Deng Chao, CEO of institutional asset manager HashKey Capital, recently told Cointelegraph that crypto projects will attract more capital from venture capitalists in 2025. These VCs are eyeing stablecoin products, real-world asset (RWA) tokenization, artificial intelligence and infrastructure.

According to Chao, increased digital asset valuations in 2024 and the tailwinds from the reelection of Donald Trump in the United States will attract more VC capital to crypto projects. Chao said:

“As we enter into a supportive macro environment driven by stimulative US policies and the formalization of crypto regulatory frameworks, these macro tailwinds are set to drive more VC investments heading into 2025.”

Despite the optimistic outlook, the CEO cautioned that macro risks, including geopolitical tensions or increased deficit spending, could increase price volatility and uncertainty in the new year.

Real-world asset tokenization and emerging markets

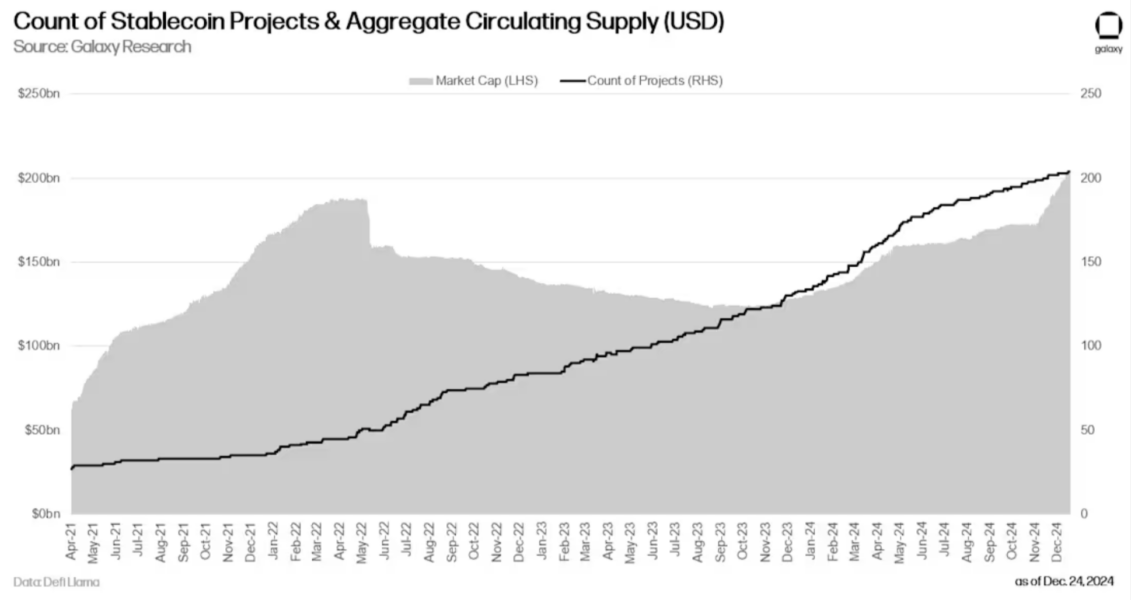

Chao added that stablecoins were the strongest proven use case for crypto in 2024, and VCs were increasingly focused on stablecoin usage in emerging market economies.

Dollar-pegged stablecoins are real-world tokenized assets increasingly used as a store of value by individuals in countries with rapidly depreciating local fiat currencies or strict capital controls.

Cheaper fees, near-instant finality times and no bank account required make dollar-pegged stablecoins a viable method of providing banking services to the unbanked.

According to the World Bank, an estimated 1.4 billion people lack access to adequate banking services.

This lack of banking services is primarily due to insufficient infrastructure in developing countries — a problem solved by smartphones with internet access and crypto wallets.

The real-world asset tokenization sector, which includes government securities, stocks, corporate bonds, stablecoins, collectibles or any other asset tokenized on a blockchain ledger, is projected to reach up to $30 trillion by 2030.

VC investment set to increase in 2025 but falls short of 2021 peak

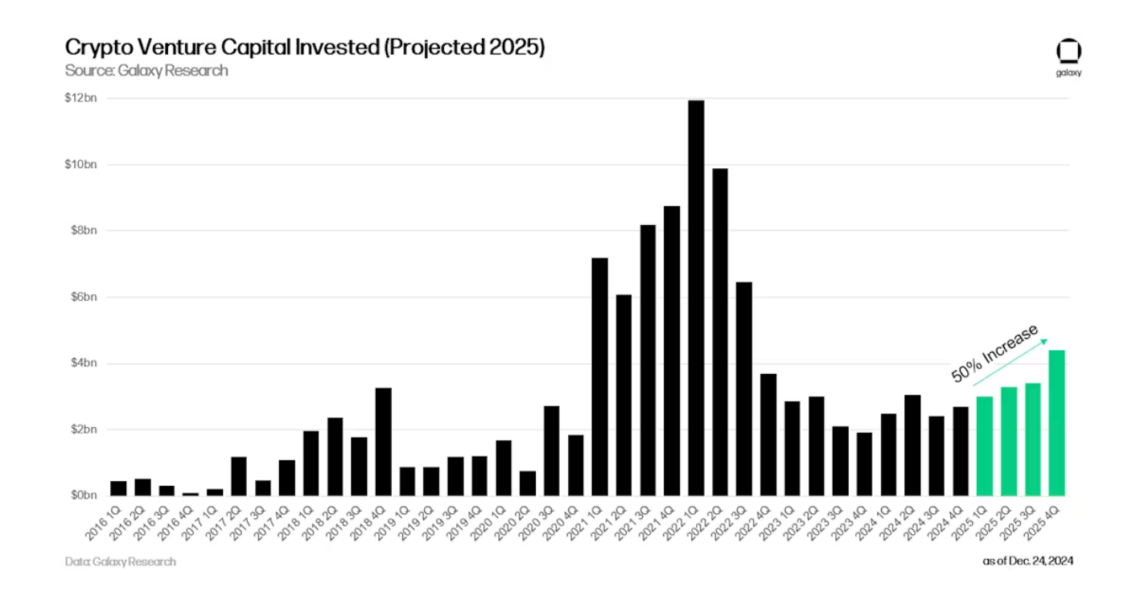

Market analyst Infinity Hedge predicted that crypto VC investment in 2025 would surpass last year’s levels but wouldn’t approach the peak recorded during the 2021 bull market.

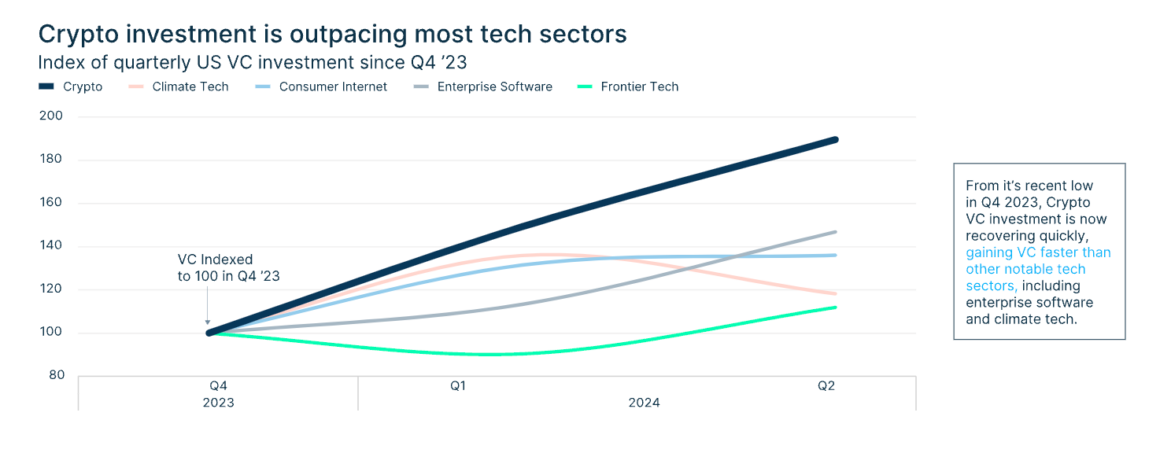

Crypto companies raised approximately $13.6 billion in 2024 compared to $10.1 billion in 2023. According to market data platform PitchBook, VC investments in crypto projects are projected to grow to $18 billion in 2025.

A recent report from Galaxy Digital also forecasted VC investments in crypto projects to grow 50% year-over-year in 2025 but will fail to reach highs established in 2021–2022.

Source: https://cointelegraph.com/news/crypto-venture-capital-key-sectors-2025