Just over $50 billion worth of Ether is currently locked in accumulation wallets — nearly 65% more than the beginning of 2024, according to a crypto analyst.

“By October 18, 2024, the total amount of Ethereum in accumulation addresses surpassed 19 million,” CryptoQuant contributor Burakkesmeci wrote in an Oct. 20 analyst note.

11.5M ETH increase in accumulation addresses

At the time of publication, with Ether trading at $2,645, this amounts to approximately $50.2 billion locked in accumulation addresses — addresses of long-term investors with no prior withdrawals.

Burakkesmeci highlighted that the amount of Ethereum in accumulation addresses has increased by 65% since January when there were around 11.5 million ETH in these addresses.

Accumulation addresses are an important indicator for traders and market participants, as they provide an indication of overall confidence in the long-term outlook of Ethereum.

Burakkesmeci opined that the total amount of ETH in these wallets “will exceed 20 million” by the end of 2024. He based much of his reasoning on the anticipation behind the launch of spot Ether ETFs in July.

“It’s no longer just for tech enthusiasts—institutions and individuals see it as a key part of the financial future,” Burakkesmeci stated.

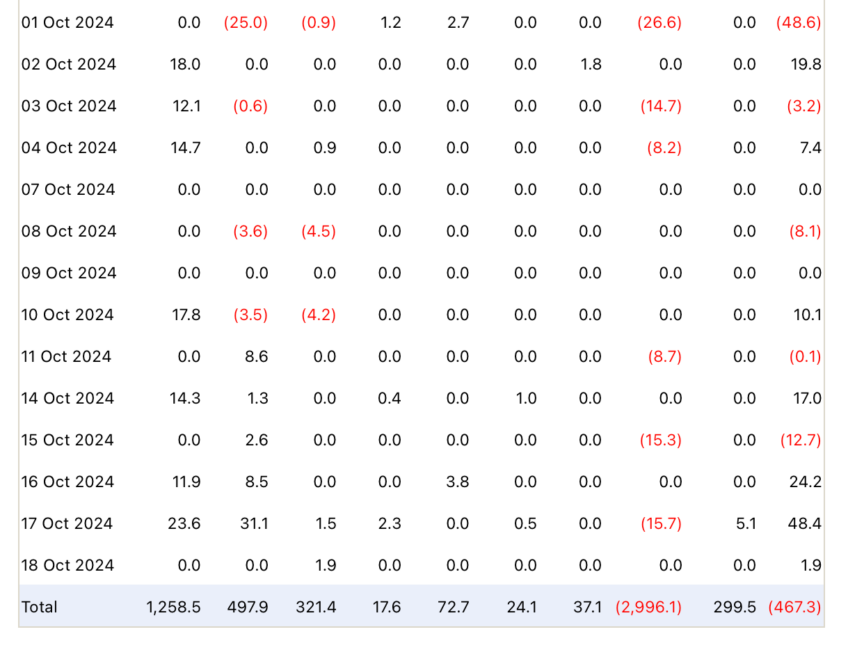

Since launching on July 23, spot Ether ETFs have recorded total net outflows of $467.3 million, according to Farside data.

On Oct. 15, Cointelegraph reported that Ethereum investors are disappointed as its supply continues to increase despite high network usage.

Traders recent concerns over Ether future open interest

In a recent blog post, Ethereum founder Vitalik Buterin acknowledged this issue and suggested that improving transaction times through solutions like single-slot finality could help.

On the same day, the aggregate Ether futures addressable market surpassed 5 million ETH for the first time, representing a 12% increase from four weeks prior.

It caused concern among traders, as they believe it could be a warning flag. The surge in demand for leveraged ETH positions typically precedes severe price corrections.