The Ethereum ecosystem is seeing increasing value growth, showing more investor interest in Ethereum-native assets.

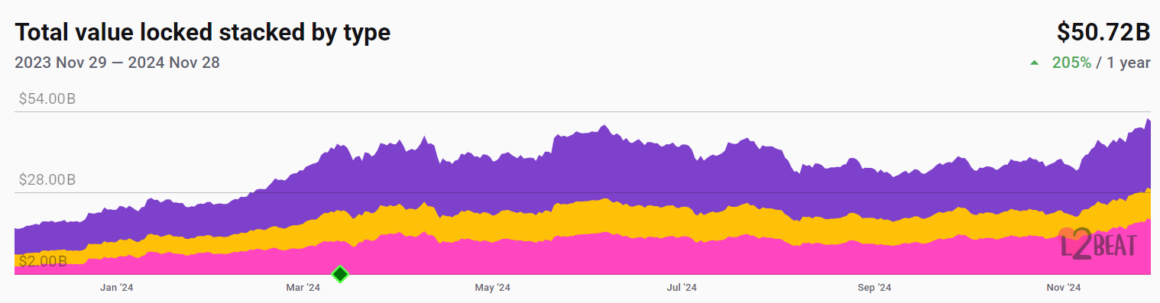

Ethereum layer-2 (L2) networks have reached a new all-time high of more than $51.5 billion in cumulative total value locked (TVL).

This marks an over 205% increase in cumulative TVL, from just $16.6 billion in November 2023, L2beat data shows.

L2 scaling solutions are essential for creating more scalability around Ethereum, the leading smart contract network. By offloading and processing transactions on secondary chains, the L2s reduce the overall cost and waiting time associated with the Ethereum mainnet.

Despite their significant benefits, some industry experts are concerned that L2s are “cannibalistic” for the revenue of the Ethereum mainnet and may eat into the price potential for Ether.

While the milestone is a sign of increasing maturity in the L2 industry, it does indeed introduce liquidity fragmentation risks, Alvin Kan, the COO of Bitget Wallet, told Cointelegraph:

“The growth of Ethereum L2s also bring challenges, such as liquidity fragmentation. Core DeFi protocols on public chains are now competing for liquidity, while cross-chain bridges— which facilitate asset transfers between chains — introduce certain security risks.”

Arbitrum One and Base lead 205% L2 value surge

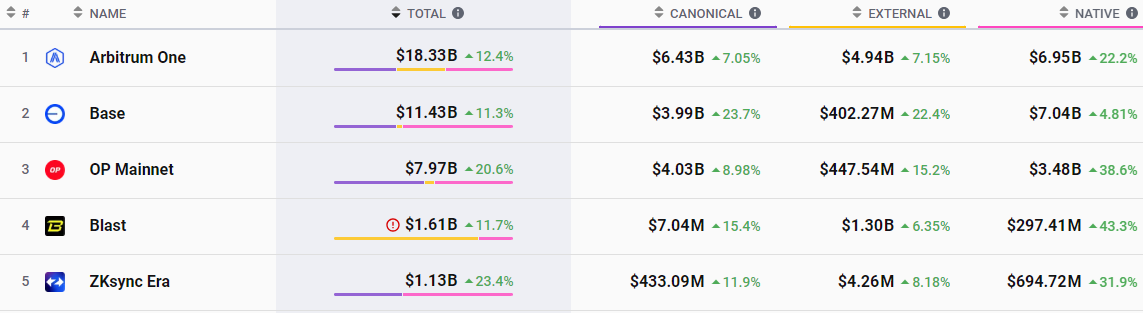

Arbitrum One and Base were the main drivers of the rise to over $51 billion TVL.

As the leading L2, Arbitrum holds over $18.3 billion worth of TVL, representing 35% of the total L2 ecosystem’s TVL.

The second-largest L2 network, Base, holds $11.4 billion in TVL, just over 22% of the cumulative L2 TVL.

Arbitrum’s TVL increased more than 12%, while Base’s TVL rose over 11.4% during the week leading up to Nov. 28.

Base surpassed the record 106 transactions per second (TPS) on Nov. 26 as its TVL surpassed the $10 billion milestone for the first time. The total number of Base transactions recently crossed the 1 billion milestone, mainly due to memecoin mania during this bull cycle.

Dencun upgrade was a significant milestone for L2 fee stabilization

L2s have seen a significant boost from the biggest network upgrade since the Merge — Ethereum’s Dencun upgrade — which shipped in March.

It provided a significant boost for fee stabilization around L2s, Nick Dodson, the co-founder and CEO of Fuel Labs, told Cointelegraph:

“On the point of EIP-4844, a lot of people talk about the fee reduction, but it’s more about fee stabilization. It’s actually more about expanding capacity and scale and not so much lowering fees.”

Some Ethereum L2s saw a 99% median transaction fee reduction after the upgrade went live, including Starknet, Optimism, Base and Zora OP mainnet.

Source: https://cointelegraph.com/news/ethereum-l2s-record-51-b-tvl-205-yearly-growth