On Friday, the entire crypto market dropped by over 12% amid fears over a new worrisome coronavirus variant from South Africa. Bitcoin fell sharply alongside other crypto assets, hitting a seven-week low and officially entering bear market territory.

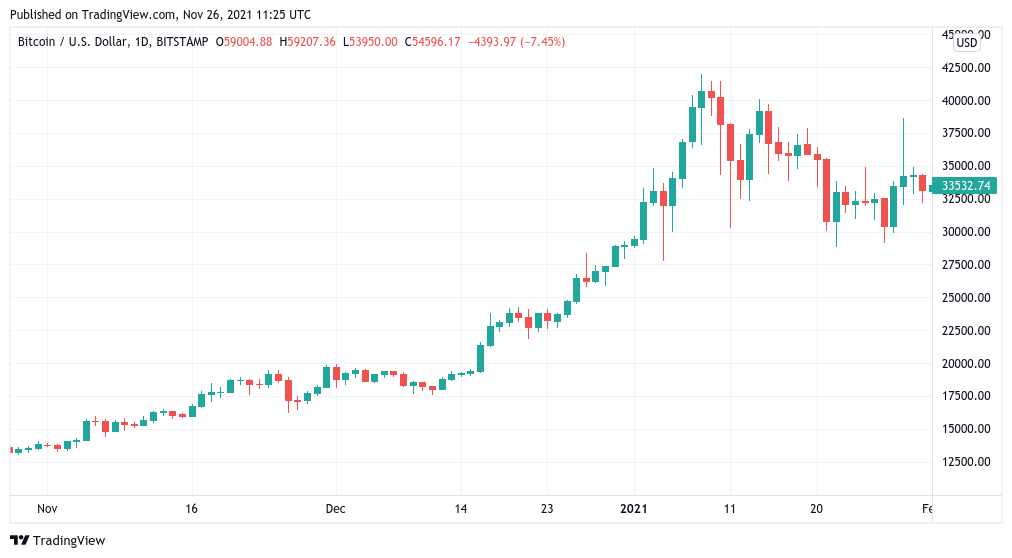

The world’s biggest cryptocurrency dropped Friday over 8% in 24 hours, as low as $53,609, according to CoinMetrics data. This slide brought Bitcoin down 20.88% from its November 10 all-time high above $69,000, the weakest in six weeks.

Other cryptocurrencies also plunged Friday. Ether, the second-biggest crypto, fell more than 10% to $4,059, while XRP slumped 9.9% to just under 95 cents, CNBC reports.

The broad crypto sell-off — aside from Bitcoin also hitting Binance’s BNB, Solana, Cardano, Ripple’s XRP, and Dogecoin — has wiped above $200 billion from the combined crypto market cap since Monday. The entire crypto market dropped on Friday by over 12%, from $2.627 trillion to $2.394 trillion. When Bitcoin hit its all-time high in early November, the entire market had a combined value of nearly $3 trillion.

Friday’s crash was triggered by South Africa’s exclusive warning about a rapidly spreading new coronavirus variant, which may be vaccine-resistant. With the steep drop in global stock markets and the US stock index futures, cryptocurrencies also bore the burn.

On Thursday, the World Health Organization gave a briefing on the new variant, which is known as B.1.1.529 or ‘Omicron’ and is thought to contain more than 30 mutations. The UK and other nations have temporarily suspended flights from six African countries in response.

As CNBC said, global stock markets were sinking Friday, with European stocks set for their worst session in more than a year and US stock futures down sharply. Investors are retreating from riskier assets for the relative safety of bonds, with US Treasury yields moving sharply lower. Bond yields move inversely to prices.

“Forget Black Friday; today has been renamed Red Friday after the color of share price screens as stocks slump globally on fears over a new Covid strain,” Russ Mould, investment director at AJ Bell, told Forbes.

This is the second crash this week after the one triggered by India when news of the Indian Cryptocurrency and Regulation of Official Digital Currency Bill was leaked earlier this week. The Crypto Bill is scheduled to get listed for the upcoming winter session in the Indian parliament starting on November 29. Following the leak, the crypto market was flooded with speculations about a crypto ban, given the confusing news.

“The crypto market has been hit by a temporary sell-off that mirrors that of the global stock market amid concerns about a new Covid-19 variant that’s been discovered in southern Africa,” crypto investor and deVere Group chief executive Nigel Green told Forbes.

“Triggered by a mini-wave of uncertainty, the parallel moves of the crypto market and the stock markets highlight that digital assets are now mainstream. The headlines have prompted a knee-jerk reaction, made more pronounced because much of the market was celebrating Thanksgiving and not participating,” he said.

“This [Bitcoin price crash] will be short-lived, with crypto markets likely to rebound in the near-term as investors once again focus on the heightening global inflation fears,” added Green.

Before the latest sell-off, Bitcoin had seen a wave of interest from investors looking to shield themselves from run-away inflation that has spiked worldwide in recent months. Bitcoin proponents have often described it as “digital gold,” referencing the yellow metal’s status as a so-called safe-haven asset. Although, it’s worth noting that Bitcoin is a volatile asset and has been known to experience price swings of more than 10% on a single day.