G20 finance ministers and central bank governors are meeting this month, and the Bank for International Settlements has findings to present.

In preparation for a meeting of the G20 finance ministers and central bank governors this month, the Bank for International Settlements Innovation Hub (BISIH) submitted two reports — on cryptocurrency and central bank digital currencies (CBDCs) — on July 11. The reports reached very different conclusions about the related technologies.

The BISIH report on crypto is the shorter of the two publications at 24 pages. It provided a short overview of the crypto ecosystem of cryptocurrencies, stablecoins and decentralized finance (DeFi), followed by a laundry list of “[s]tructural flaws and risks.”

The crypto report rehashes some common issues, such as the centralization of much crypto trading, the instability of stablecoins and the purported irreversibility of smart contracts. It raises some relatively little-discussed points, such as the inescapable centralization of DeFi due to the need for an oracle.

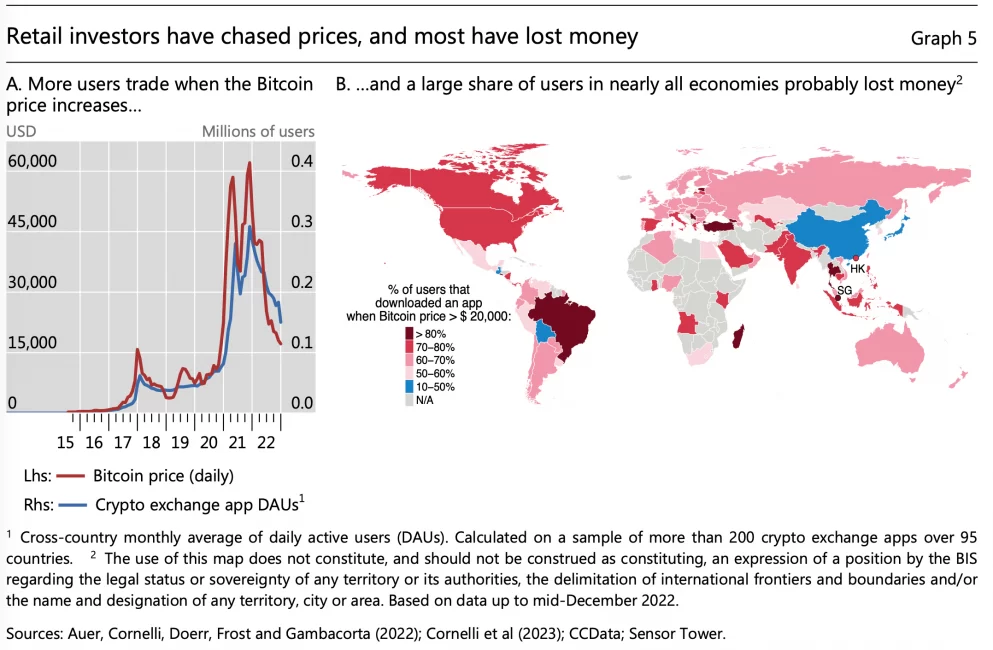

Another comparatively rare insight the BISIH crypto report provided was the risk from human nature. Crypto investors, it pointed out, are inclined to chase prices — that is, buy high and sell low — just as is often seen in traditional finance.

But the BISIH saw the real risk from crypto as its growing interconnectedness with the real economy. “Institutional investors and households continue to show interest in crypto despite the events of the past year,” the report said, referring to the recent crypto winter. In addition, increasing tokenization of assets could encourage the growth of the crypto market further, the report claimed, without explaining the mechanism for it. Stablecoins could bring on “cryptoisation” of economies, where cash is squeezed out.

The BISIH, along with the central banks of Germany and the Netherlands, has started Project Atlas to visualize cross-border crypto flows, but “further steps are needed for a holistic assessment of crypto markets.” The report concluded:

“Crypto’s inherent structural flaws make it unsuitable to play a significant role in the monetary system.”

The BISIH has implemented 12 CBDC proofs-of-concept or prototypes over the past three years, out of 29 total projects, and has learned valuable lessons, it stated in its CBDC report. The report considers the variables of wholesale versus retail CBDCs and their desirability, feasibility and viability.

The tone of the report differed markedly from the crypto text:

“By underpinning the future monetary system, CBDCs would be the foundation upon which further innovations build.”

The report summarized the mass of findings from all 12 projects and suggested ways the information could be used. It provided grounds for a research gap analysis, first of all. “Experimenting under the BISIH umbrella allows projects to build iteratively on one another,” the report said.

A new #BISInnovationHub report to the G20 explores the key insights and lessons learnt from 12 CBDC projects that cover retail and wholesale, both in a domestic and cross-border context. Read more https://t.co/kIIotdl1DS #G20India pic.twitter.com/mZeOAC2LAE

— Bank for International Settlements (@BIS_org) July 11, 2023

Also, BISIH projects could encourage a “modular approach,” in which components such as payment, foreign exchange and compliance could be “decoupled” from projects for more general use. More CBDC projects are coming, the BIS promised.

Source: https://cointelegraph.com/news/bis-gives-cbdcs-thumbs-up-crypto-thumbs-down-reports-g20-ministers