Polygon is one of the most popular Ethereum layer-2 scaling solutions with a booming DeFi ecosystem. Everything you need to know about it writes Jose Oramas on CryptoPotato.

Polygon, formerly known as MATIC network, is a layer-2 scaling solution created in 2019 to address several limitations in the Ethereum blockchain, such as transaction speed, throughput, and gas fees.

It was originally designed as a scaling solution, but it rapidly evolved into a multi-purpose ecosystem that’s been receiving a lot of attention. MATIC, its native token, debuted on the Binance Launchpad in 2019 amid the Initial Exchange Offerings (IEO) boom.

But first thing’s first, let’s see what layer-2 solutions are if we want to have a better knowledge of Polygon.

WHAT ARE LAYER-2 SOLUTIONS AND WHY DO WE NEED THEM?

A layer-2 solution is a blockchain that runs parallel to a mainnet — in Polygon’s case, Ethereum — but processes transactions outside of the mainnet, resulting in an increased throughput (transaction speed) and lower gas fees.

In other words, what layer-2s do is that they build a communication channel between the two blockchains and send the information package (the transaction data) from the mainnet to the parallel blockchain to execute the transaction for a fraction of its cost and at a much higher speed, all without compromising the Ethereum mainnet.

As we know, Ethereum is the go-to ecosystem for most software developers looking to launch their dApps (decentralized applications) due to its vast and secure infrastructure and innovative tooling.

However, the high demand for dApps and the subsequent supply clogged the network, and its throughput has significantly downgraded — it’s not uncommon to see gas fees rising up to two or three digits in USD equivalent, which can be quite expensive depending on how much you interact with the network, leaving the Ethereum blockchain only for the ‘big players.’ You can use Etherscan’s gas tracker to check the current gas fees.

This is why Layer 2 solutions have become essential to the DeFi ecosystem as they enhance Ethereum’s scalability and throughput while still benefiting from its security properties.

HOW DOES POLYGON WORK?

Polygon works similarly to other Proof of Stake (PoS) protocols in terms of network nodes, governance, staking, and other functionalities.

Proof of Stake Consensus

The platform leverages the Proof of Stake consensus, which relies on a set of node validators to verify and validate transaction blocks on the network, instead of relying on the classic Proof of Work (PoW), which consumes an enormous amount of processing power to create new blocks.

The main difference comes in that instead of having to do the work (computing work in PoW algorithms), in PoS, token holders validate and verify transactions.

The PoS ecosystem of Polygon works by rewarding users with MATIC, the protocol’s native token. To earn MATIC, you can choose one of the following options:

Become a validator and commit to the network by running a full node to validate transactions on the blockchain. As a node validator, you receive a cut of fees and newly created MATIC. However, if you act maliciously, make a mistake, or even if your internet connection is slow, your MATIC rewards will be slashed as punishment.

Become a delegator, which is a type of public node. As a delegator, you receive other people’s MATIC and use it to help the network conduct PoS validation. The larger the delegated stake, the higher the delegator’s voting power. This is easier than being a node validator, but it also comes with its challenges.

Polygon Bridge

If you want to transfer funds from the Ethereum network to Polygon’s, you need to use the PoS bridge, which is a set of smart contracts that help to conduct assets from the Ethereum mainnet to the Polygon sidechain.

The PoS bridge is the backbone to transfer assets from Ethereum to Polygon and then use these funds to interact with the apps and blockchains on the Polygon ecosystem. You’ll have to pay a transaction fee in ETH, of course, which can be expensive, but once you’re in the Polygon network, transactions are very cheap — less than a dollar.

Polygon Protocol

The Polygon Protocol connects all Polygon-based blockchains with each other and the Ethereum network. It also allows chains to tap into Ethereum to inherit its security model.

Polygon’s Software Development Kit (SDK)

In May 2021, Polygon announced the Polygon Software Development Kit (SDK), a collection of plug-and-play software tools that allows developers to launch their own fully customizable blockchains and DeFi apps.

The main idea is to make Ethereum a fully-fledged multi-chain system, which it already is, but the current limitations and the lack of structure on the Ethereum ecosystem makes it harder for developers to work on their projects.

Polygon aims to give the ecosystem a boost with Polygon SDK, based on three major concepts: Ethereum-compatibility, modularity, and extensibility, making it a flexible framework for developers keen to work on Ethereum scaling and infrastructure solutions.

Polygon SDK is divided into two iterations. The first version supports Ethereum-compatible stand-alone chains, which are sovereign blockchains in charge of their modules and security. These chains can use the Polygon bridge to communicate with Ethereum (e.g., transferring assets or sending arbitrary messages) while keeping their independence.

On the second version, we’ll see support for other types of chains, such as Layer 2, with their own set of modules and tools to further empower developers.

UTILITY: WHAT CAN YOU DO ON POLYGON?

Polygon allows you to do pretty much everything you do on Ethereum, but without the high gas fees or the low throughput.

Polygon went from being a simple scaling solution to becoming a more broad and complex ecosystem where users and developers alike have a wide set of use cases, including launching Ethereum-compatible blockchains, use Ethereum-based decentralized applications (DApps), mint non-fungible tokens (NFTs), become node validators, delegators, stake MATIC, and much more.

There are numerous successful projects that work on Polygon, such as yield generating protocols like Aave or Curve Finance, decentralized exchanges such as SushiSwap, and the most popular decentralized NFT (Non-Fungible Token) marketplace, OpenSea.

You can use Polygon as the base blockchain on these protocols instead of Ethereum. For example, OpenSea allows you to choose Polygon instead of Ethereum as the main network and use it every time you trade NFTs — you just need to have a Polygon-compatible wallet like MetaMask or Coinbase Wallet and connect it to OpenSea.

It’s also worth noting, though, that not all protocols that are built on Ethereum have their Polygon iterations, and to this extent, there are certain limitations.

THE MATIC TOKEN

The MATIC token is an ERC-20 token that powers the entire Polygon ecosystem. It’s used to pay for gas fees, for staking, and for governance. As per CoinMarketCap, there’s a current circulating supply of 7.48 billion MATIC tokens, with a max supply of 10 billion.

After being rebranded to Polygon and implementing new features for developers and users on the ecosystem, the MATIC token saw explosive growth in price due to an increased use case. At the time of writing this, in February 2022, it’s the 16th largest cryptocurrency by means of total market capitalization.

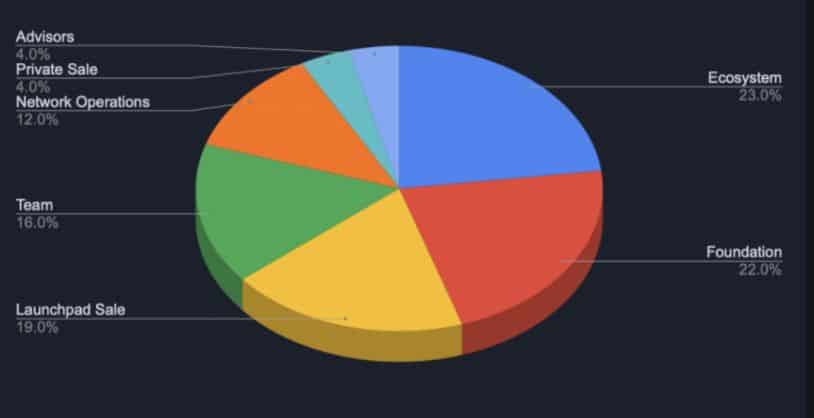

The MATIC token supply distribution is as follows:

- Advisors: 4%

- Private Sale: 4%

- Network Operations: 12%

- Team: 16%

- Launchpad Sale: 19%

- Ecosystem: 23%

- Foundation: 22%

MEET THE TEAM BEHIND POLYGON

Polygon was created by four software engineers with a strong background in software development:

Jaynti Kanani: co-founder, CEO, and Senior software engineer.

Sandeep Nailwal: co-founder and CEO.

Anurag Arjun: co-founder and Chief Product Officer.

Mihailo Bjelic: co-founder and software engineer.

POPULAR DAPPS USING POLYGON

SushiSwap: an Ethereum-based decentralized exchange (DEX) that works as an Automated Market Maker (AMM).

Curve Finance: an exchange liquidity pool on Ethereum that provides seamless stablecoin trading at a low risk.

1inch: a DEX aggregator that acts as a liquidity bridge between several DeFi protocols, providing users with the best liquidity on Ethereum, Binance Smart Chain (BSC), Polygon, and more.

Aave: a yield aggregating protocol that allows users to borrow crypto to use it as collateral to take out flash loans.

QuickSwap: a decentralized exchange running on the Polygon network that provides lightning-fast transactions at a cheap cost.

Closing Thoughts

Polygon is one of the most exciting DeFi projects in existence, with a promising future for the DeFi community regarding scalability and blockchain interoperability.

And with its vast set of tools for developers, its innovative mechanism and modules, and full support for the Ethereum Virtual Machine (EVM), we could soon see an enormous inflow of projects thriving on the Polygon ecosystem.