Centralized finance platforms may offer convenience and liquidity, but their history of catastrophic failures calls for a shift to their decentralized alternatives.

Centralized finance (CeFi) services such as crypto exchanges have accelerated the adoption of digital assets and blockchain solutions. Despite this, while retail traders can still use them for convenient crypto transactions and day-to-day operations, institutional investors can thrive long-term if they limit their exposure to CeFi risks and move to decentralized finance (DeFi) instead. With ambitious new projects coming to the table, the next leg of innovation will be pioneered by platforms offering the necessary infrastructure to bring institutional funds on chain.

CeFi is vulnerable to systemic risks

The history of CeFi platforms is fraught with catastrophic failures, from Mt. Gox to more recent examples like FTX and BlockFi. CeFi platforms have demonstrated serious vulnerabilities, suffering from issues ranging from hacking to bankruptcy and causing significant losses to both retail and institutional investors. It seems that, unlike the traditional banking system, the crypto industry doesn’t have “too big to fail” services. The surprising collapses of Mt. Gox and FTX have revealed the weaknesses of the CeFi structure.

The same risks persist even today, as the CeFi industry hasn’t been able to upgrade its underlying infrastructure despite new security measures.

2022 was a challenging year for the crypto industry, and it proved once again that CeFi couldn’t provide transparent and secure investment management capabilities, with the platforms often co-mingling customer funds, engaging in extreme rehypothecation and lacking solid risk management practices. Moreover, centralized exchanges and platforms have too much control over user funds.

Although CeFi has been the go-to ecosystem for crypto asset management for years due to its liquidity and convenience, the risks are too significant to ignore.

Why DeFi is better for asset management

The emerging DeFi sector offers some great alternatives that give institutional investors more control over their funds while taking security into their own hands.

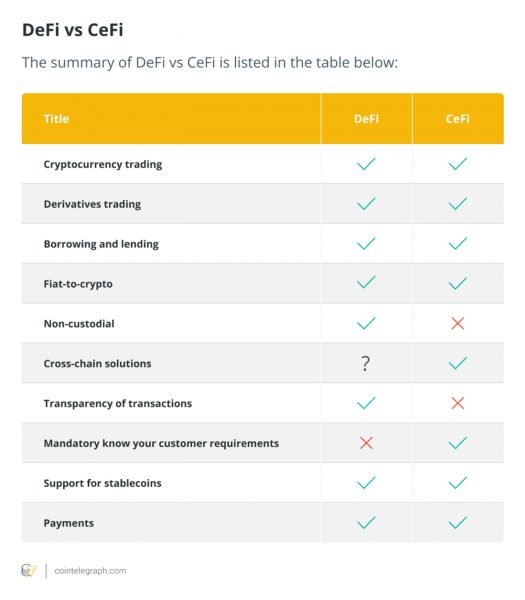

DeFi platforms offer higher transparency and security, building on the promise of decentralization. All transactions on DeFi protocols are recorded on-chain, providing real-time visibility into assets and enabling asset managers to monitor their positions at any time.

Importantly, DeFi platforms allow investors to retain custody of their digital assets, mitigating risks associated with third-party custodians, which is typical for CeFi services. A case in point is the loss incurred by investors when Prime Trust, a third-party custodian, lost the keys to one of its wallets, leading to mass withdrawals. The firm recently filed for bankruptcy.

DeFi can change the game for crypto asset managers, but it also needs to address several challenges. To begin with, DeFi is highly fragmented, which makes it difficult to build well-rounded investment strategies across multiple chains. Ethereum still dominates the sector, but efficient networks like Avalanche and BNB Chain as well as layer-2 solutions like Arbitrum, Polygon and Optimism are also gaining traction.

For institutional investors, combining the convenience of CeFi with the transparency and security of DeFi would be the best-case scenario.

Unlocking DeFi opportunities while offering a TradFi simplicity

To combine DeFi advantages with TradFi-like convenience, the decentralized management platform Velvet Capital offers various benefits to institutional investors, leveraging a cross-chain operating system and providing an easy-to-use interface and tools.

Backed by Binance Labs, Velvet Capital enables the exploration of DeFi opportunities across multiple chains, which unlocks liquidity, eliminates fragmentation and helps crypto hedge funds, family offices and asset managers build diversified DeFi portfolios.

This cross-chain infrastructure and intuitive interface allow institutional investors to easily launch and manage tokenized funds, portfolios, yield-farming strategies and other structured products.

As a DeFi protocol, Velvet Capital helps investors build portfolios and strategies that are fully on-chain, allowing investors to see their assets in real-time. DeFi is about trustless interactions with transparency as the central pillar, and investors using Velvet Capital’s platform know exactly which assets they’re holding in custody.

Velvet Capital never takes custody of client assets and enables investors to hold their digital assets in a noncustodial wallet or multisignature vault.

The app makes it simple to create and manage crypto financial products by providing the back-end infrastructure as well as an intuitive experience to let users focus on finding the best assets and strategies across multiple chains.

Velvet Capital is the first DeFi protocol that provides omnichain asset management capabilities so that portfolio managers are not limited to a single chain and can execute complex strategies across several ecosystems, including Ethereum and BNB Chain.

Investors who need additional advice can benefit from Velvet’s marketplace feature, which enables users to get exposure to the crypto market alongside the best hedge funds and asset managers. Its marketplace has index funds built by the community, funds run by institutional investors and funds run by advanced crypto traders.

While Velvet has an experienced team, it plans to adopt decentralization by letting the community participate in governance through its decentralized autonomous organization (DAO), and its Founders Club NFT collection acts as a gateway to the DAO.

Moreover, Velvet Capital will launch its institutional-grade, omnichain DeFi operating system in October, and interested parties can book a demo through their website.

Projects like Velvet Capital are at the forefront of a financial revolution, using DeFi infrastructure to democratize asset management. In an era dominated by centralized financial institutions, this approach offers a safer and more inclusive way for investors to expose the crypto space while mitigating CeFi risks.