In a post-FOMC meeting on March 22, the chairman of the Federal Reserve said his “only interest is that we identify what went wrong here.”

United States Federal Reserve Chairman Jerome Powell has conceded that his regulator was blindsided by the sudden collapse of Silicon Valley Bank, despite it being under their watch.

In a press conference held just after the Federal Open Market Committee meeting on March 22, Powell said he immediately knew there was a need for an internal investigation when the bank shut down on March 10, stating:

“I realized right away that there was going to be a need for a review. I mean, the question we were all asking ourselves over that first weekend was, ‘how did this happen?’”

The Federal Reserve on March 13 announced the launch of an internal investigation led by Vice Chairman Michael Barr to look into the events surrounding the failure of SVB and how the Fed “supervised and regulated” the bank.

Powell confirmed that Barr will be testifying next week.

“We’re doing the review of supervision and regulation,” Powell said. “My only interest is that we identify what went wrong here,” he added.

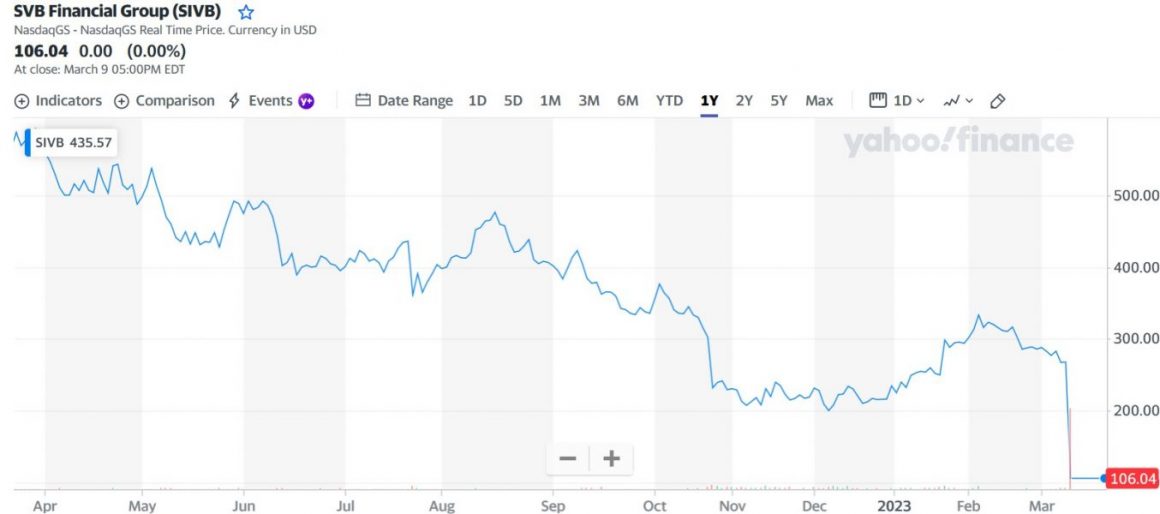

SVB’s collapse has been linked to the Federal Reserve’s successive interest rate hikes that have been aimed at taming inflation. This is understood to have eroded SVB’s long-term bonds it purchased at near-zero rates.

When SVB announced that it suffered a $1.8 billion after-tax loss and was looking to raise $2.25 billion, the market panicked, leading to a $160 billion wipeout in its market cap in 24 hours.

At the time, despite SVB CEO Greg Becker urging investors to “stay calm” and not to “panic”, depositors began to request withdrawals from SVB en masse, causing a bank run.

On March 10, the United States Federal Deposit Insurance Commission stepped in, taking possession of SVB to help depositors get access to their money. Emergency measures were put in place by the government soon after to guarantee all deposits at SVB.

Powell’s latest comments on SVB come as the Federal Reserve Board announced that it will increase interest rates by 25 basis points.

The news has U.S. Senator Elizabeth Warren frustrated with Powell, who has now raised interest rates nine consecutive times to 5%.

“I think he’s a dangerous man to have in this job,” she said, in a March 22 interview on CNN.

“We’ve never seen hikes at this rate in the modern economy,” she said, adding that it risks “pushing our economy into a recession.”

Warren believes the effects of Powell’s “weak” regulatory approach toward large banks in the U.S. over the last five years is another factor to blame for the recent banking crisis:

“I predicted five years ago the consequence of that kind of weakening would be that we see these banks load up on risk, build their short term profits, give themselves ginormous bonuses and big salaries and then some of those banks would explode.”

“That is exactly what has happened on Jerome Powell’s watch,” Warren added.

Source: https://cointelegraph.com/news/how-did-this-happen-powell-says-fed-stumped-over-the-collapse-of-svb