The White House isn’t doing any favors for derivatives traders by turning a blind eye to the biggest players in the space.

The White House released its annual economic report on March 20, and it dedicated an entire section to digital assets.

The authors should be commended for doing so. I largely agree with the report’s assessment that certain aspects of the digital asset ecosystem are causing problems for consumers, financial systems and the environment.

However, as a builder in the digital asset space, I cannot disagree more with its conclusion that “crypto assets currently do not offer widespread economic benefits.”

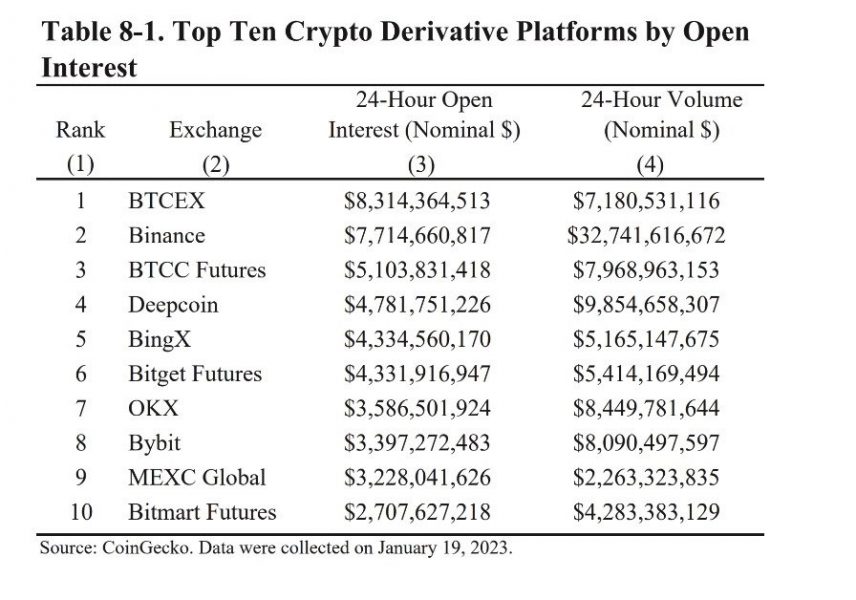

To understand how the White House plans to regulate digital assets, it’s important to examine what was left out of the White House report. A particularly out-of-touch piece of data that made the report was a list titled, “Top Ten Crypto Derivative Platforms by Open Interest.” It included offshore exchanges including BingX, Deepcoin and BTCC Futures.

While most digital asset proponents would agree with the report that these exchanges are not reputable by any means, and open interest is a metric that is trivially easy to manipulate, it’s neither here nor there. The real issue is why the White House report chose to focus on offshore exchanges that have no checks and balances and aren’t even open to United States-based users.

What’s more revealing is the fact that they choose to completely ignore the largest derivatives product that is available to U.S.-based users, one that has been vetted and received approval from the Commodities Futures Trading Commission to launch in a safe and regulated manner: the Bitcoin and Ether futures offered by the Chicago Mercantile Exchange (CME).

The CME is an entity that is fully compliant with all U.S. laws and regulations and, with the recent launch of the Micro Bitcoin and Micro Ether futures, has made it possible for retail investors to access a safe, regulated and U.S.-based futures derivative product.

Why would they choose to omit the mention of the CME?

Could it be because the CME can only list commodities, putting into question the Securities and Exchange Commission’s position that ETH is a security?

Furthermore, none of the platforms mentioned by the White House have any name recognition among crypto-native investors. While this could be attributed to the fact that there are relatively few derivative exchanges on the market and that none of these exchanges seem to have filled the void left by FTX, another omission is very telling.

The White House report also fails to mention Deribit, the largest options exchange by volume and open interest. Based in the Netherlands but unavailable to U.S. users, the company is focused on education and outreach and is far more transparent than most on the market. So, why was it not included?

The White House is purposefully excluding any legitimate businesses from the list of derivative platforms, a position that is likely taken in order to paint digital assets as shadowy, unsafe assets.

Derivatives, such as futures and options, are a core component of any financial system. The U.S. — and White House — would benefit from a thriving digital asset economy that includes derivatives and options markets. And I do agree that the exchanges listed in the White House report are indeed quite risky.

But what the White House is missing is that there is a better alternative, one that cannot be swept under the rug anymore and one that is transparent, noncustodial, cryptographically secure and fully open-source: decentralized finance (DeFi).

DeFi is fully noncustodial and has no intermediaries, so there are no “entities” to regulate because users are always in control of their funds. In addition, most DeFi uses collateral requirements and limits access to leverage: All lending protocols are overcollateralized, and the balance is instantly auditable, as opposed to fractional reserve banking.

The lack of regulatory clarity from the U.S. SEC and CFTC stifles innovation in the derivatives space.

Most DeFi protocols can and should plan to follow the guidelines of self-regulatory organizations such as the Financial Industry Regulatory Authority to protect all users. Clearly stated regulations have a place in any industry, but regulation by enforcement stifles innovation. I’m seeing this firsthand as a builder in the digital asset space, and the lack of clarity is making it impossible for any U.S.-based entity to even tap into the U.S. market.

Digital asset proponents know about previous financial crises. Most of us lived through the hellscape that unfolded post-2008 due to bank deregulation. Our goal is to rebuild the financial infrastructure from the ground up, in the most transparent and securest way possible. DeFi is backed by mathematically unbreakable encryption, and centralized exchanges based offshore are the shadow banks of this generation.

Builders in the DeFi space want to create the most secure financial system in history. We want to empower citizens of the world, not private banks or runaway financiers.

And despite what U.S. regulators may think, we are willing to work with governments, central banks and regulators. We just need to know you’re arguing in good faith.

Source: https://cointelegraph.com/news/white-house-report-takes-aim-at-bybit-and-forgot-about-deribit