Asset manager BlackRock is reportedly pushing its money-market digital token to be used as collateral in cryptocurrency derivatives trading.

According to an Oct. 18 Bloomberg report, the company is in talks to integrate its BlackRock USD Institutional Digital Liquidity Fund (BUIDL) token with the trading systems of major crypto exchanges such as Binance, OKX and Debirit. Brokerage firm Securitize is reportedly a partner in the initiative.

The move would expand BUILD’s use as collateral, widening the competition with stablecoins that are largely used as collateral for crypto derivatives trading, such as Tether’s USdT.

CCData revealed that the derivatives accounted for over 70% of the total crypto trading volume in September, with about $3 trillion in crypto derivatives contracts traded on centralized exchanges.

Derivatives are financial contracts that derive their value from another asset, like stocks or cryptocurrencies. Traders use derivatives to bet on asset price changes or protect from losing money, while collateral is used as security for these trades, like a deposit, to ensure losses can be covered.

BUIDL is already accepted as collateral by FalconX and Hidden Road, two of the largest crypto brokers. The token has a minimum investment of $5 million and is available only for qualified institutional investors.

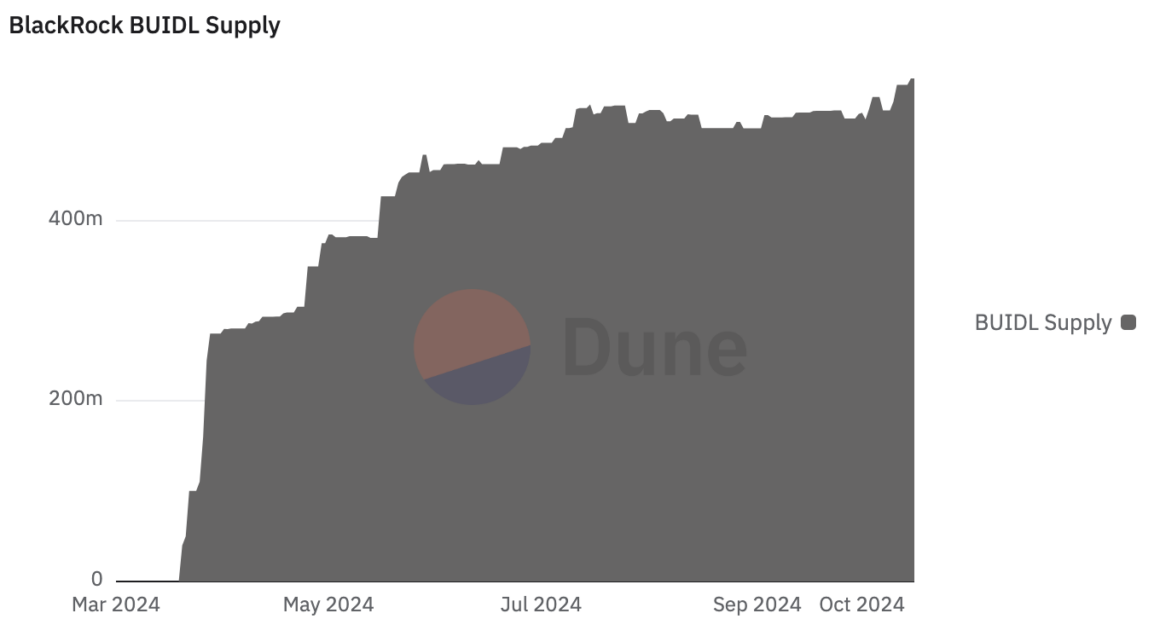

According to data from Security Token Market, BUIDL’s market capitalization stood at $547.7 million as of Oct. 18, making it one of the biggest use cases for assets tokenization on blockchain. The fund primarily invests in US Treasurys, cash and other liquid assets. Bank of New York (BNY) is behind the interoperability of transactions between digital and traditional markets.

On Oct. 3, a subcommittee of the Commodity Futures Trading Commission (CFTC) voted in favor of recommending a proposal allowing digital assets to be used as collateral for commodities and derivatives trading. The decision could receive final approval by the end of the year, marking a notable milestone in the integration of traditional and crypto markets.

The move would allow brokers to use tokens, such as BUIDL, stablecoins and other cryptocurrencies, to be used in traditional markets via embedded systems.

Speaking to Bloomberg, Deribit CEO Luuk Strijers said the platform is “reviewing” a number of tokens as collateral, including BUIDL. Franklin Templeton’s OnChain US Government Money Fund (FOBXX) is another popular tokenized money market fund backed on Wall Street.

According to data on Dune Analytics, the market capitalization of tokenized securities is $1.7 billion at the time of this writing.

Source: https://cointelegraph.com/news/blackrock-eyes-buidl-derivatives-collateral-crypto-exchanges