What are the best metaverse projects that investors should keep on their radar? Cointelegraph Research ranks the top metaverse projects.

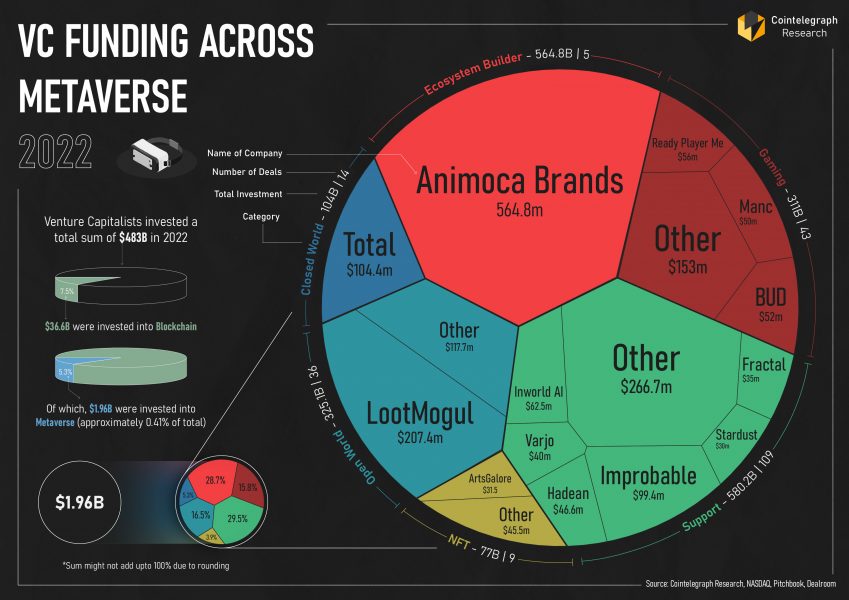

The metaverse continues to expand, with industry giants and upcoming players racing to seize a slice of the potentially trillion-dollar pie. Close to $2 billion was invested in blockchain-based metaverse deals in 2022, according to Cointelegraph Research’s Venture Capital Database.

A 2022 report by McKinsey estimated the metaverse industry to potentially generate up to $5 trillion in revenue by 2030, a number overtaken by Citi’s forecast of $8 trillion to $13 trillion. These estimations reflect significant growth from the global metaverse market of $65.5 billion recorded in 2022. To realize these optimistic forecasts, the metaverse industry would need to sustain an impressive 85% compound average growth rate.

Investors will never guess which metaverse won Cointelegraph Research’s 2023 Ranking of Metaverses. The winning blockchain-based metaverse enables the ownership of in-game assets, has over $61 million in value locked in its smart contracts and over 8,000 monthly users, and features a deflationary token model. To learn more about the project, read Cointelegraph Research’s new “The Hitchhiker’s Guide to the Metaverse” report.

Stronger than ever

Despite its projected growth, the metaverse landscape is not without its challenges. Industry leaders have been plagued by losses to their market capitalizations, with Meta (formerly known as Facebook) losing 77% of its market cap — equivalent to $800 billion — between late 2021 and 2022. As a result, Meta CEO Mark Zuckerberg plans to eliminate 21,000 jobs in 2023.

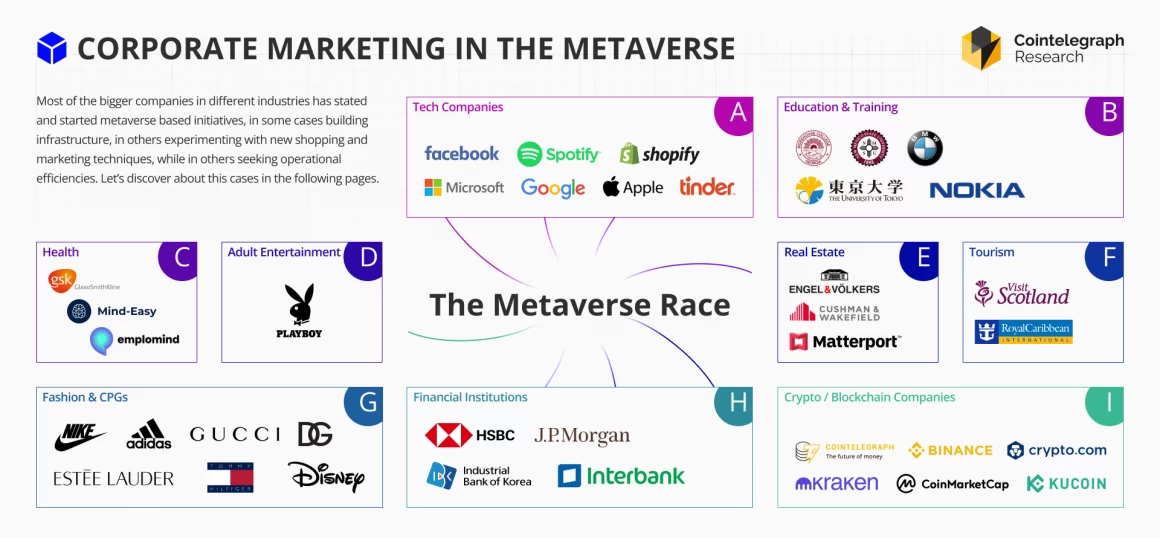

Despite setbacks, industry titans like Microsoft, Apple, Nvidia and Qualcomm are all developing metaverse strategies. Apple’s entry into the metaverse is highly anticipated, with its augmented reality/virtual reality headset launch slated for June 2023. Similarly, gaming firms like Epic and Roblox utilized the pandemic lockdown to their advantage, successfully launching metaverse concerts that reached millions worldwide.

In 2022, mergers, acquisitions and financing in the metaverse realm rose from $13 billion in 2021 to over $120 billion, bolstered by Microsoft’s $69-billion acquisition of Activision. The deal had a 7.6x enterprise-value-to-sales multiple and a 20.2x enterprise-value-to-EBITDA (earnings before interest, taxes, depreciation and amortization) multiple. Although valuation multiples are expected to decrease in line with higher interest rates, investment activities remain robust.

The top blockchain metaverse projects are also attracting significant capital. The leading blockchain metaverses measured by market cap (at the time of writing) include The Sandbox ($1.02 billion), Decentraland ($905 million) and Axie Infinity ($830 million). The year-to-date performance of The Sandbox is 44%, while Decentraland’s YTD performance is 62%. Neither of them surpass Bitcoin’s YTD return of 68%.

For investors seeking exposure to the metaverse, exchange-traded funds like the Fidelity Metaverse ETF and the Roundhill Ball Metaverse ETF offer viable options. However, Cointelegraph Research’s “The Hitchhiker’s Guide to the Metaverse” report reveals that a majority of token transactions associated with metaverse projects result from speculation rather than actual in-metaverse usage, a trend that calls for cautious investment.

The Cointelegraph Research team

Cointelegraph’s Research department comprises some of the best talents in the blockchain industry. The research team comprises subject matter experts from across the fields of finance, economics and technology to bring the premier source for industry reports and insightful analysis to the market. The team utilizes APIs from a variety of sources in order to provide accurate, useful information and analyses.