Getting to grips with cryptocurrency isn’t easy. Even after you’ve got your head around Bitcoin and Ethereum and the difference between proof-of-work and proof-of-stake, there’s still a whole new world of terminology to learn and understand.

But even among fairly hardened cryptonians, there are still terms that are difficult to understand. Here are the seven terms that almost nobody in blockchain understands as fully or as deeply as they’d like.

Blobs

In the 1958 movie starring Steve McQueen, and its 1988 remake, The Blob is an amoeba-like jello monster that terrorizes the inhabitants of a small town, growing larger and redder as it consumes them.

In crypto, most especially Ethereum, blobs (Binary Large Objects) are substantial chunks of data not required by Ethereum’s electronic virtual machine (EVM). Blob data is held onchain for around 20-90 days and then deleted.

The result is a more cost-effective and scalable blockchain. As part of Ethereum’s Dencum update, blobs are often discussed in parallel to the next term on this list.

Blobs may also refer to chunks of data held on decentralized storage systems such as IPFS or Filecoin. These blobs are encrypted and stored across multiple nodes.

Finally, blobs can also refer to transaction blobs on Monero, which is the binary data of a transaction before it is broadcast to the network. Being that Monero is a privacy chain these blobs are structured in a way to maintain anonymity.

And that’s a whole lot of blobs.

Rollups

Rollups are a way of processing transactions on layer-2 protocols, freeing up valuable space on the base layer. A rollup folds transaction upon transaction on the layer-2 level, sometimes dozens of times over, then rolls them together before sending the data back to layer-1.

There are two main types of rollups, optimistic and zero-knowledge (ZK) proofs.

Optimistic rollups is a fairly clear term. It means the rollup operates on an “optimistic” approach, assuming a transaction is valid unless proven wrong by a validator. They only check the validity of a transaction if there’s a dispute.

ZK rollups prove a transaction without revealing any of the transaction data. Hence, “zero-knowledge.”

ZK-rollups offer instant finality because the cryptographic proof guarantees the data is valid.

In many ways a rollup is to your standard blockchain transaction what a Calzone is to a regular pizza slice. By rolling it over, you can fit more in.

Byzantine Fault Tolerance

It’s one of the classic blockchain terms and a key feature of the technology, but for most people, it’s something they spend absolutely no time thinking about.

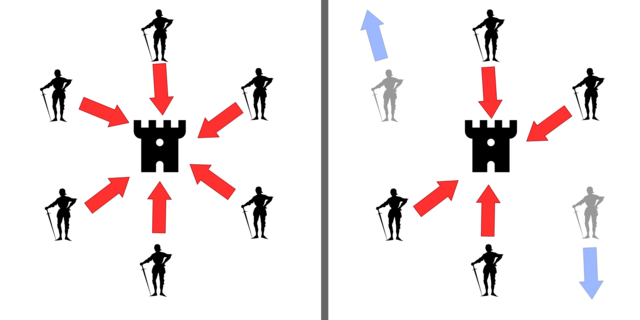

The Byzantine Generals problem was a theoretical exercise that describes the difficulty of decentralized parties arriving at a consensus without a trusted centralized entity. Namely, it grappled with the possibility for bad actors to produce false information to produce a poor outcome in a given scenario.

Specifically, generals with no direct communication must attack Byzantium simultaneously to be victorious. If one of the generals retreats, or signals they will attack but then retreats, the battle will be a rout; worse than a coordinated retreat between all generals.

Satoshi Nakamoto solved the Byzantine Generals problem for Bitcoin by using a proof-of-work consensus mechanism. The significant amount of time and effort in creating a block is costly for the creator, thus giving them the incentive to produce accurate information.

A Byzantine fault is an error in a decentralized computing system that would show a different error or result to different actors, as in the Byzantine Generals problem.

Therefore, Byzantine fault tolerance is the resilience of that computing system to producing such a fault.

We hope this wasn’t too Byzantine an explanation.

Proto-danksharding

Sharding is a means of partitioning a ledger into smaller pieces called shards.

But proto-danksharding is one of the most opaque terms to enter the lexicon of the crypto world. The term just isn’t particularly instructive. Is proto short for prototype? Is this the same dank of your favorite meme folder? Both may be fairly reasonable assumptions, but both are wrong.

First proposed by Protolambda and Dankrad Feist, the creators who lent their names to the idea, proto-danksharding is a transaction type that accepts the aforementioned blobs. The blob-utilizing solution is designed to overcome Ethereum’s longstanding issues with high gas fees and low transaction throughput.

The blobs are used by layer-2 rollups to bundle transactions and submit them to the Ethereum base layer without overwhelming it.

But if proto-danksharding seems like a confusing and mysterious turn of phrase, you can instead choose to use the far more instructive name for the process; EIP-4844.

On second thoughts, the term proto-danksharding isn’t all that bad.

DVT — Distributed validator technology

Most people in cryptocurrency are already familiar with the validators that approve transactions in proof-of-stake consensus models.

DVT takes that concept and decentralizes the process across multiple validators. As described by Lido, DVT “functions as a system that operates similarly to a multisignature (multisig) setup for running a validator.”

This they call “simple DVT” though what’s simple about it remains a mystery.

Ultimately, DVT utilizes multiple operators instead of depending on a single operator, enhancing resilience and mitigating single points of failure.

Dynamic resharding

Dynamic resharding is not your grandmother’s old shards. Dynamic resharding is a relatively new term that Near Protocol’s marketing team has dubbed “the holy grail of sharding,” but it also creates a new lexicon that isn’t immediately understandable.

Building upon the concept of blockchain shards, resharding occurs when the network adjusts the number of shards depending on the load.

An overloaded shard can become two shards, while two underutilized shards can become one.

Nonce

Nonce is one of those terms most people come across during their early days of cryptocurrency discovery and then completely forget about, like the individual names of a large group of people you’ve just met at a party.

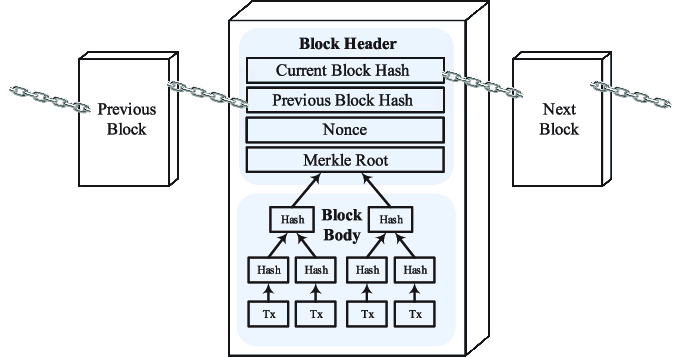

In the Bitcoin blockchain, the nonce is the number used in the block header, which is then cryptographically hashed. It is the number guessed through trial and error to decide which miner produces the next blockchain.

Nonce generation makes the mining process more fair and transparent. It takes lots of computation power and energy to do and in some cases, miners may have to adjust the nonce multiple times before solving a block.

Source: https://cointelegraph.com/news/crypto-terms-confusing-sharding-rollups