Cryptocurrency exchanges Binance and Crypto.com are losing market share to smaller competitors as decentralized exchanges (DEXs) gain momentum.

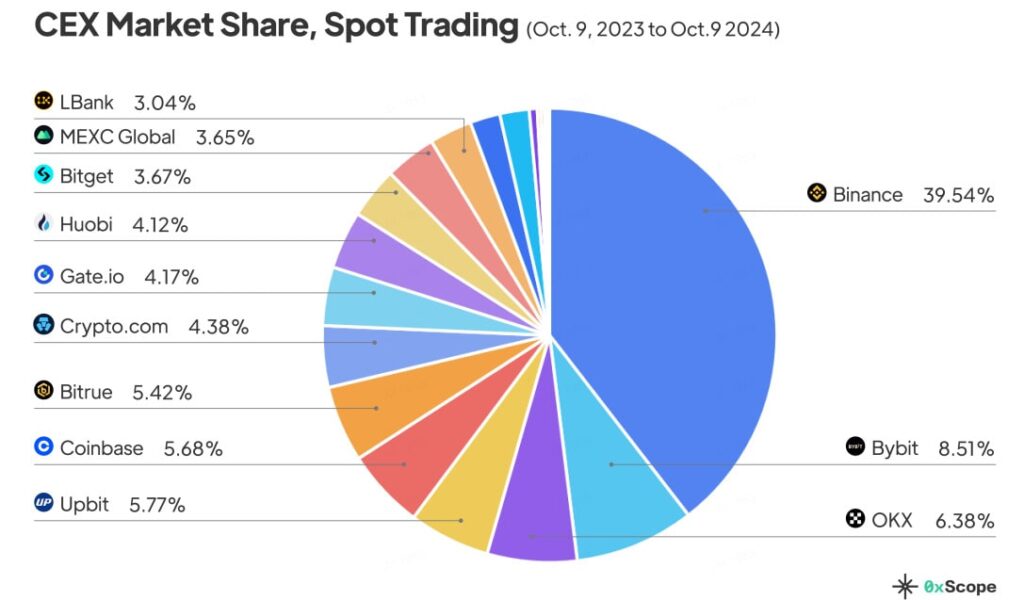

Binance, the world’s biggest crypto exchange, saw a 13% year-over-year decline in spot trading volume from 52.5% in October 2023 to its current 39.5% market share.

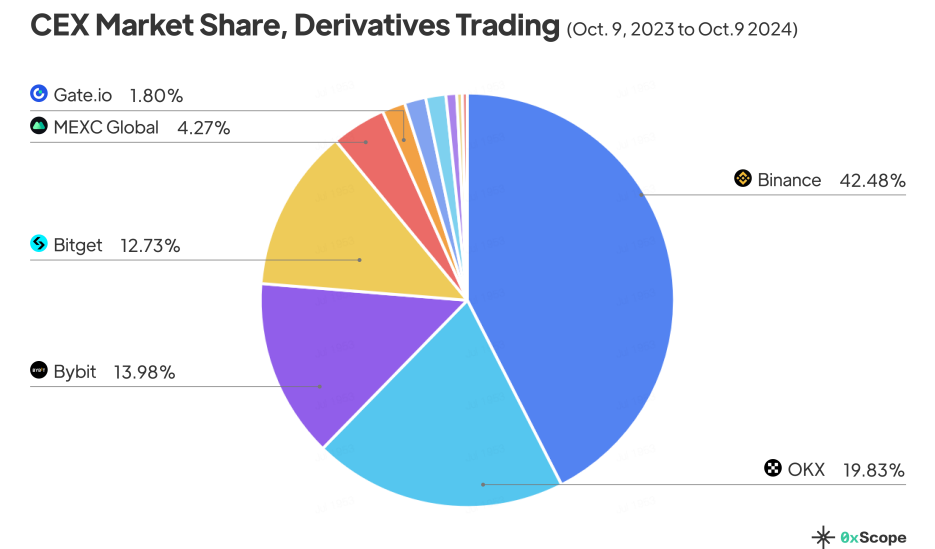

Mirroring its declining spot trading, Binance’s crypto derivatives market share also shrunk 8.4% year-over-year, from 50.9% in October 2023 to 42.5% by October 2024, according to an 0XScope research report shared with Cointelegraph.

The report highlights that smaller exchanges, such as Bybit, Bitget and OKX, have capitalized on Binance’s declining market share:

“[Bybit] surged from the No. 7 spot last year with a 3.2% market share to just behind Binance at No. 2 with 8.51%, more than doubling its share. Meanwhile, OKX, now the third-biggest spot exchange, slightly climbed from 5.4% to 6.38%.”

Bitget’s growing market share, which rose from 8.2% to 12.7%, is due to a growing focus on educational initiatives, user-centric exchange development and recent strategic partnerships, according to Gracy Chen, CEO of Bitget, who told Cointelegraph:

“Bitget’s collaboration with high-profile athletes like Lionel Messi and global sports teams such as Juventus helps build trust and recognition, driving new users to the platform.”

Binance was one of many leading exchanges to lose ground.

Centralized cryptocurrency exchange (CEX) Crypto.com saw a similar decline, with its market share falling from 15% in October 2023 to below 4% by February 2024. According to the report, the decline coincided with surges in market share for both Binance and Upbit.

DEX trading on the rise

Decentralized exchanges are becoming a growing threat to CEXs.

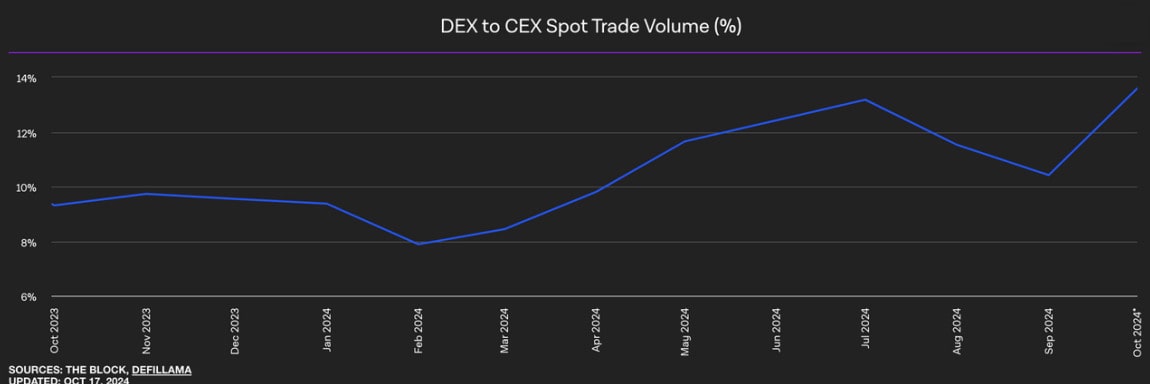

Over the past year, DEX trading volumes grew “significantly larger,” surpassing the monthly $250 billion mark in March and June for the first time since December 2021.

As of Oct. 17, the DEX spot trading volume in relation to CEXs was 13.6%, meaning that for every $1 billion traded on centralized exchanges, $136 million was traded on decentralized platforms.

CEX trading volumes still dominant

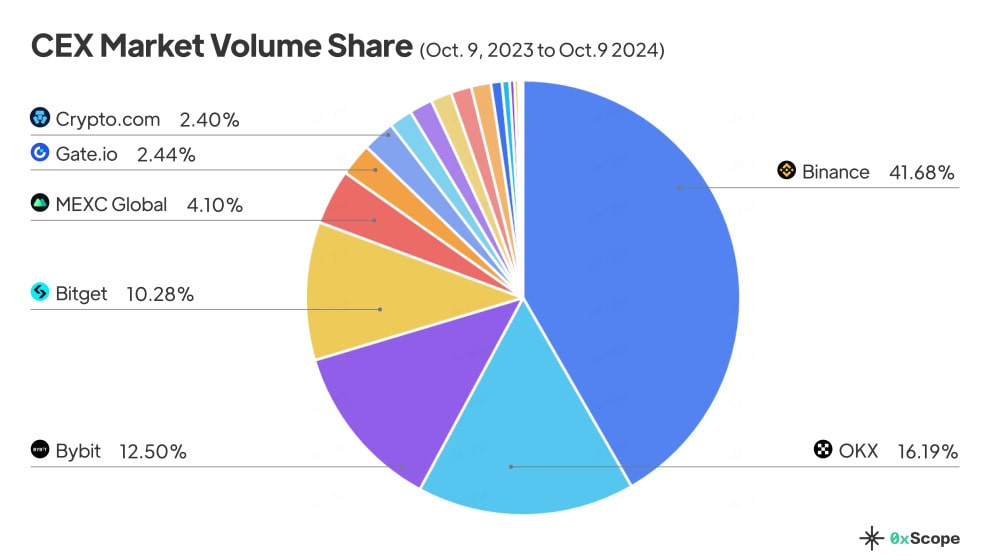

Over the past year, the 22 largest centralized exchanges have processed a cumulative $54 trillion worth of trading volume.

Binance accounted for over $22.5 trillion of that trading volume despite its falling spot market share.

Binance’s top competitors still face an uphill battle, partly due to the growing DEX trading volumes. The report said:

“Binance’s market share has been trending upwards in recent weeks, and if this momentum continues, rival exchanges such as OKX, Bybit, and Bitget will have a more difficult time capturing more market share.”

The report notes that Binance’s market share has been trending upward since the beginning of 2024, with its spot market share staying above 40% for most of the year. Meanwhile, its derivatives market share fluctuated between 45% and 50%.

Source: https://cointelegraph.com/news/binance-crypto-com-lose-ground-dex-rise