Bitcoin futures open interest has reached $5.2 billion on the global derivatives giant Chicago Mercantile Exchange (CME), $200 million shy of its late October 2021 all-time high.

Open interest in CME’s Bitcoin futures has grown from $3.63 billion to $5.20 billion over the last 30 days, according to Coinglass data. The open interest surge has run parallel to Bitcoin’s 26% gain over the same time, with Bitcoin currently trading at just over $44,000.

From Oct. 1 to 21, 2021, open interest in CME’s Bitcoin futures surged from $1.46 billion to $5.45 billion.

The rapid uptick in open interest also coincided with a drastic price jump for Bitcoin, which grew from $45,000 to $66,000.

IG Australia analyst Tony Sycamore told Cointelegraph the open interest uptick shows a renewed interest in Bitcoin, but it doesn’t explain how CME traders are positioned.

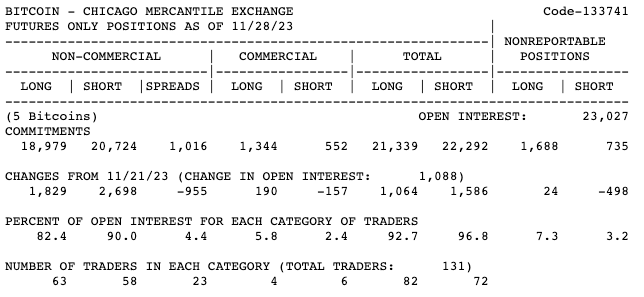

Sycamore pointed to CME’s Nov. 28 report to the Commodities Futures Trading Commission, which showed the “big players” on its platform were sitting net short at the time, with 20,724 short positions compared to 18,979 longs, Sycamore explained.

Until CME’s latest report comes through on Tuesday, Dec. 12, Sycamore said investors won’t be able to see exactly how the players at CME are positioned.

“What we can’t see right now is whether the big players have gone from a net short to a net long, Sycamore said. “If we saw the market getting extremely long, you’d be very worried about a snapback. The market that we could see last week was short, so I don’t think we’re at that point yet.”

The massive uptick in Bitcoin’s price is being driven by more than just speculation around the SEC’s potential approval of a roster of spot ETF products, Sycamore added. A decision on the ETFs is pinned for early January.

“I think there’s got to be more driving this now. It’s not just the ETF or halving speculation anymore. This is starting to take on a life of its own.”

Sycamore said the recent Bitcoin rally could more closely be attributed to crypto’s relationship with the macro environment, looking to the Federal Reserve’s signal to begin cutting interest rates as a more significant driver of price action.

In November, CME nabbed the top spot in Bitcoin futures open interest from Binance, which many interpreted as a signal that traditional finance institutions were beginning to show a greater appetite for crypto products.

Many analysts believe a spot ETF approval will result in a rapid upward price tick for Bitcoin, but not everyone is convinced the current rally can stick, with some predicting a “sell the news” style event in the days and weeks following a potential approval.

Source: https://cointelegraph.com/news/bitcoin-futures-cme-open-interest-nears-high