MakerDAO’s Rune Christensen says appropriate regulation will see stablecoins become mainstream, but the real opportunity is in decentralized stablecoins.

Decentralized stablecoins may eventually dominate the stablecoin market, so long as crypto “ends up living up to its potential,” says Rune Christensen, the co-founder of DeFi pioneer MakerDAO.

Speaking to Cointelegraph’s Andrew Fenton at Token 2049 in Singapore, Christensen aired his thoughts on the future of decentralized stablecoins such as Dai and their role in the wider crypto economy.

They discussed a presentation by Castle Island Ventures partner Nic Carter at the TOKEN2049 conference in Singapore in which he said that interest-bearing stablecoins could become 30% of the market within two years.

Christensen agreed but said it would probably depend on the macro situation, adding “if high inflation high rates continue, then probably,” stablecoin dominance will increase.

When asked whether a decentralized stablecoin could compete with its centralized cousins, he replied:

“Easily I mean, I think if the space ends up living up to its potential, then decentralized stablecoins will be the entire market like centralized stablecoins would be the edges that connect us to like the legacy system.”

He added that if crypto “delivers” and becomes regulated, centralized stablecoins will become more mainstream. However, the real potential is in decentralized stablecoins, he suggested:

“I think the real killer advantage of decentralized stablecoins, run by actual data like Maker, is this ability to gamify your savings.”

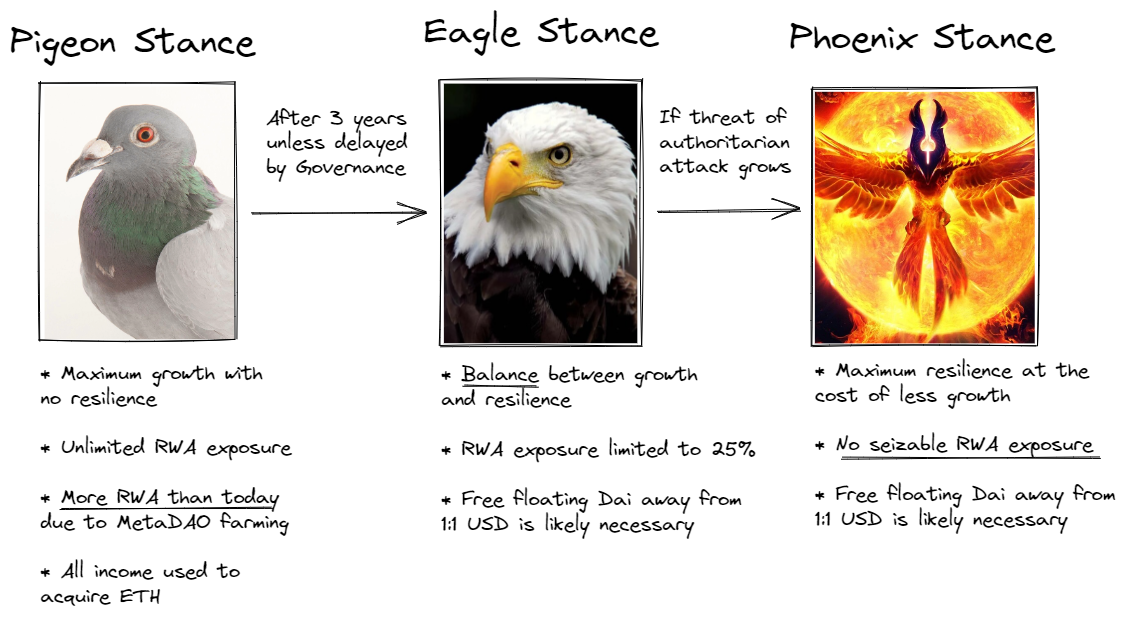

In mid-2022, Christiansen proposed MakerDAO’s “Endgame Plan”. The plan proposes making DAI a free-floating asset, initially collateralized by real-world assets (RWA).

There will be a three-year period when DAI remains pegged to the dollar. During this period, the protocol will double down on RWA to accumulate as much Ether as possible which increases the ratio of decentralized collateral.

Rune believes that Maker has built a very solid and stable foundation but it has been overtaken by scammy and illegitimate projects.

He wants to try and gamify to make the protocol fun and more appealing to younger users. “It’s what people want,” he said before adding, “Things are designed like a game and that’s the kind of interface they will use.”

Source: https://cointelegraph.com/news/decentralized-stablecoins-could-dominate-makerdao-founder