Ethereum co-founder Vitalik Buterin has sold his remaining MakerDAO, while confidence has remained high for upcoming spot Bitcoin ETF approvals.

Buterin sells remaining MakerDAO tokens

Ethereum co-founder Vitalik Buterin has sold his remaining stack of 500 MakerDAO tokens (MKR), a day after MakerDAO proposed a potential move away from Ethereum to competitor blockchain Solana.

On-chain analytics platform Lookonchain was one of the first to spot Buterin’s transaction on Sept. 2, noting that Buterin held the MKR tokens for over two years:

After 2 years of dormancy, @VitalikButerin sold all remaining 500 $MKR for 353 $ETH ($580K) 6 hrs ago.https://t.co/S6EC2lwxLq pic.twitter.com/tj8baxcJgO

— Lookonchain (@lookonchain) September 2, 2023

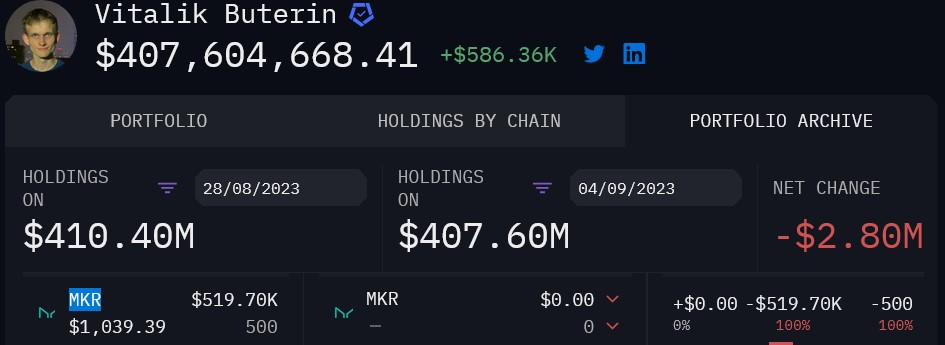

Data from fellow blockchain analytics platform Arkham confirms the sale was likely the last of Buterin’s known MKR holdings, with his MKR portfolio showing it at $0.

The $520,000 in MKR as reported by Arkham only comprised about 0.12% of Buterin’s $407 million portfolio in cryptocurrency holdings.

MakerDAO’s native chain, dubbed “NewChain,” is part of the fifth and final phase of the MakerDAO “Endgame” upgrade which its co-founder, Rune Christensen now wants to see be launched on Solana.

Bitcoin halving, spot ETF approvals to cause ‘billions’ of inflows: Pomp

Bitcoin investor and podcaster Anthony Pompliano has become the latest commentator to tout his confidence for the approval of spot Bitcoin ETFs in the near future, noting that the approvals, along with the upcoming halving event will cause an explosion in price for BTC.

In a Sept. 1 interview on CNBC, Pompliano said the approval, first and foremost, will result in billions of dollars of inflows by institutions.

“My belief is that a Bitcoin ETF will be approved in the United States of America. It will lead to billions and billions of dollars of inflows,” he said.

"My belief is a #Bitcoin ETF will be approved in the U.S. It will lead to billions of dollars of influence," says @APompliano. "At the same time, I think regulators have to get up to speed, they're getting educated. The dollar on blockchain is used just as much as Visa is used." pic.twitter.com/jNgkLG5Pav

— Squawk Box (@SquawkCNBC) September 1, 2023

Pompliano expects these spot Bitcoin ETFs to be approved sometime in the lead up to Bitcoin’s halving event which is set to take place in April 2024.

The two events will lead to a “demand shock,” says Pompliano:

“This ETF is going to be a demand shock. There is going to be assets that flow into this industry […] the closer and closer we get to the halving it will coincide with a supply shock and we could see a repeat of 2020 where we go up quite significantly in price.”

Meanwhile, a note from analysts at JPMorgan also predicts that the SEC will likely have no choice but to approve multiple spot Bitcoin ETFs following Grayscale’s legal victory on Aug. 29, according to recent reports.

Musk biography reveals he’s been quietly funding Dogecoin: Report

An excerpt of Elon Musk’s new biography reportedly reveals Musk’s early ambitions to build a blockchain-based “everything app” which included using Dogecoin (DOGE) for payments.

The excerpt, published on The Wall Street Journal on Aug. 31, reveals that Musk, was “semi-serious” about integrating Dogecoin for in-app payments on X (formerly Twitter) and was supposedly “funding” the memecoin.

“Perhaps, he said half-jokingly, it could have a payment system using Dogecoin, the semi-serious cryptocurrency whose development he had been quietly funding,” the excerpt read.

The excerpt written in context of Musk’s ambitions to turn X into a payments platform where users could send money, hand out tips and pay for stories, music and videos.

Charging people a small amount to be verified was another one of Musk’s plans to provide a new revenue stream for the platform, which eventually came into effect.

“It could fulfill my original vision for X.com and PayPal.”

The multibillionaire has wanted to create an “everything app” — which offers banking services, social media and other applications all in one — since he created X.com over 20 years ago.

The excerpt revealed that Musk strongly considered building a blockchain-based app to enable the all-in-one service:

“I think a new social-media company is needed that is based on the blockchain and includes payments.”

However, Musk ultimately decided to buy Twitter because of its strong user base, the excerpt said.

Tom Emmer rebuffs Gary Gensler’s claims that crypto “rife with noncompliance’

United States Congressman Tom Emmer has taken another shot at SEC chair Gary Gensler, after the regulator recently suffered two defeats in court at the hands of Ripple Labs and Grayscale.

Emmer called out Gensler for his anti-crypto stance in a Sept. 3 post on X (formerly Twitter).

“We will see how pending litigation plays out, but it should be increasingly obvious to policymakers that, despite @GaryGensler’s mass marketing campaign, crypto is not an industry rife with noncompliance,” Emmer wrote.

1. SEC loses on Ripple…

2. SEC loses on Grayscale…We will see how pending litigation plays out, but it should be increasingly obvious to policymakers that, despite @GaryGensler's mass marketing campaign, crypto is not an industry "rife with noncompliance." https://t.co/hhtAEK8m0S

— Tom Emmer (@GOPMajorityWhip) September 2, 2023

The Minnesota Congressman added that he was pleased to see the U.S. Government’s system of checks and balances be played out, with the Court of Appeals holding what Emmer describes as an “abusive” administrative state accountable.

In recent months, Emmer has made a number of pro-crypto efforts of his own, having introduced the Blockchain Regulatory Clarity Act in March and the CBDC Anti-Surveillance State Act in February, which aims to limit the U.S. Federal Reserve from issuing a central bank digital currency.

Also making news

FTX debtors have disclosed a series of financial statements revealing a transaction of $2.51 million was directed from the company to the American Yacht Group, benefiting former Alameda Research co-CEO Sam Trabucco in March 2022. Though FTX debtors state that there are no guarantees of the data’s absolute accuracy or completeness and disclaim any liability for errors or omissions.

On Sept. 2, Cathie Wood, the CEO of ARK Invest said the convergence between Bitcoin and artificial intelligence could transform the way companies organize, causing a significant reduction in business running costs and an explosion in productivity.

Source: https://cointelegraph.com/news/what-happened-in-crypto-on-the-weekend