Alternative funding options, such as grant programs, have grown in popularity as the bear market continues to slash venture capital investments in the crypto industry.

As the bear market keeps slashing venture capital investments in the crypto industry, alternative funding options, such as grants, have been gaining traction as a means of supporting the community while enabling the growth of established projects.

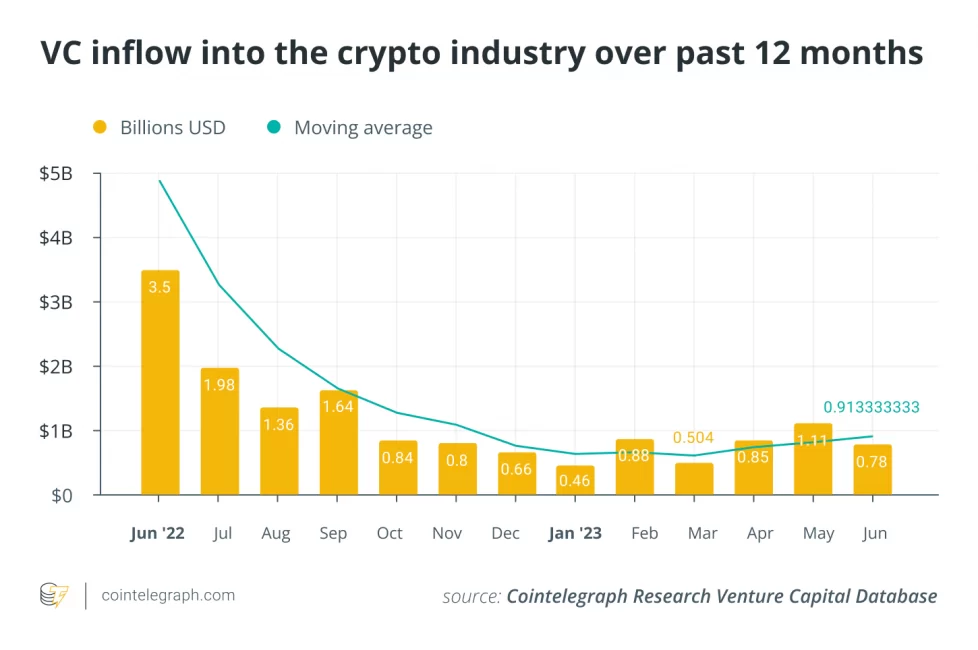

According to Blockchain Grants, at least 40 crypto projects are currently offering grants for developers working on Web3 solutions, while data from Cointelegraph Research indicates that the market downturn has left a void in crypto venture capital, resulting in a 30% drop in funds injected into Web3 projects over the past 12 months.

Grants and venture capital are two different funding mechanisms with distinct purposes and conditions. While grants are often used to support projects that align with specific objectives and values, venture capital seeks startups with high growth potential and a focus on financial returns.

Yet, receiving grants may only be beneficial for projects if funds are put back into the work, Cumberland Labs CEO Naveen Agnihotri told Cointelegraph. “Grants can be especially helpful for the up-and-coming crypto projects, but only if the funds are put back into the work,” noted Agnihotri, adding that venture capital, otherwise, “can help a founder bootstrap his or her project with a rather helpful style because both parties have been incentivized to engage in such a way.”

Open call for grants

With the goal of keeping projects accountable for funds received while fostering innovation, the SingularityNET team has updated its Deep Funding grant program. Following the recent opening of its third round, the program will now reward teams based on milestones achieved and deliverables, as well as peer-to-peer revisions. Until Sept. 3, the program will receive proposals for five funding pools and plans to distribute over $1.5 million to AI-related projects in the coming months.

“Granting programs hold a pivotal role in shaping the crypto industry’s next phase of development and innovation. By offering financial support and a platform for unconventional ideas, these programs fuel creativity, research, and the creation of pioneering solutions,” noted Rafael Presa, operations manager of Deep Funding. Since its inception in 2022, the program has helped 28 artificial intelligence (AI) projects, with grants distributed through decentralized voting within the SingularityNET ecosystem.

We are looking for community members willing to take an active part in spreading the word on our community-driven program @DeepFunding, and we are rewarding those who do! Submit your proposal now:

— SingularityNET (@SingularityNET) August 18, 2023

Also funding projects, the Interledger Foundation is using its grant program to boost initiatives enabling payment networks for unbanked communities worldwide. “Grant programs can alleviate some of the financial pressure entrepreneurs and innovators [face]. There have been cases where amazing projects were left abandoned and never revealed to the world due to a lack of resources needed to bring the idea to completion,” said Briana Marbury, CEO of the Interledger Foundation. The program is receiving applications until Nov. 21 and plans to award grants of over $100,000 in this round.

Applying for grants: What to consider

When applying for grants, it’s crucial to understand the goals and priorities of the grantor. According to Presa, this demonstrates a genuine interest and understanding of the program’s core objectives. “Engaging with the community, seeking feedback, and refining your proposal accordingly not only improves its quality but also showcases your commitment to collaboration and improvement.”

For Agnihotri, projects must focus on solving real problems when positioning a proposal. “Now that we’re in a bear market […] I think it’s a great time to really think about the problems and, in turn, the big ideas. Get yourself somewhere secluded and just think, think, think, and then if an idea of significance comes around, really take the time to thoroughly write out a grant proposal,” he suggested, adding that the bear market gives projects time to think about real problems to be solved.

“Although money might not be sloshing around in abundance during these times, there is still money and that money is attracted to good ideas,” Agnihotri stated.

Source: https://cointelegraph.com/news/crypto-grants-foster-innovation-amid-venture-capital-exodus