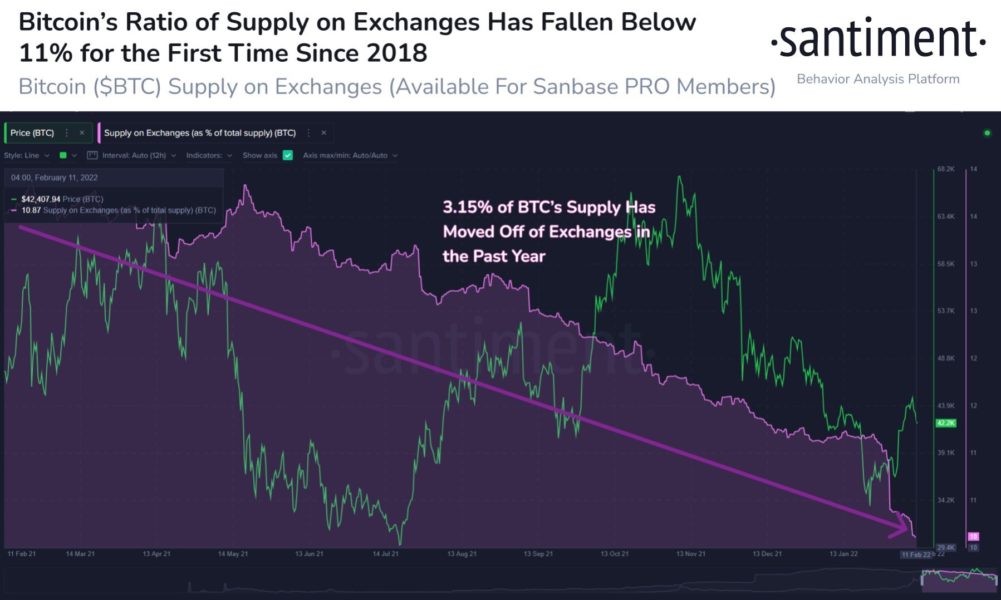

The supply ratio has shrunk by 3%, and Bitcoin exchange supply is the lowest in 37 months. BTC exchanges now hold only 10.8% of the supply. Amid global adoption and holding trends, BTC owners have substantially moved their digital assets from trading platforms to crypto wallets in the last three years.

Santiment’s recent data highlights a sharp surge in Bitcoin outflows from leading digital exchanges. According to the numbers, BTC trading platforms now hold just 10.8% of the circulating supply of the crypto asset, compared to more than 14% in February 2021.

The reason for BTC exchange supply shrinking could be due to wider global adoption of the number one cryptocurrency and holding sentiments of BTC owners. BTC owners have moved their digital assets from trading platforms to crypto wallets in substantial quantities in the last few years.

Data from Santiment reveals that there has been a sharp upsurge in Bitcoin outflows from most of the leading exchanges around the globe. The latest data shows that exchanges now hold just 10.8% of the circulating supply of the crypto asset, compared to more than 14% in February 2021.

The latest supply figures are the lowest since December 2018.

(Source: Santiment Twitter )

“With another series of dramatic drops, Bitcoin’s supply on exchanges is now down to just 10.87%, the lowest percentage seen since December 2018,” Santiment stated. “Generally, this continued trend of coins moving off of exchanges limits the risk of major sell-offs.”

This phenomenon is not new, and in the past, a similar trend was seen after every market correction. For example, in 2018 and again in 2020, holders moved BTC from trading platforms to wallets. The same phenomenon was also seen post the market plunge in December 2021 and January 2022.

However, since January 24, 2022, the bitcoin price has seen a spike of 20%, and BTC has been witnessing a shift in sentiments in the last two weeks. The number one cryptocurrency is leading the latest digital asset weekly fund flows. The numero uno crypto asset has raked in $71 million worth of inflows during the recent week.

After a significant change in market sentiment, BTC’s market cap is stabilizing near $800 billion.

“Bitcoin’s crowd sentiment has remained positive this week, and this is likely contributing to the decline BTC & altcoins have seen to end the week. We will be looking for a bit of crowd FUD as a signal that bounces will happen heading into next week,” Santiment added.

As recently reported, the Canadian branch of accounting giant KPMG allocates Bitcoin and Ether to its corporate treasury. The firm’s executives “expect to see a lot of growth” in DeFi, NFT, and metaverse areas in the years to come.