During the 2017 bull run, initial coin offerings (ICOs) were all the rage. The last bull market — in 2021 — was dominated by the growth of decentralized finance (DeFi) and yield farming. Now, as a fresh bull cycle gathers pace, 2024 will bring a breadth of more sophisticated financial products on-chain. From complex derivatives to structured products, big-boy instruments and traders will enter the digital-asset playground.

As we have seen with previous cycles, the crypto ecosystem tends to closely follow the traditional financial (TradFi) market. After all, Bitcoin was first designed as an alternative payment system. ICOs even borrowed their name from TradFi’s initial public offerings (IPOs), which date back to 1783.

Meanwhile, the DeFi ecosystem mimics traditional financial services, such as lending, borrowing, and yield generation, only in a decentralized manner. So it seems only natural that more complex financial vehicles should eventually get a Web3 makeover.

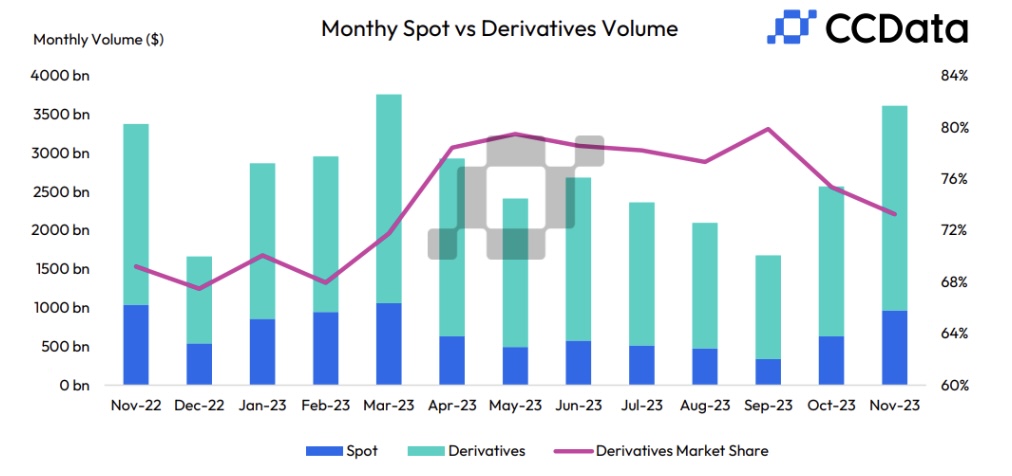

Already, we have seen impressive growth in the crypto derivatives market. November saw derivatives trading volumes spike 37.3% month-on-month to $2.58 trillion, the highest since March, though their share of the overall crypto market dropped from 79.9% in September to 73.3%. At the same time, open interest in crypto options has been hitting fresh all-time highs.

Alongside this healthy recovery, we are also seeing more sophisticated derivative products, such as the rise of decentralized perpetual futures trading and innovative risk management mechanisms. This will be a key area for innovation as we head into the new year, while we will also see the launch of new complex products that mimic traditional counterparts.

In particular, we’ll see growth in exotic options, structured products, and collateralized debt obligations (CDOs) in the crypto space. We have seen some attempts at crypto CDOs — notably from Opium Finance back in 2021 — while the crypto structured products market is quietly gaining steam.

However, these complex products are still a small fraction of the overall crypto market. For example, on-chain structured products compose just 0.21% of crypto’s total market cap, opening a possibility for significant expansion.

So what will drive interest in these innovative derivative products? I see three key drivers of this trend in 2024 and beyond. First, growing institutional interest in digital assets will naturally drive demand and innovation in this space. The traditional derivatives market holds an estimated value of 10 times the world’s total gross domestic product (GDP), with derivatives available for virtually every asset imaginable. The crypto derivatives market will see similar momentum in growth as sophisticated traders pile in.

Second, as crypto winter-induced nervousness subsides, investors will once again seek outsized returns on their digital assets. But this time, we can expect less interest in yield farming due to the high risk of hacks. Instead, attention will turn to derivatives and structured products. Often offering the potential for sky-high returns over 100% APY, these complex products offer one thing that yield farming doesn’t: downside protection. And this brings us to our last point.

After the collapse of Terra, Celsius, FTX et al. in 2022, battle-hardened investors are looking for guarantees that their assets won’t just disappear in a puff of smoke. This makes products with a degree of capital protection look attractive. Complex financial vehicles like structured products often offer capital protection, with some — like the so-called “Shark Fin” structure — even paying a guaranteed coupon.

Structured products essentially allow investors to make an educated guess on the future direction of travel for their chosen underlying asset — in crypto, this could be Bitcoin. With a Shark Fin product, guessing correctly could result in handsome returns. But even if the guess is wrong, the investor still gets his money back and walks away with a small coupon. The only catch is that his money could be converted to the underlying asset — such as Tether to Bitcoin — at an unfavorable price. But this is a much less bitter pill to swallow than, say, the liquidation risk in yield farming.

This in-built protection is exactly what made structured products so popular in the traditional financial market, at least before the financial crisis decimated trust in complex investment vehicles. At launch in the 1990s, their purpose was to offer investors tailored risk-return outcomes, making them suitable for a wide array of portfolios — and they went down a treat.

As the crypto market matures and the focus shifts to more predictable returns within diversified portfolios, these vehicles will get another moment in the sun. In a market still reeling from the events of 2022, capital preservation has become far more important for many investors, especially as crypto breaks out into the mainstream. Demand always drives innovation, so we expect to see new launches in the on-chain structured product space, as well as new complex derivatives projects, spurring rapid growth in assets in these areas. This will be one of the defining innovations of the current bull run.

Source: https://cointelegraph.com/news/2024-year-crypto-investors-get-sophisticated-derivatives