Bitcoin hit a new all-time high of over $75,000 on Nov. 6, well above its previous $73,800 high in March as traders piled into crypto with early results from the United States elections putting Donald Trump ahead.

At the start of the New York open, Bitcoin initially showed strength, rallying in excess of 3% to hit an intra-day high at $70,577 as US presidential elections-related volatility spiked in the crypto market.

Several hours after the US trading day closed on Nov. 5, Bitcoin reached a new all-time high, hitting $75,000.85 at 3:08 am UTC on Nov. 6 on Coinbase, according to TradingView.

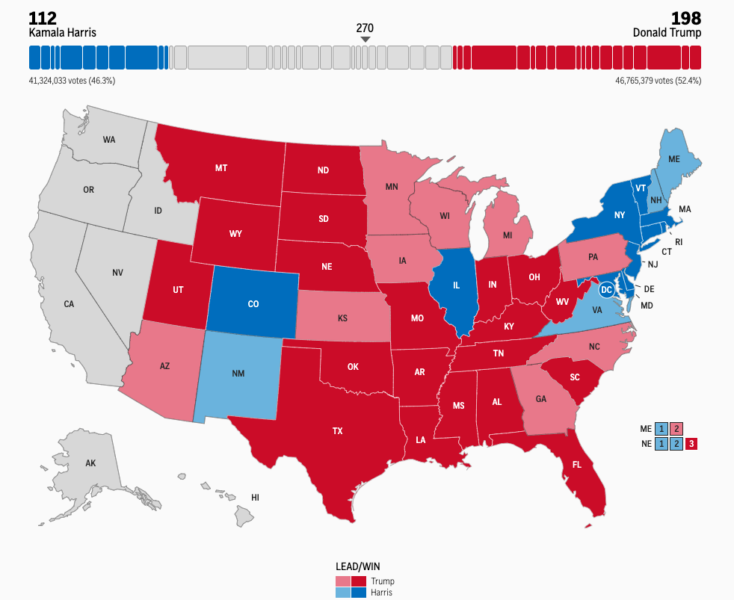

Early election results from the Associated Press showed Trump ahead, winning 198 electoral college votes compared to Kamala Harris’ 112 as of 3:30 am UTC on Nov. 6. Either would need a minimum of 270 electoral votes to win.

At the time of publication, Bitcoin is trading at $74,339, up 7.2% over the last 24 hours

For the bulk of 2024, traders have expressed positive views regarding Bitcon’s price potential if Republican presidential candidate Donald Trump won the election, and throughout the year, the Republican and Democratic candidates have evolved their policy views on regulation within the cryptocurrency industry.

On Nov. 5, Bitcoin analyst Tuur Demeester suggested that election news favoring Trump has been connected to rallies in Bitcoin price.

Is Bitcoin’s rally correlated with Trump’s rising odds?

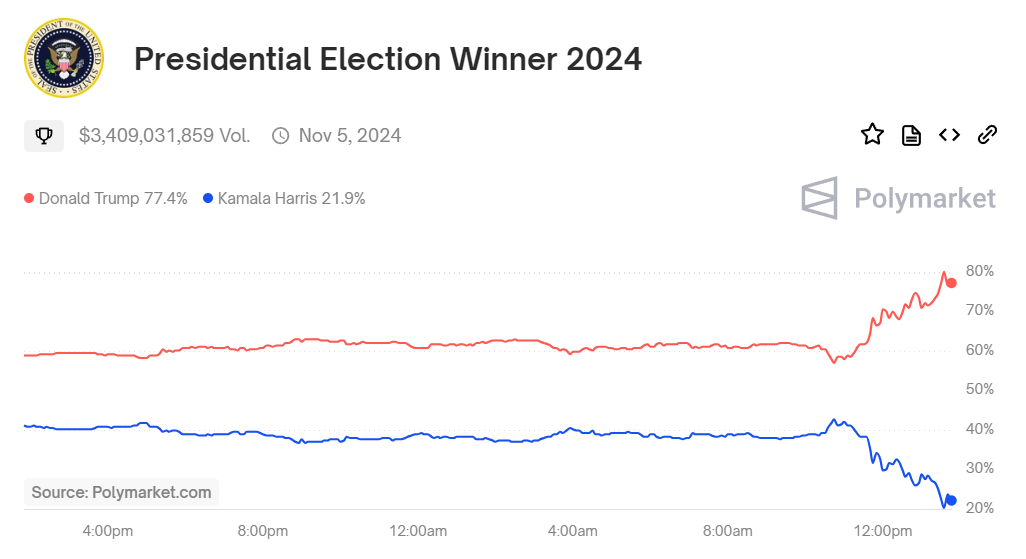

Bitcoin’s price is seemingly aligned with Trump’s rising odds on the decentralized prediction market Polymarket.

On Nov. 5, Bitcoin price rallied back above $70,000 as Trump’s predicted odds of a victory pushed back above 60%, while Harris’ slid below 39%.

Bitcoin price volatility is expected to remain after the US elections

Despite hitting an all-time high, traders expect Bitcoin’s price to remain volatile and changes in market participants’ positioning reflect this sentiment.

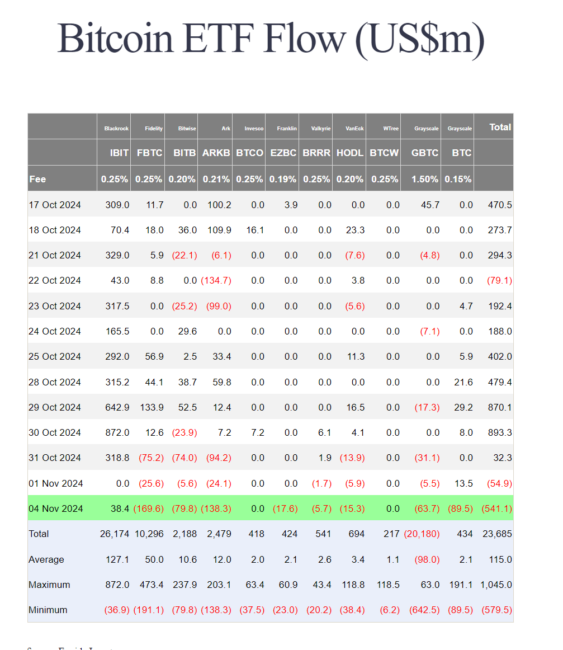

Nov. 4 was a rare day of robust outflows from the Spot Bitcoin ETFs. Total outflows reached $541.1 million as Fidelity, ArkInvest, Bitwise, Grayscale and GBTC saw selling. Meanwhile, BlackRock’s IBIT saw $38.3 million in inflows.

A series of protective measures were observed in the Bitcoin options market, a point that Pelion Capital founder Tony Stewart thoroughly discussed.

Adding a bit of color and translation to Stewart’s comment, Cointelegraph’s options analyst Marcel Pechman said,

“Traders are overall more bullish, especially for Nov. 7, Nov. 15, and Nov. 29. Most new bets were on prices at 72,000 to 75,000 or higher. The notable buy of $64,000 puts suggests some fear and market makers face higher risk if Bitcoin drops, as they sold puts at lower prices.”