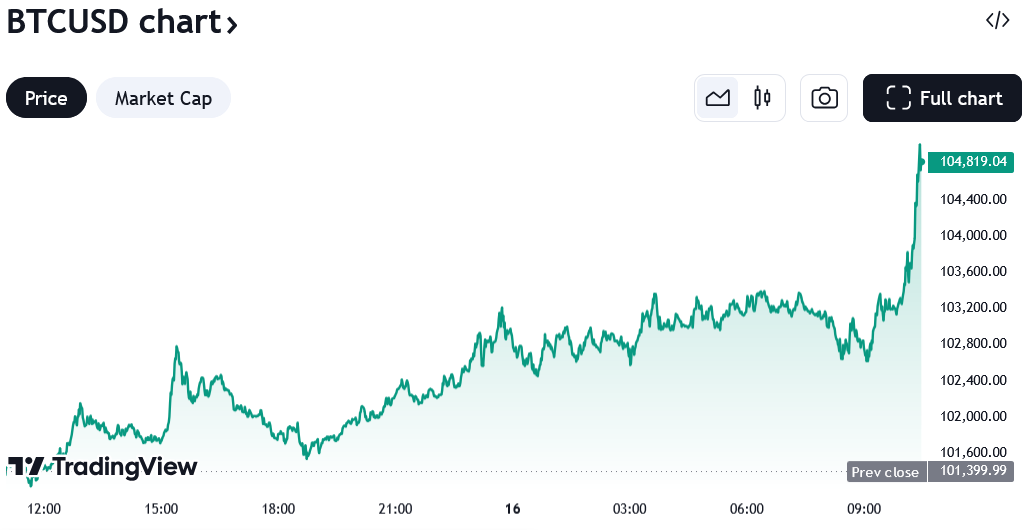

Bitcoin’s price rallied nearly 5% in a day to set a new all-time high above $106,000 on Dec. 15 as speculation of it becoming a United States reserve asset continues to grow.

Bitcoin topped out at $106,554 but has since fallen slightly to $106,000, TradingView data shows. Its previous high was $104,000, which was set on Dec. 5.

CK Zheng, chief investment officer of ZK Square, told Cointelegraph that Bitcoin has likely entered “Santa Claus mode” as many investors fear missing out and look to allocate more capital into the asset class.

He predicts a Bitcoin price tag of $125,000 in early 2025 but warns of a possible 30% correction could follow as most of the bullish news from the incoming Trump administration has been “priced in.”

A 30% correction from $125,000 would see Bitcoin retrace to around $87,500.

It comes as Strike founder and CEO Jack Mallers said US President-Elect Donald Trump could potentially issue an executive order designating Bitcoin as a reserve asset on his first day in office on Jan. 20.

“There’s potential to use a day-one executive order to purchase Bitcoin,” Mallers stated, adding:

“It wouldn’t be the size and scale of 1 million coins but it would be a significant position.”

Meanwhile, Satoshi Action Fund CEO Dennis Porter says a third Bitcoin reserve bill is in the works at the state level — however, he didn’t reveal which state would follow Texas and Pennsylvania’s lead.

“We had Pennsylvania, and we had Texas. And now we have another state coming on board. And they sent me the draft. So I know it’s real,” he said during a Dec. 15 X Spaces.

Porter added he expects at least 10 states to introduce a Bitcoin reserve bill in total.

“Its not going to stop. We’re going to see more and more of these bills come. At least 10, in my opinion.”

Financial analysts also tip a 0.25% interest rate cut from the US Federal Reserve on Dec. 18, which could push Bitcoin’s price even further in the coming months.

Another catalyst behind Bitcoin’s price surge could be one of the new rules by the Financial Accounting Standards Board, which enables institutions to record the value of their crypto assets more realistically. The rule will apply to fiscal years beginning after Dec. 15.

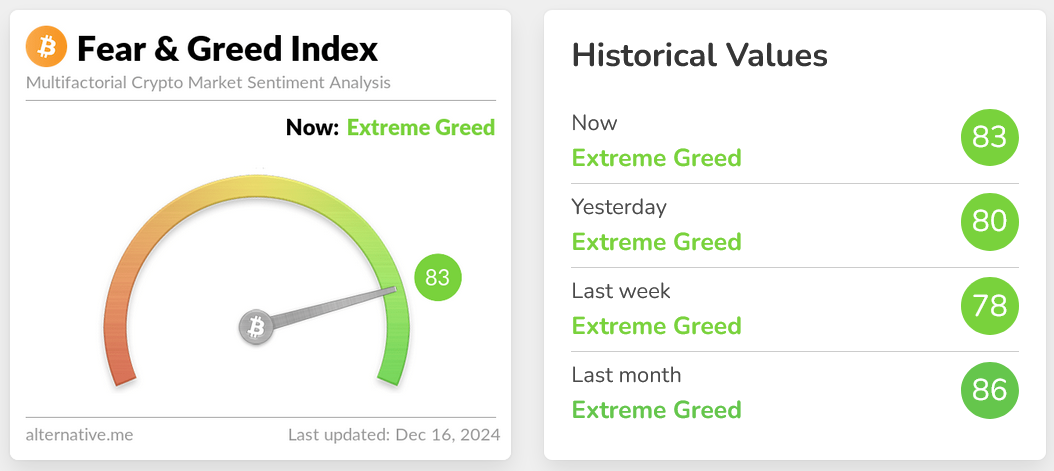

Bitcoin’s market sentiment is currently in the “Extreme Greed” zone at a score of 83 out of 100, according to the Crypto Fear and Greed Index.

It hasn’t been higher since Dec. 5, when Bitcoin broke through the $100,000 milestone.

Source: https://cointelegraph.com/news/bitcoin-sets-new-all-time-high-above-105000