In the first quarter of 2021 the Decentralized Finance (DeFi) industry shawn a wave of growth. The main indicator for assessing the DeFi industry is the total amount of locked funds on smart contracts (Total Value Locked). In April 2021, it crossed the $ 100 billion mark, according to the DeFi LIama tracker. Analysts at the research company Messari found, that in the first quarter of 2021, the trading volume on all decentralized exchanges increased by 236% and reached $ 217 billion.

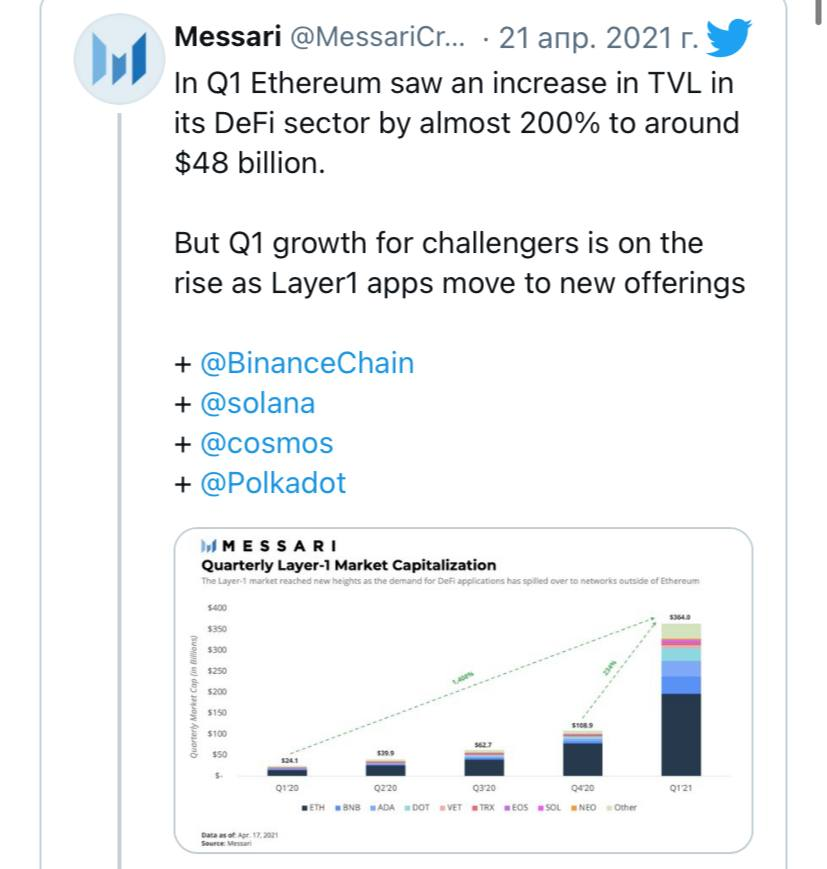

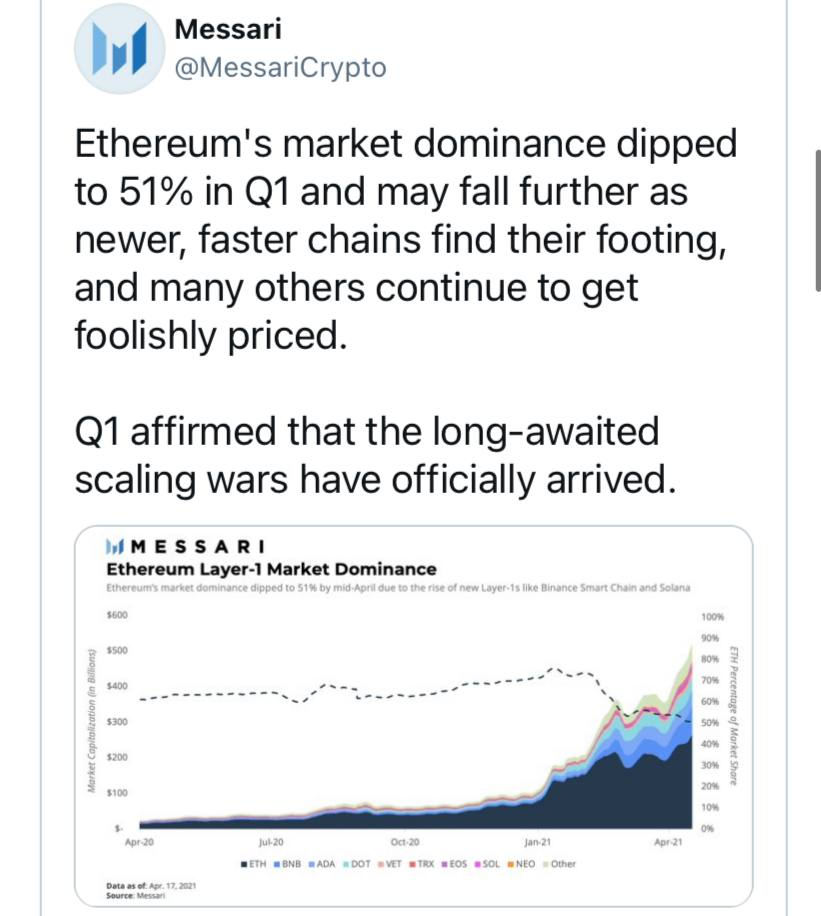

Projects on Ethereum remain the most popular: if in 2020 the total amount of funds blocked on smart contracts in the Ethereum network was $ 16 billion, by the end of March 2021, according to Messari data, it increased by 200% and amounted to $ 48 billion. However, by that time the share of DeFi on Ethereum in the total volume has significantly decreased and instead of 80% it was 51% of the total volume of blocked funds.

The main problem for the further development of DeFi projects on the Ethereum network was the growth of transaction fees. In February 2021, they reached values of $ 30-40, according to Ycharts. As of May 8th, this value is $ 14.

Therefore, investors began to actively invest in alternative projects on other chains, and today there are more than enough of them in DeFi. At the moment, the Binance Smart Chain ecosystem has become the largest competitor for Ethereum, and the Tron decentralized ecosystem is also growing very quickly. Other large ecosystems in DeFi include Polkadot, Avalanche, Solana and others.

The main advantage of the BSC blockchain is low transaction costs, which amount about 0.000000001 BNB. In terms of the number of transactions, the BSC blockchain surpassed Ethereum by 3 times. Pancake decentralized exchange is the largest project on BSC with a total amount of blocked funds of about $ 6.36 billion at the time of writing. It is followed by the aggregator of liquidity pharming Bunny ($ 4.36 billion) and the Venus landing platform ($ 4.2 billion).

Tron’s DeFi ecosystem is not yet as popular as BSC, however, this ecosystem is growing very quickly. Indirectly, one of the reasons for this is the activity of Tether Limited, which instead of the Ethereum blockchain began to actively issue USDT stablecoins on the Tron blockchain, as a result, the volume of transactions in USDT on Tron already exceeds their volume on Ethereum, as well as the total amount of USDT. Among the advantages of the Tron blockchain, are low fees.

According to Tronweekly estimates, the total amount of blocked funds (TVL) in the Tron ecosystem in mid-April was $ 15 billion, of which $ 2.90 billion came from the JustLend landing platform, $ 2.27 billion from the DEX JustSwap. At the moment, according to the Tron Foundation, it is $ 12 billion.

The Ethereum Foundation plans to solve the problem with high fees in the system by implementing new updates, but this is a long process that can take months or years. For this reason, the dominance of DeFi on Ethereum may continue to decline in the near future.

https://ycharts.com/indicators/ethereum_average_transaction_fee

https://www.tronweekly.com/tron-defi-ecosystem-tvl-15-billion/