The cryptocurrency market may be on the verge of the much-awaited altcoin season (altseason), much to the delight of speculative traders, but the determining factors might have changed, according to a market analyst.

“Stablecoin liquidity” to determine next altseason

The crypto market is transforming, with cycle indicators, market structures and trading patterns changing rapidly.

“Altseason is no longer defined by asset rotation from Bitcoin,” CryptoQuant CEO Ki Young Ju said in a Dec. 2 post on X.

He said the traditional signal marking the beginning of an altcoin season when capital rotates from Bitcoin to altcoins is outdated. Instead, altcoin trading volume has become more prevalent against stablecoin and fiat currency pairs.

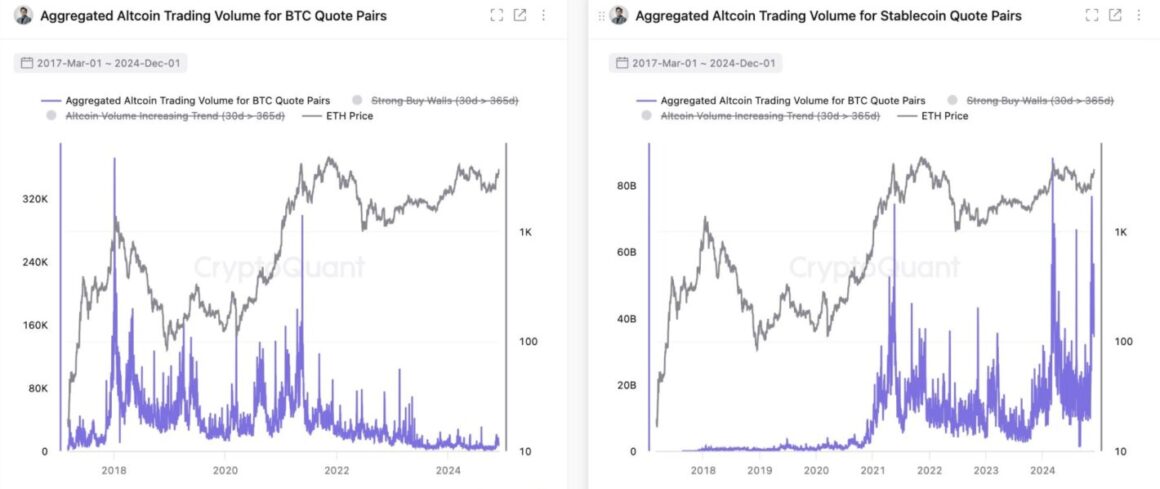

For example, the combined altcoin trading volume for Bitcoin pairs has remained significantly low over the last few weeks despite an uptick in Ether price over the same period. Moreover, several altcoins, such as XRP and Solana are near their all-time highs, while Bitcoin price has been consolidating under $100,000.

Meanwhile, the chart below on the right shows a spike in the aggregate altcoin trading volume for stablecoin pairs, which has increased in tandem with growth in ETH price.

This reflects “real market growth rather than asset rotation,” Ki said.

This change suggests a deeper, more sustainable evolution in the crypto market, driven by stablecoins’ increased liquidity and stability.

“Stablecoin liquidity better explains the altcoin markets.”

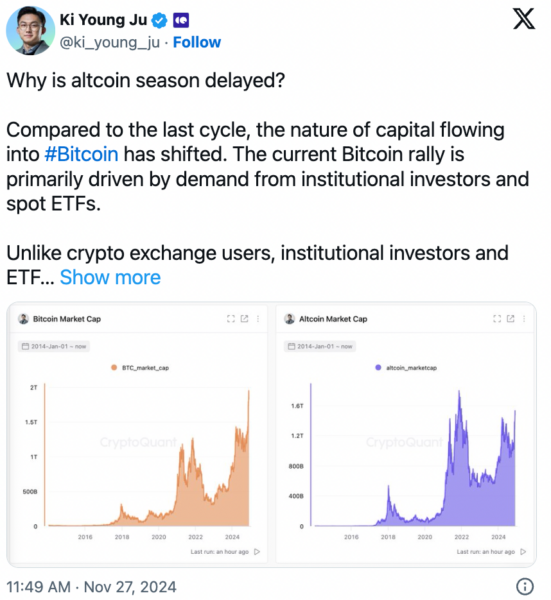

Ki added that the nature of capital flowing into Bitcoin has shifted compared to previous market cycles. Unlike the retail-driven capital flows in previous bull cycles, the current bull market is primarily driven by institutional capital flows into spot Bitcoin exchange-traded funds (ETFs).

Meanwhile, the market capitalization of all cryptocurrencies, excluding BTC, remains well below its all-time high, indicating reduced fresh liquidity from new exchange users.

“For altcoins to reach a new all-time high market capitalization, they will require a significant influx of fresh capital to crypto exchanges.”

Altseason is close

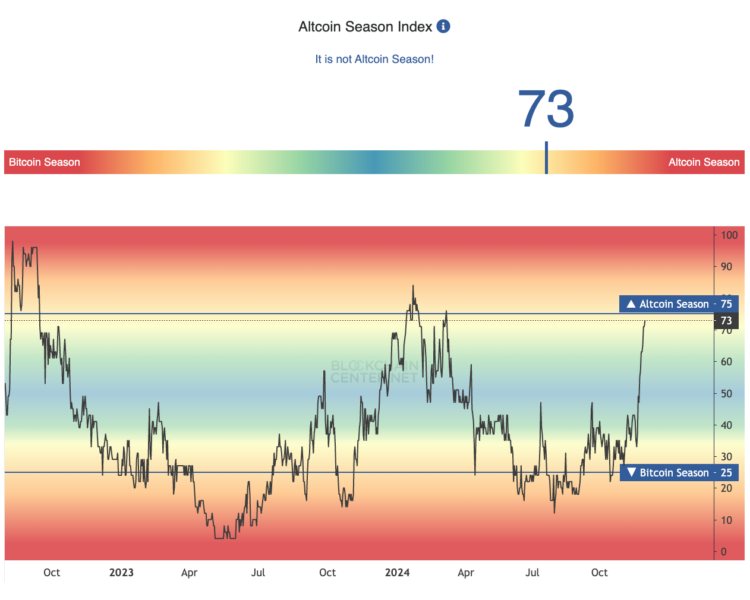

The performance of the altcoins seemingly coincides with an improvement in the altcoin season index, indicating that the altcoin season is close. According to this index by Blockchain Center:

“If 75% of the top 50 coins performed better than Bitcoin over the last season (90 days), it is Altcoin Season.”

This indicator essentially demonstrates that 73% of the leading 50 altcoins have outperformed Bitcoin in the past 90 days. Since this index has increased sharply over the last few days, it is edging closer to the 75% threshold.

With multiple top-cap cryptocurrencies challenging new highs, market participants should watch the stablecoin liquidity and the Bitcoin dominance index, which could be signaling the beginning of an altcoin season in the next few days.

Source: https://cointelegraph.com/news/altcoin-season-no-longer-driven-bitcoin-rotation-analyst