Even as digitalization increases, the commercial bank’s place in the economy is solid and will be supported by some new forms of money, the credit rating agency said.

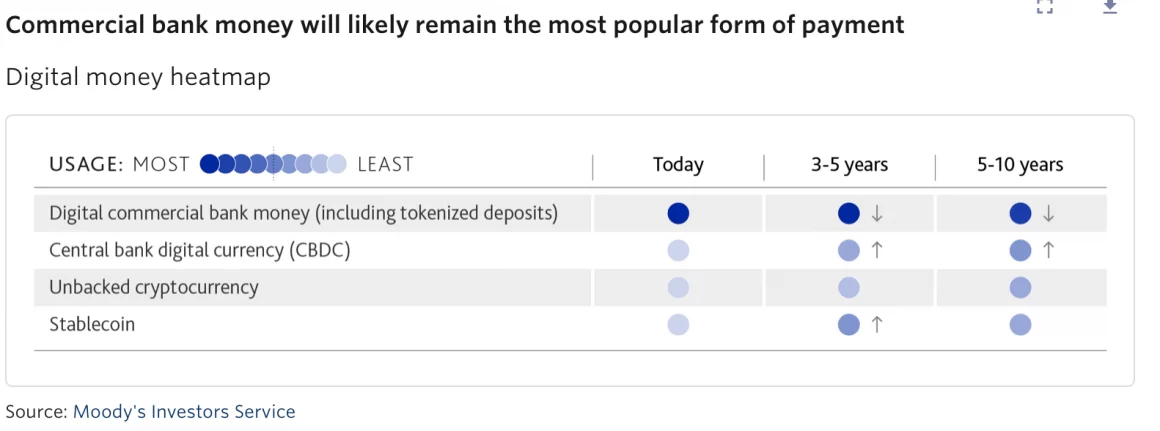

Digitalization is shaping the future of money, but traditional central bank money housed in commercial banks will remain dominant, Moody’s predicted in a new report. Essentially, trust trumps efficiency, it said after surveying a wide range of emerging or potential forms of money.

The monetary landscape is becoming fragmented, Moody’s said, but many new payment solutions support the use of commercial bank money. For example, “We believe that digital wallets […] will support the dominance of commercial bank money as long as bank accounts remain their primary source of digital currencies.”

Nonetheless, digital wallets could threaten banks’ revenue by excluding them from the transaction process. Tokenized deposits will maintain a similar tie to commercial banks, even if other forms of tokenized assets, which remain largely untested, do not.

“CBDCs will be perceived as the safest form of digital money,” Moody’s said, referring to central bank digital currencies. They do not require deposit insurance and promise gains in inclusivity and ease of payment — especially cross-border — but technical and policy complexities hinder their adoption. The report added that most CBDCs would be intermediated, preserving the place of the commercial bank.

Cryptocurrencies got a middling review. “Despite being around for more than a decade, they still do not meet the basic functions of money,” Moody’s wrote. Even though crypto offers wide availability, round-the-clock transferability and programmability, factors such as volatility, high transaction fees, low throughput, user experience issues and, often, limited liquidity outweigh those advantages, the report claimed.

Stablecoins were treated with similar dismissiveness. “Stablecoins suffer from an intrinsic conflict of interest because their operators are incentivized to invest in riskier assets to increase revenue,” the report said. Nonetheless, “stablecoin usage may increase modestly,” the report said. Furthermore:

“That said, the market capitalization of all crypto assets has increased by more than 60% year-to-date to $1,330 billion as of 20 April 2023.”

The monetary landscape is still developing. The report said, for example:

“Digital money issued by a private company could significantly impact the payment landscape. Nevertheless, […] there has been no successful project to date, and many countries will likely not allow them to operate at scale.”

Other innovations mentioned in the report include mobile money issued by telecommunications companies and tokenized money market funds.