SOL price recently rallied by 30%, but on-chain data suggests that the network’s growth challenges could restrict Solana’s upside.

Solana saw two positive developments this week with the launch of the Saga Android-based smartphone powered by the Solana blockchain and the retail trading debut of Grayscale Solana Trust shares.

The developments, along with bullishness in the broader market, boosted the price of Solana by 29.05% from April 11 to a monthly high of $26.03.

While the mobile launch positively boosts the Solana ecosystem, the Saga phone appears overpriced at over $1,000 apiece. Nevertheless, the smartphone received positive reviews in user experience and quality.

Independent cryptocurrency investor Amy Wu noted that there are a lot of opportunities for more “Saga-exclusive dApps, games, and rewards as the phone ships globally, which will also make it easier to justify the $1k premium price.” It remains to be seen how the Solana Foundation will lead the marketing efforts for the phone against existing giants like Samsung and Apple.

The Grayscale Solana Trust has only $2.9 million in assets under management — which is low compared to the 24-hour daily trading volume of SOL, which surpassed $500 million — and is unlikely to have an impact on price.

There are also warning signs of lack of growth across on-chain metrics and bullishness across the derivatives market, threatening a steep correction.

NFTs carry the Solana ecosystem

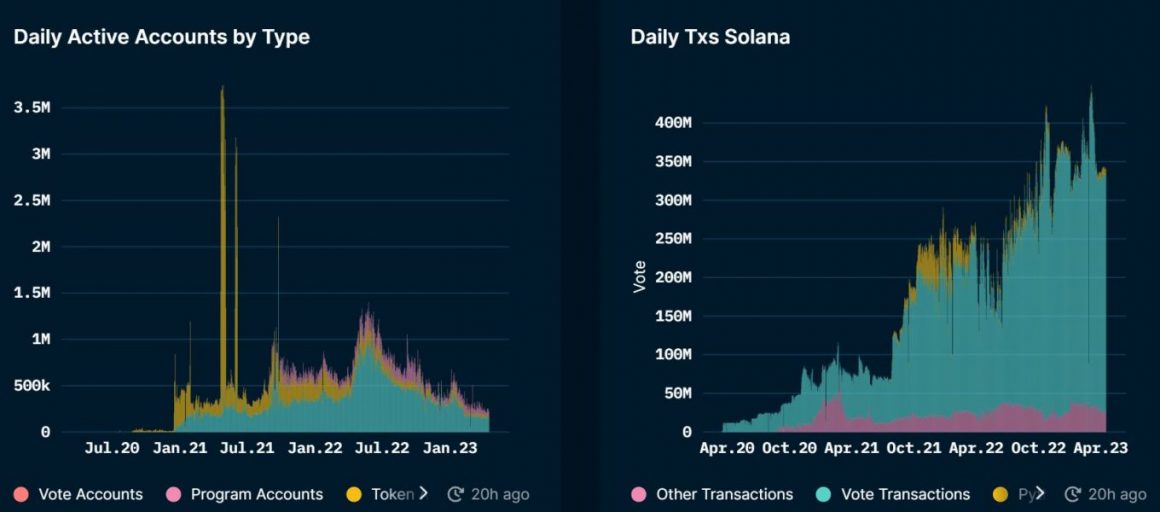

The number of daily transactions on Solana reached a new all-time high in April, showing a consistent uptrend. However, the number of daily active accounts have dipped to new lows, which raises some concerns.

Solana’s decentralized finance (DeFi) ecosystem subsided after FTX’s collapse, with significant liquidity drained. The total deposits on Solana DeFi applications are less than $300 million, with Solana knocked out of the top 10 DeFi blockchains by liquidity value locked, per DefiLlama.

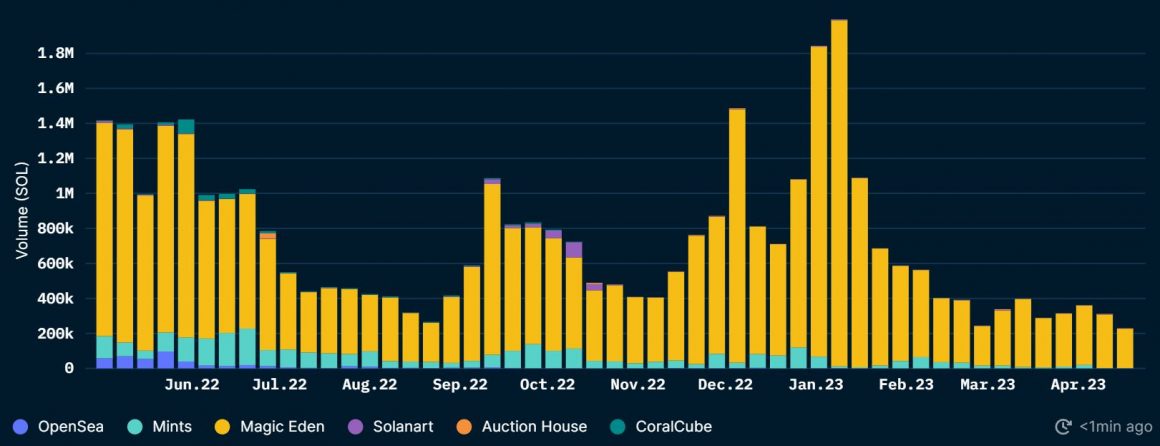

DeFi usage across the Solana ecosystem has been limited to liquidity staking protocols, with decentralized exchanges and lending protocols taking a back seat. It appears that nonfungible tokens (NFTs) are carrying the ecosystem.

Solana’s market share in NFT trading rose from 6% to 14% of total NFT sales volume in less than a year by February 2023, according to a Delphi Digital report. It is the second-largest NFT ecosystem after Ethereum.

The report added, “The Solana NFT ecosystem is driven by traders who are more financially incentivized and trade a lot more often compared to Ethereum NFT users.”

However, the NFT trading volumes have declined since February 2023 below the November 2022 level, which is a discouraging sign.

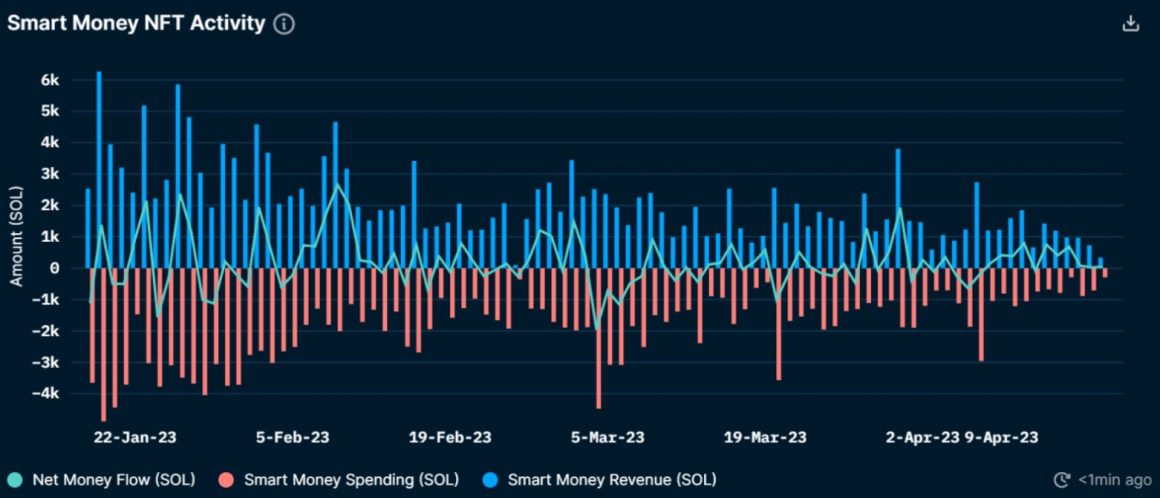

Additionally, the smart money activity has also compressed significantly, with fewer spending and gains made by “smart money” wallets. Nansen tags prolific and active trading addresses as “smart money.”

Solana price action

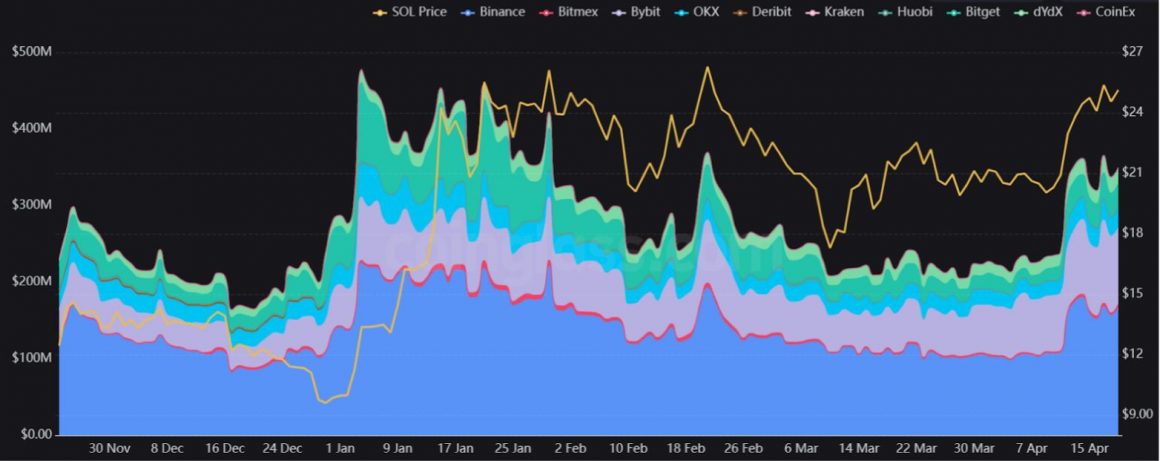

The open interest (OI) volume for SOL futures, which represents the number of open positions for SOL contracts, surged toward a 2023 high with a spike from $239 million to $365 million in the 48-hours following April 11, according to data from Coinglass.

The rise in SOL’s price coincides with the OI volume surge, suggesting that derivatives volumes are driving the latest uptrend.

The rise in OI volumes also accompanies a surge in the funding rates for perpetual swap contracts, suggesting that leverage traders are bullish on the coin. This is a bearish contrarian signal, as the market usually runs the stops of crowded perpetual orders.

The SOL/USD pair faces resistance from the 50-day exponential moving average at $25.40 and the 2022 breakdown levels around $29.76. The moving average convergence/divergence (MACD) indicator, a momentum indicator, shows a divergence between the price surge and the MACD indicator, hinting at a possible pullback. Support for the pair lies around the $20 level.

The Solana ecosystem’s growth in NFT trading volumes has been impressive, but it has declined since February 2023, and the smart money activity has compressed significantly.

The rise in open interest volumes for SOL futures and funding rates for perpetual swap contracts may suggest that derivatives volumes are driving the latest uptrend. Overall, while Solana has had positive developments, it remains to be seen how the ecosystem will sustain the price growth.