Decentralized exchange Curve has joined with blockchain network Elixir to expand access to decentralized finance (DeFi) for BlackRock’s tokenized money market fund, Curve said on Nov. 29.

Token holders will soon be able to mint Elixer’s yield-bearing stablecoin, deUSD, against BlackRock USD Institutional Digital Liquidity Fund (BUIDL), Curve said.

They can then swap deUSD for other DeFi stablecoins — USD Coin, Tether, and Frax — on Curve’s liquidity pools.

“[U]p to $1B in institutional real-world assets (RWAs) can now mint deUSD, a yield-bearing synthetic dollar,” Curve said.

“Curve already hosts the majority of deUSD trading and liquidity, with $64M (approx. 60% of total liquidity) currently in Curve pools,” according to the announcement.

Liquidity providers (LPs) can earn rewards for providing liquidity to the pools, Curve said. Elixir’s website touts APRs as high as 40% for some deUSD stakers.

Curve is a popular decentralized exchange with nearly $2 billion in total value locked (TVL) as of Nov. 29, according to DefiLlama.

BlackRock’s tokenized money fund

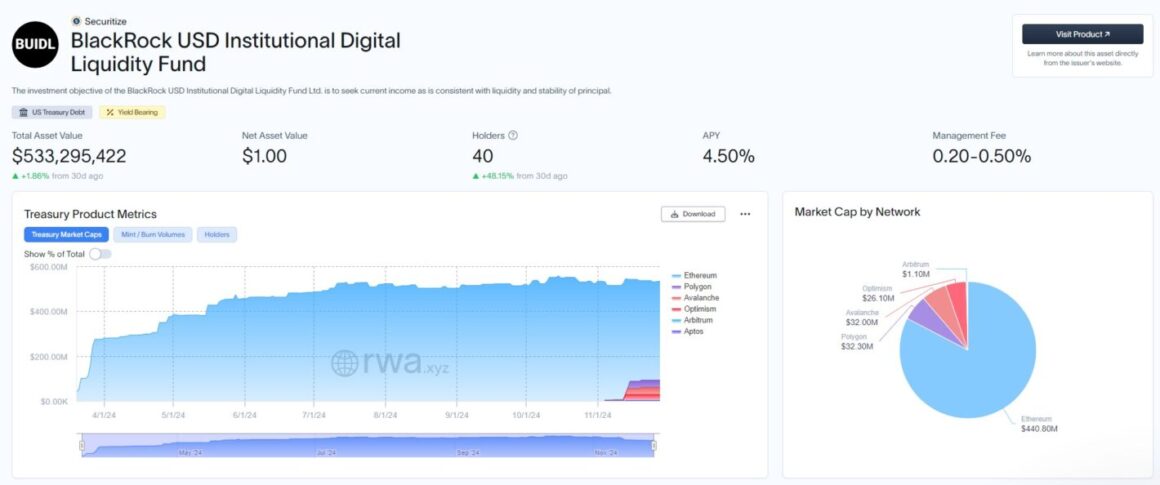

Tokenized by Securitize, BUIDL is a money market fund that invests primarily in short-dated United States Treasury bills (T-Bills) and similar low-risk, interest-bearing securities.

BUIDL is the largest tokenized Treasury fund in terms of assets under management (AUM), followed by the Franklin OnChain US Government Money Fund (FOBXX), with AUM of approximately $540 million and $450 million, respectively.

On Nov. 13, BlackRock launched BUIDL on several additional blockchain networks, including Aptos, Arbitrum, Avalanche, Optimism and Polygon.

On Nov. 19, Elixir tipped plans to launch a liquid staking token (LST) for BUIDL and other tokenized securities.

The growth of tokenized RWAs

Demand is surging for tokenized RWAs that offer low-risk yields from T-Bills and other money market instruments.

Tokenized Treasury products now command approximately $2.5 billion in TVL as of Nov. 29, up more than three times since the start of 2024, according to RWA.xyz.

Collectively, tokenized RWAs represent a $30-trillion market opportunity globally, Colin Butler, Polygon’s global head of institutional capital, told Cointelegraph in an interview.

Source: https://cointelegraph.com/news/curve-blackrock-partner-buidl-de-fi