A number of emerging economies across Africa have the potential to become digital asset hubs. Simultaneously, the cost of compliance for crypto exchanges is increasing as regulatory clarity emerges, according to Ben Caselin, chief marketing officer of VALR, a crypto exchange based in Johannesburg, South Africa.

“South Africa is the entryway to the rest of Africa with a good rule of law and independent judiciary. It’s easy to open a company in South Africa,” Caselin told Cointelegraph in an exclusive interview.

Caselin views several emerging economies in the African subcontinent as promising hubs for digital asset adoption.

In April, South Africa’s Financial Sector Conduct Authority (FSCA) granted new crypto asset service provider (CASP) licenses to VALR. The exchange, which raised $55 million in equity funding from Pantera Capital, Coinbase Ventures and others, has obtained Category I and II CASP licenses from the FSCA.

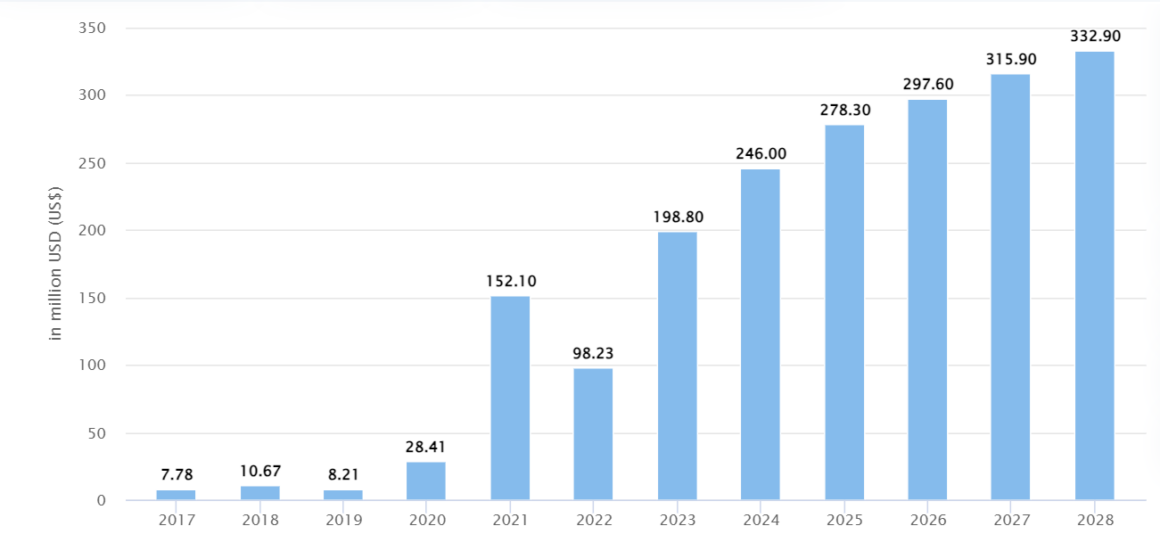

Revenue in the South African cryptocurrency market is expected to touch $246 million in 2024 and show a compound annual growth rate of 7.86% to reach $332.9 million by 2028, according to a Statista report.

South African crypto regulation picks up

On March 12, South Africa’s Financial Sector Conduct Authority (FSCA) approved 59 cryptocurrency platform licenses under existing law. At that point, 262 applications were still being processed from a total of 355 applicants.

South Africa is the first African nation to license crypto exchanges. In 2021, it explored a separate regulatory framework for crypto, with plans still in place by 2022 as it aimed for final regulations that year.

Caselin said that after years of consultation and working closely with the regulator and other local market players, the FSCA has only recently established its regulatory regime for Crypto Asset Service Providers, requiring on-site visits to ensure compliance.

Over the next few years, Caselin expects this regime to further mature. Eventually, getting more clarity around capital controls and crypto assets is important, Caselin said, adding that he expects “more clarity around definitions”. Elaborating, he said:

“While nowhere is perfect, South Africa’s regulatory regime is among the best, alongside Dubai. Arguably, South Africa provides more regulatory clarity than most countries in Asia, including Hong Kong and Singapore, and certainly more clarity than in the United States.”

Regulation has also affected compliance costs, which have “increased manifold” for VALR. Caselin said that over the past few months, VALR has increased its headcount “significantly,” with more than 10% of its total workforce in compliance.

South Africa an important emerging technology hub

In July, Solana-based marketplace AgriDex facilitated a cross-border agricultural trade between a South African producer and a London importer. The importer paid for over two hundred bottles of extra virgin olive oil and several cases of wine sourced from a South African farm and vineyards.

AgriDex enabled the payment through the Solana blockchain, charging just 0.15% to each side of the trade, compared to the much higher fees typical of traditional payment methods.

Simultaneously, South Africa is also making progress in regulating artificial intelligence technology. In August, the South African Department of Communications and Digital Technologies (DCDT) released a national policy framework, marking a key step in establishing the country as a leader in artificial intelligence.

Once finalized, the AI policy will provide the “foundational basis” for developing AI regulations and possibly an AI Act in South Africa.

In South Africa, where, according to Caselin, VALR is the largest crypto exchange by trade volume, approximately 70% of the exchange’s trading volume comes from institutions and corporate clients looking to hedge risk and trade. VALR serves over 1,100 corporate and professional investors and more than 850,000 traders worldwide.

While VALR continues to grow in Africa, over the past year, the exchange has also made progress in Asia. Caselin said that if the current trend continues, then VALR will have doubled its user base by the end of this year to reach a million registered users.

“South Africa is one of the important digital assets hubs in the world, not only due to its proactive regulatory stance but also as one of the three most advanced economies in Africa in terms of productivity, infrastructure and willingness to innovate,” Caselin concluded.

Source: https://cointelegraph.com/news/south-africa-digital-asset-hub-crypto-compliance-fsca