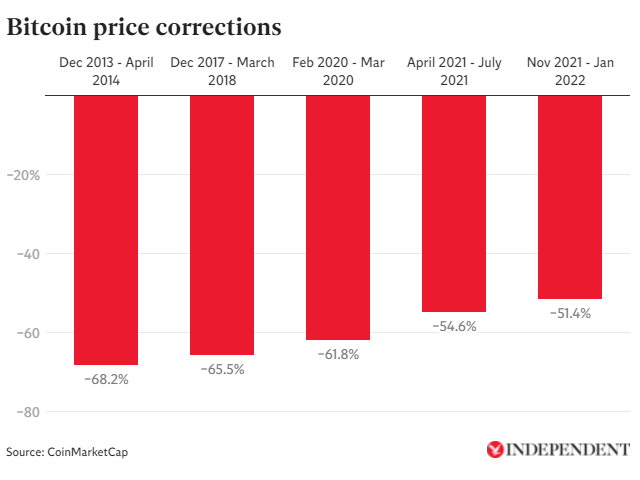

On Friday, a sudden price crash followed by several days of steady losses has pushed bitcoin to its lowest level in six months, down more than 50% from the all-time high it experienced in November. Analysts told The Independent what caused the slump and why Bitcoin’s recovery may be a ‘long shot’.

Typically for the crypto market, the latest price downturn can be attributed to various factors, including a crackdown on crypto operations in Kazakhstan and fears of an outright ban in Russia. But the leading cause of the collapse appears to be a plunge in the stock market amid concerns of a potential hike in interest rates by the US Federal Reserve.

Some analysts warn that the abrupt downturn could end up of a so-called ‘Crypto Winter,’ and it could be years before Bitcoin and the broader market fully recovers.

“Investors are maintaining a conservative stance in line with the highly anticipated US Federal Open Market Committee (FOMC) on Tuesday,” told The Independent Alexander Mamasidiov, co-founder of the mobile digital bank MinePlex.

“With the committee likely to signal its exact plans for the interest rate increase, many investors in the digital currency ecosystem are likely to start betting on more safe assets, thereby pulling funds away from crypto. Since the growth trend is now highly correlated with the stock market, any signs of potential recovery will be hinged on a wider correction in the stock market,” he added.

Usually, uncertainty in the broader financial markets has caused a sell-off of more volatile assets, such as Bitcoin (BTC), Ethereum (ETH), and other leading cryptocurrencies.

In the last two months, about $1.5 trillion has been wiped from the overall crypto market, with every single one of the top 10 cryptocurrencies continuing to suffer heavy losses in recent days.

The severity of the drop already titled Bitcoin’s ‘Black Friday’ saw more than $175 million of Bitcoin liquidations in a single day. Although, it is still not as deep as the one seen in 2021, when Bitcoin plunged from a then-record high of $64,000 in April to below $30,000 by July, before surging to a new all-time high before the end of the year.

“At this point, fear has gripped the cryptocurrency industry, and investors are arguably aiming at rotating their capitals off risky assets that cryptocurrencies embody,” said Alex Axelrod, CEO of Swiss financial service firm Aximetria, who does not believe in the short-term bounce-back.

“Bitcoin’s recovery is a long shot as investors are more keen on the price being stabilized for now. Hopefully, the coin can maintain support at $32,500 in its bid to retest the $40,000 resistance level in the next few weeks,” he suggested.

Commonly, Bitcoin’s volatility is difficult to predict. While it has followed the same recent trends of the more traditional market, it has been known to buck from such patterns from a single event completely.

It’s noteworthy that a previous crash or a surge can be triggered by a single tweet from Elon Musk or a statement from a world leader.

Dmitry Mishunin, the founder and CEO of smart contract firm HashEx, said, commenting on the near future trend:

“Crypto is crypto because their growth tracks are not completely bound by macroeconomic events. A revival in price surge can be reignited with a boosted investor sentiment, which can come at any time.”

As reported earlier, the exchange Huobi has predicted a bear market in 2022 for Bitcoin as central banks tighten their monetary policies and the market sees a liquidity crunch. On the other side, DeFi and cross-chain interoperability will continue to expand and adapt, with DAO governance eventually becoming a significant driver of activity