The crypto market has just clocked its largest three-day sell-off in almost a year, shedding $313 billion since Aug. 2.

The sharp crypto sell-off arrived amid faltering performance from equities with the S&P 500 falling as much as 4.4% in the same time frame.

The market stumble has been led by weak employment data, slowed growth among major tech stocks, and revived fears of a recession.

Several major companies including Microsoft and Intel posting lower-than-expected Q2 results and market leader NVIDIA battered by expectations of impending rate cuts in September, something that has seen capital flow back into smaller, lagging companies.

The last time crypto sold off this sharply was in mid-August, 2023.

Layer-1 network Solana was the hardest-hit cryptocurrency among the top 10 largest tokens by market cap, falling 25.7% from $184 to $137 since July 30.

Meanwhile, Bitcoin and Ether also tumbled, plunging 14% and 17% respectively in the same time frame.

Several market commentators have also looked to a spate of selling from Jump Crypto as an aggravating factor, with the trading firm offloading hundreds of millions of dollars in assets from their books in the last several days, per Arkham Intelligence data.

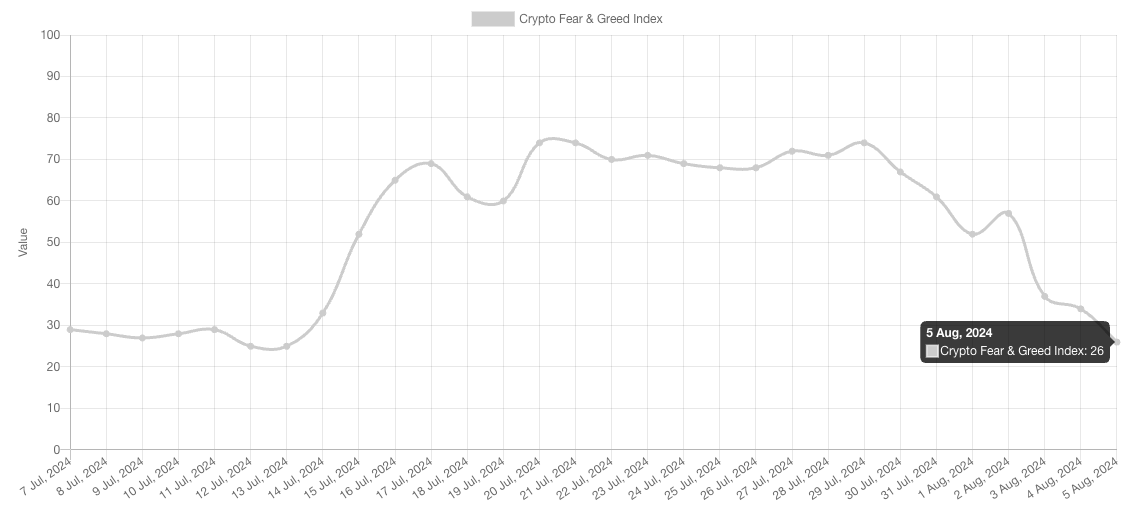

The Crypto Fear and Greed Index — an indicator that tracks market sentiment toward Bitcoin and crypto — has fallen back into “fear” and currently displays a score of 26 at the time of publication, according to Alternative.me data.

Moving forward, the crypto market is staring down the barrel of another tough week with much of the losses incurred over the weekend needing to be bolstered by an uptick in spot and derivatives activity from traditional financial institutions.

“Bitcoin has entered the CME Gap, but technically, it can only be filled during TradFi trading hours,” Keith Alan, co-founder of trading resource Material Indicators, wrote in his latest X post on Aug. 4.

Source: https://cointelegraph.com/news/crypto-crash-300-billion-largest-three-day-plunge-crypto-one-year