Utonic, an emerging restaking protocol on The Open Network (TON), received a $100-million institutional commitment in total value locked (TVL) ahead of protocol launch.

The TON-based restaking protocol received a $100-million commitment from firms including Mirana Ventures and Foresight Ventures.

The protocol aims to contribute to TON’s security and decentralization, according to Lemon Lin, co-founder of Utonic. Lin told Cointelegraph:

“The tech path of restaking has been proven successful by Eigenlayer and others on Ethereum and can be perfectly practiced on TON to enhance security and the level of decentralization.”

Interest in restaking was ignited by the success of the Ethereum-native restaking protocol EigenLayer, which surpassed $1 billion in TVL on Dec. 28, 2023. EigenLayer became the fourth-largest restaking protocol by Feb. 15, reaching $6.99 billion in TVL.

Restaking protocols like EigenLayer enable validators and stakers to restake liquid staking derivative tokens like Lido Staked ETH (STETH) and RocketPool’s rETH to secure and validate other networks. These assets can also be deployed in other decentralized finance (DeFi) protocols to earn additional yield.

Utonic expects 20% APY even during a bear market

The Utonic protocol expects to launch with a lucrative annual percentage yield (APY) of up to 30%.

When asked about a potential yield reduction during bear market conditions, Lin said that he expects an over 20% yield. He explained:

“Native 3.65% APY plus an extra 5%–15% APY coming from AVS, expecting farming incentives on L2s, the total can be over 30% APY. Even if it’s in a bear market where on-chain liquidity is draining, we still expect 20% APY.”

The Utonic protocol enables TON restakers to earn yield from three different sources — native validator yield, Actively Validated Services (AVS) yield and farming incentives.

Through the protocol, users can stake TON tokens and reallocate the staked equivalent into additional applications, like securing AVS, in exchange for additional passive yield on their holdings.

Utonic plans to go live at the end of September.

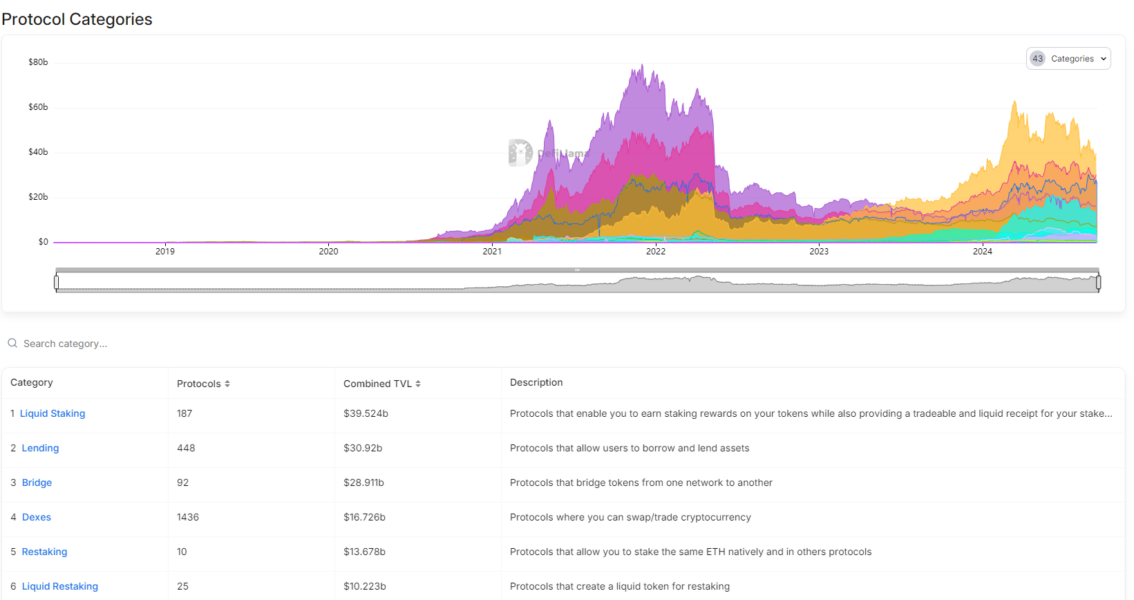

Interest in restaking and liquid staking grows across top blockchains

Interest in liquid staking and restaking solutions has been increasing, with EigenLayer’s recent growth contributing to the trend.

According to Bybit Research, liquid staking on Solana could experience a nearly five-fold increase, reaching $18 billion, fueled by retail investor adoption driven by enhanced liquidity and capital efficiency.

Liquid staking creates more capital efficiency for investors by offering an equivalent of the initial staked token that can be deployed in other DeFi applications.

On Ethereum, liquid staking is the largest protocol category worth a combined TVL of over $39.5 billion.

Source: https://cointelegraph.com/news/ton-restaking-protocol-100m-tvl-launch