Everyone’s a genius trader during bull markets, but there are also ways to generate profits during bear trends. How to capitalize on liquidations, writes Elaine Hu on Cointelegraph.

The first week of the new year saw a vicious pullback across all cryptocurrencies in the market. Ether (ETH) price dropped from its November peak at $4,800 peak to under $3,000 on Jan. 8 and Terra’s LUNA governance token also dropped from $85 on Dec. 31 to $67 on Jan. 8, 2022.

These unexpected dramatic moves often cause liquidation cascades in the lending market, but they also create unique buying opportunities in the collateral liquidation markets.

Kujira’s Orca protocol is a platform built on the Terra network and it allows investors to bid on bETH (bonded asset of Ether) and bLUNA (bonded asset of LUNA) at a discounted price when the at-risk collateral is liquidated.

As a pseudonymous analyst at Kujira pointed out, “Liquidation has for so long been the “shady underbelly” of lending platforms and monopolized by bots so much that the average user barely knows it’s going on, least of all how they could benefit from it”.

Kujira allows anyone to participate in the liquidation process by grasping the opportunity to acquire these assets at a discounted price.

In the recent crash on Jan. 8, the lowest price one could buy Ether (in its bonded asset bETH form) was $2,833, while the market price of Ether was around $3,000. Similarly, traders could buy bLUNA as low as $58.90 while LUNA’s spot price was around $67.

Liquidation stats from Kujira. Source: Twitter

Let’s take a closer look at the strategies for acquiring bETH and bLUNA at a discount during a market crash.

Market structure provides unique opportunities to buy at a discount

In the Terra ecosystem, participants can borrow Terra USD (UST), the stablecoin of the Terra blockchain, from DeFi protocols such as Anchor to participate in high-yield liquidity pools, initial decentralized exchange offerings (IDOs) or any other profitable trading activities involving UST.

To borrow UST, participants need to deposit bonded assets (bETH or bLUNA) as collateral to Anchor. The maximum amount each wallet can borrow is 60% of the collateral value, often referred to by DeFi protocols as the maximum LTV (loan-to-value).

In a bull market where Ether and LUNA prices are on the rise, the LTV continues to decrease and no collateral is at risk. When the price of Ether or LUNA goes down, the collateral value decreases and if the LTV exceeds 60%, a liquidation event is triggered.

This alerts Anchor to sell the proportion of the collateral that exceeds the maximum LTV at a discounted fire-sale price on Kujira Orca. This is where potential buyers on the other side of the trade can buy the collateral at a discount.

How to capitalize on pricing anomalies in ETH and LUNA

Here are some simple steps investors can follow if they want to purchase Ether or LUNA at a discount.

- After connecting the Terra wallet to the platform, an investor chooses the asset they would like to bid (currently only bLUNA and bETH are available), then selects the premium (the percentage of discount from spot) to receive.

- After clicking “Place My Bid” to submit the bid, the investor will see the “My Bids” window. It takes 10 minutes for the bid to be ready, and afterward, the investor needs to click “Activate” to include the bid in the bidding queue.

- Once the bid has been filled, the amount will be shown in the “Available for Withdrawal” window. The investor then needs to click withdraw and pay a fee to transfer the asset back to their Terra wallet.

Kujira Orca home page demo. Source: Kujira Litepaper

There are three important things to remember when placing the bid:

- If the investor is not using KUJI (the native token of Kujira) to pay for the withdrawal fee, they should always place a premium (discount) percentage larger than 1%, as there is a network fee of 2 UST and a 1% commission fee. If using KUJI, the commission is only 0.5%.

- If there are multiple bids at different discounted rates, the investor should activate them all at once to save network fees.

- The bids are filled equally and proportionally between everyone bidding at the same discounted rate. There is no first-come, first-serve advantage or larger bids that get a filled-first advantage. The only sequence in which the bids are filled is based on the discounted rate — i.e., the lower-discount pool gets filled first.

The mechanism of evenly distributing liquidation assets among each bidder ensures the fairest allocation to everyone. Ryan Park, co-builder of Anchor Protocol, said in an interview about Orca:

“By evenly distributing the proceeds of liquidations amongst a greater majority, collateral isn’t going into a centralized point but back into the hands of other users. The implications are staggering and quite frankly, I don’t think enough attention has been given to just how big this is.”

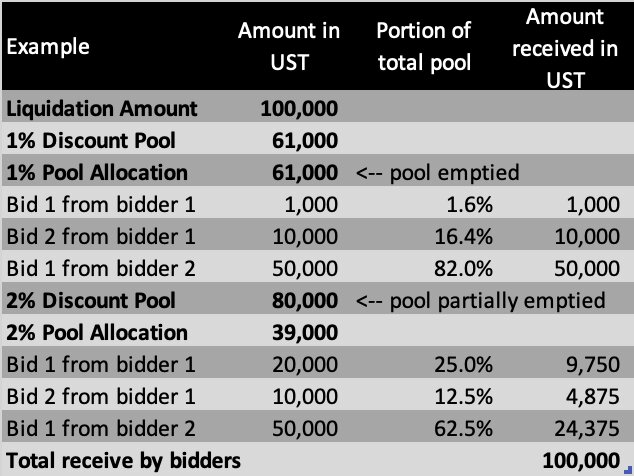

The example below shows that when there is a 100,000 UST liquidation to be executed, the 1% discount pool (61,000 UST in total) is filled first and the pool is fully emptied. The remaining 39,000 UST is subsequently passed onto the 2% discount pool to fill the bids.

Each wallet in each pool receives a proportion of the allocated liquidation amount based on the size of their total bidding offer in the pool. It is a completely fair distribution with no priority given to the quickest clicker or the largest bidder.

Example of 100,000 UST liquidation in 1% and 2% pools.

Identifying the best time to buy

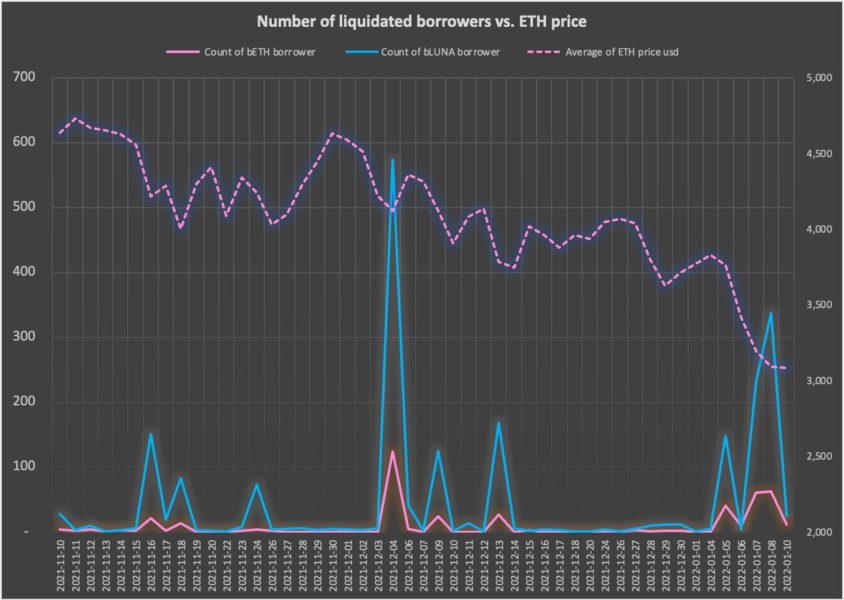

Figure1: Number of liquidated borrowers vs. ETH price. Source: Kujira Orca, Flipside Crypto

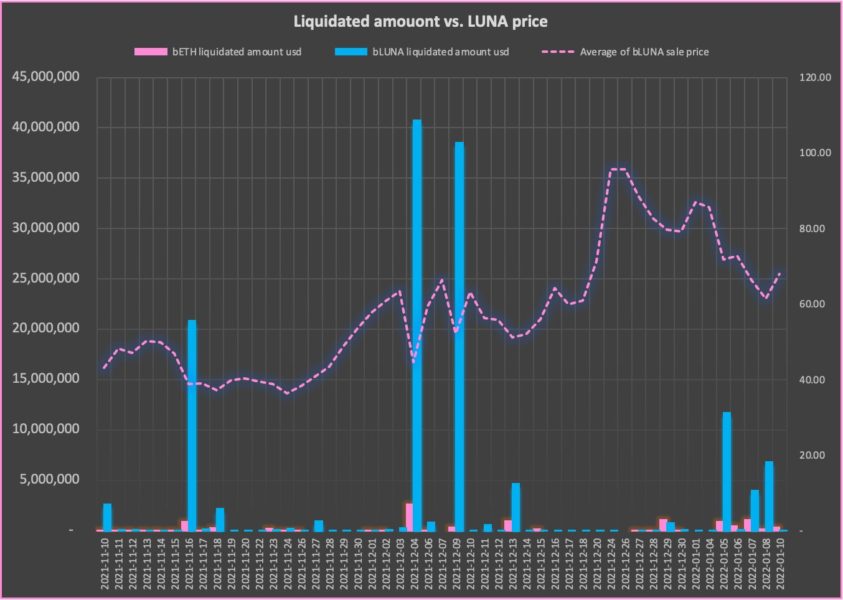

As shown in Figure 1 and Figure 2, the best time to bid is when there is a dramatic drop in collateral asset price and many borrowers’ LTV goes above the 60% maximum level.

This creates an increase in the number of liquidations (blue and purple line in Figure 1) and also the supply of liquidation assets on the platform (blue and purple bar in Figure 2).

Figure 2: Liquidated amount in USD vs. LUNA price. Source: Kujira Orca, Flipside Crypto

The worst case scenario — in terms of number of liquidated borrowers — coincides with the time when bLUNA and bETH prices dropped significantly. The liquidation amount also spiked in early December 2021 and early January 2022 when Ether and LUNA prices breached major support levels as shown in Figure 2.

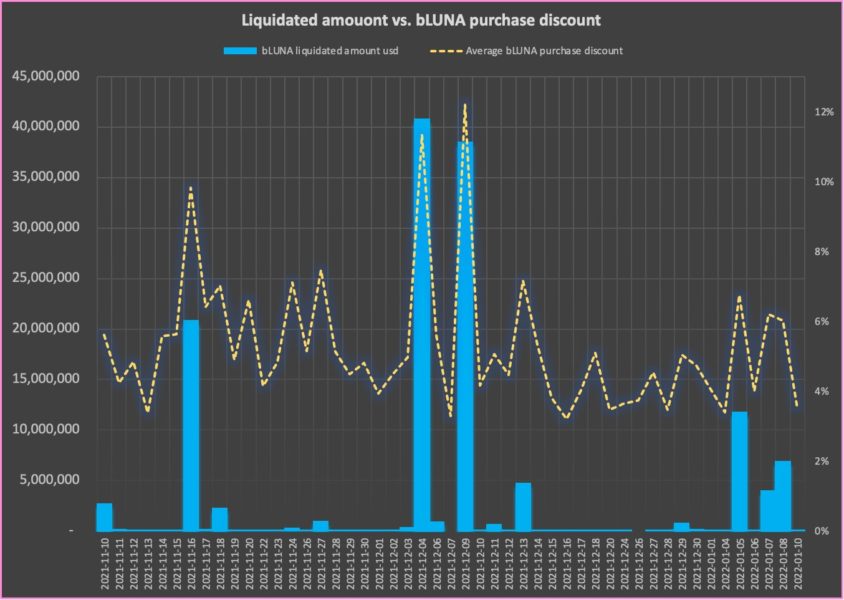

These sudden rises in liquidation create unique opportunities for investors to purchase bLUNA and bETH at a great discount. As shown in the chart below (Figure 3), in the December LUNA crash, bidders could purchase bLUNA at a 11% to 12% discount on Kujira Orca at the peak.

Figure 3: bLUNA liquidated amount in USD vs. purchase discount. Source: Kujira Orca

Similarly (shown in Figure 4), when Ether price dropped from the $4,600 level to $4,100 on Nov. 16, bidders were able to purchase bETH at a 11% discount at around $3,700.

Figure 4: bETH liquidated amount in USD vs. purchase discount. Source: Kujira Orca

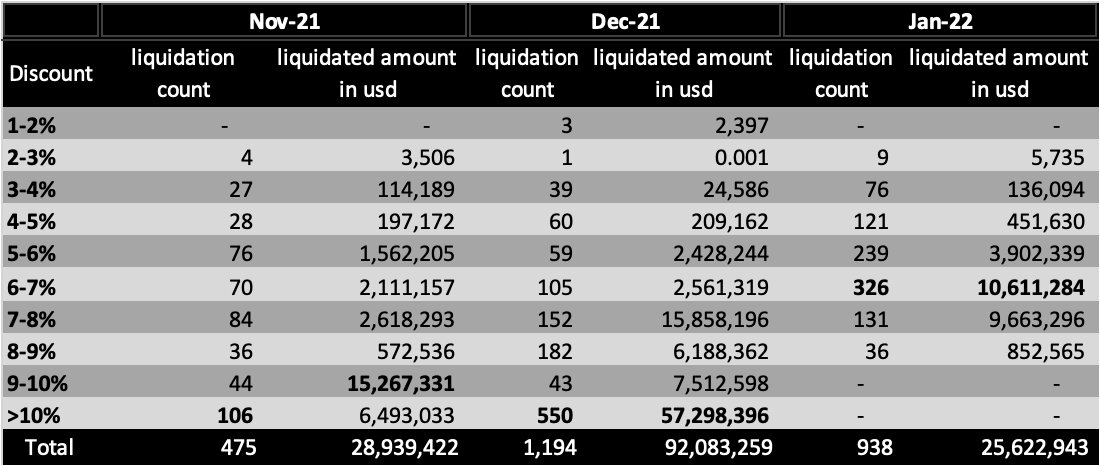

Looking into the average discount bidders received in the past three months, it is very interesting to see most of the liquidations happened in the very high discount group (9 to 10%, or more than 10%) for November and December 2021.

In January 2022, the concentration seems to have moved to the 6% to 7% discount bucket. However, January’s data is incomplete and only available until Jan. 10 at the time of writing. This means the concentration in the 6% to 7% bucket is only a reflection of the drop early in the year and could still change for the rest of the month.

Discount bucket comparison for the past 3 months — January data is only until Jan.10. Source: Kujira Orca

Traders can earn while they wait

The historical discount data clearly shows that investors can buy bETH and bLUNA at a discount as high as 9% or 10% away from the market price but the bids might take a long time to get filled.

Luckily, there will soon be a way to keep earning interest from UST while waiting for the bids.

Investors can simply deposit UST to Anchor’s Earn and accrue interests at the current rate of 19% APY, and use the aUST token they receive as the IOU token to bid liquidation assets on Kujira Orca. This way, one keeps accruing interest until the bid is filled on Kujira and the aUST is converted to UST for the liquidation purchase.