelegraph.

“The last 10 years have been pure speculation. Now is time to go from speculation to real-world utility.”

This latest bull run stands out due to some key differences.

Bitcoin today is not just another speculative asset — it’s widely viewed as a safe haven, a hedge against inflation, and a recognized asset class with a growing institutional base.

Spot-based exchange-traded funds (ETFs) in major economies such as the United States and Hong Kong have made it more accessible than ever, and the recent election of crypto-friendly presidential candidate Donald Trump in the US has rolled out the red carpet for the cryptocurrency industry.

Trump’s campaign included promises to replace Securities and Exchange Commission Chair Gary Gensler, a figure seen as an antagonist in the crypto space due to his strict enforcement approach.

Investors are hopeful this shift could reduce regulatory roadblocks, fostering a friendlier environment for crypto assets. Gensler’s tenure, marked by a “regulation by enforcement” approach, has been widely criticized by the industry for lack of legal clarity.

The journey to $100,000 started with a single crash

Bitcoin’s journey to $100,000 has been anything but linear. It’s been a path marked by wild price swings, market crashes and, at times, existential doubt.

Among its most notable near-death experiences was after Bitcoin first hit $1,000 in 2013 before tumbling to $200 in 2014. The collapse of Mt. Gox, the world’s largest Bitcoin exchange at the time, loomed large over this period, and its creditor payouts are still news today, a decade later.

In December 2017, Bitcoin reached new heights of nearly $20,000, buoyed by the initial coin offering (ICO) boom. However, regulatory crackdowns soon followed, with the US treating ICOs as unregistered securities offerings and China outright banning them. By December 2018, Bitcoin was trading at $3,200.

Bitcoin’s next major resurgence came in 2021, reaching $63,000 as institutions and high-profile firms such as Elon Musk’s Tesla added fuel to the rally.

But regulatory pressure once again dampened enthusiasm: China imposed a crackdown on Bitcoin mining, leading to a steep drop to $29,000. Following a new high of $69,000 in November 2022, Bitcoin tumbled to a low of $15,000 amid broader crypto industry turmoil from FTX’s collapse, Three Arrows Capital’s implosion, and the Terra-Luna stablecoin crisis.

Now, in 2024, Bitcoin has surged back. The SEC’s approval of spot Bitcoin ETFs in January opened the doors to broader participation, and Trump’s election in November has supercharged the rally.

“What’s propelling us now are factors like ETF accessibility, corporate buy-ins and growing allocations from institutions across the globe,” Hong Kong-based market analyst Justin d’Anethan told Cointelegraph. “The shift away from the dollar in BRICS economies also adds a layer of intrigue, positioning Bitcoin as a potential hedge in a world reassessing the role of traditional reserve currencies.”

What does $100,000 mean for Bitcoin?

For Bitcoin bulls, $100,000 is more than just a number. It’s a psychological checkpoint that validates years of “laser eye” fervor — a social media trend where Bitcoin supporters donned laser-eyed profile pictures to signal their faith in this milestone.

But as d’Anethan explained, $100,000 isn’t the end goal.

”Over the past year, the rise has been largely driven by sophisticated players: we’ve seen corporate treasuries (mainly MicroStrategy), ETFs pop up, and even pension funds starting to allocate to BTC, all with limited fanfare,” he said.

“Retail investors have yet to pile in, and when that euphoria hits, it won’t stop at $100,000.”

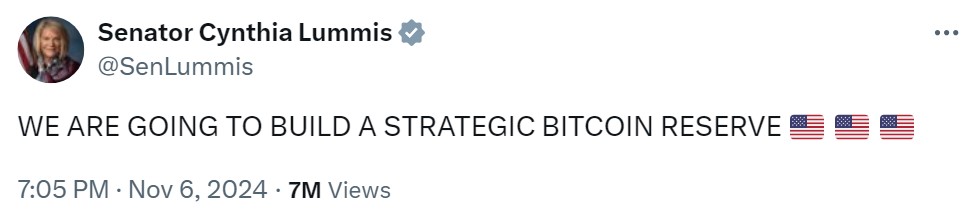

Trump’s campaign also floated the idea of a strategic Bitcoin reserve, which has stirred mixed reactions.

Some view it as a move toward centralization, while others, like Bitcoin marketplace Magisat founder Quary, see it as neutral to Bitcoin’s decentralized ethos.

“Who holds Bitcoin doesn’t really affect the network in any way,” Quary told Cointelegraph.

“Hopefully, both US and BRICS (Brazil, Russia, India and China) have similar interest in Bitcoin and both own big stakes in Bitcoin. That’s the best case scenario in my opinion — an unbiased decentralized network where all powers can partake.”

Where does Bitcoin go from here?

Hitting $100,000 is a symbolic achievement, but for many, it signals the beginning of Bitcoin’s larger story.

In the near short term, with the US Federal Reserve’s anticipated continued pivot toward rate cuts, Bitcoin could find itself in a favorable macro environment for risk assets.

“As long as we don’t face a major liquidation from 2022’s bankruptcies or an unforeseen black swan, the path of least resistance seems up,” d’Anethan said.

However, as history shows, Bitcoin’s trajectory is rarely a smooth upward line. Corrections are likely, even amid positive momentum.

In a world of shifting economic powers and evolving monetary policies, Bitcoin has transformed from a niche asset into a viable financial alternative.

Whether it’s a hedge against inflation, a safe haven or a symbol of financial sovereignty, Bitcoin’s climb to $100,000 is a clear signal: The era of cryptocurrency is here to stay, with all its volatility, complexity and transformative potential.

Source: https://cointelegraph.com/news/100k-bitcoin-btc-price-investment