The ongoing “crypto winter” (sort of) may surprisingly coincide with a major tide of cryptocurrency mass adoption. There is no contradiction, only laws of economics and the understanding that inflation can no longer be solved by simply halting the money printers.

Analysts of the large American financial holding Wells Fargo Bank believe that the global mass adoption of cryptocurrencies, already underway at a breakneck pace, is far from done, as it is approaching the point of explosive growth.

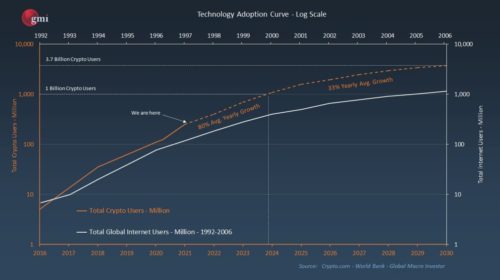

Banking experts compare the current situation in the crypto industry with how the Internet was infiltrating society three decades ago. Slowly – due to the general population’s lack of technical literacy – gaining popularity, the World Wide Web in less than a decade became an integral part of our society. According to analysts, cryptocurrencies are following a similar path. In fact, if we look at the relevant graphs, we can see how blockchain technology adoption is happening even faster than the introduction of the previous generation to the Internet.

Wells Fargo Bank reports that the number of cryptocurrency users (both investors and those who use crypto as money) is rising rapidly around the globe, already approaching the “hyper-adoption” phase, just like the internet was in the mid-1990s.

The financiers also note that, despite their short investment history, cryptocurrencies have already proved to be a viable asset. However, they emphasize that investing in digital assets at this point requires special knowledge, again parallelling the introduction stages of the World Wide Web. The report also claims that crypto is on the verge of “explosive growth, large-scale advancement, and universal popularity”.

Changpeng Zhao, the founder and CEO of Binance cryptocurrency exchange, similarly expects the global crypto adoption rate to go up from the current 5% to 20% by the end of 2022, thanks to DeFi, SocialFi, and GameFi.

We will get back to the Wells Fargo Bank analysis, but let’s now focus on the macroeconomic background for the impending cryptocurrency mass adoption. First, there is inflation. In the US, Consumer Price Index for the primary goods is still rising: 11.7% year on year, higher than even in the 1970s. (Prices for services are slower to grow.) So far, world inflation shows no signs of stopping its growth, in turn affecting local inflation in individual countries.

Of course, inflation doesn’t only mean surging prices but also an increase in wages. In the US, it was 10.6% year on year for those aged 16 to 24 – the highest growth rate on record. The main driver seems to be the lifting of the hourly minimum wage by most states, since young people under 24 are mainly employed in temporary and low-skilled part-time jobs in the service sector.

With the US inflation rates at a 40-year peak, prices were up 7.5% in January compared to 2021. Globally, inflation has been best showcased by the increase in food prices. According to official UN data, the global food price index has risen by more than 28% over the past year. The UN blames everything on the pandemic and worsening climate conditions and warns that we shouldn’t expect much improvement in 2022.

Butter, sugar, meat, milk – all these products have been getting increasingly more expensive during the past year. As has been indicated, there is a combination of factors at play here, from the aforementioned coronavirus pandemic to structural changes in the agricultural market. Not to mention, people in states limited by Covid rules have no alternative but to stock up, cook and eat.

As a result, food is being swept off the shelves while supply chains are running with interruptions, and fuel prices continue to rise, doubly affecting the cost of goods transported and even worse so – the presidential rating. Biden has already earned the dubious distinction of being an even less popular head of state than Trump at the same point in his term.

What will it lead to in the long run? Climbing prices for electricity, essential goods, and housing everywhere resulting in a steady decline in the standard of living. Although slow in developed nations, it will be much more noticeable in the Second World countries and, at times, also quite severe in the Third World.

Is there a way out of this global crisis? More and more economists agree that it lies in market fragmentation and the return of the world economy to several supply chains running in parallel. In other words, the sooner there is a viable alternative to the United States as a trading partner, and the dollar as the main convertible currency, the better, including for the Americans themselves.

The solution appears obvious: cryptocurrencies should become the alternative, with DeFi replacing the current financial system (banks, etc.).

So what does it have to do with the onset of the “crypto winter”? In January, the bitcoin price fell to $33,000 per coin – a stark contrast to just three months before when it had broken records and traded at $69,000. Since November, BTC has lost about half of its value amid fears of the US Federal Reserve possibly hiking its interest rates.

JPMorgan estimates the actual value of bitcoin at $38,000, whereas analysts at UBS Bank predict that BTC could soon fall to $30,000. It means that the first cryptocurrency could become much less attractive for speculators and investors – but just as much more viable as a means of payment. It’s as if gold has sharply declined in price in the fiat world, and they started using it to mint hard coins again. Simply put, following the price collapse, the cryptocurrency returns to its original function – means of payment rather than an investment asset.

To be continued…