The Ethereum blockchain transitioning from the PoW consensus algorithm to PoS is the most anticipated event of the crypto world in 2022. It is supposed to give the platform a “second wind” and allow it to maintain its leadership in DeFi. The big question is, can Vitalik Buterin’s team do everything as they planned?

The current state of the Ethereum network is far from prosperous. With the launch of DeFi applications, NFTs, and various blockchain games, asset swaps (often meaningless, within the game) and digital collectibles trade are overloading the web. As a result, users who need a quick transaction confirmation have to pay higher fees, which scares a lot of them away. The need for change has been apparent for a while now, and transitioning Ethereum from PoW to PoS seems to be the way forward.

The switch to the new Ethereum 2.0 version has dragged on for ages, with huge investments in staking received throughout. The Ethereum 2.0 (ETH 2) network already has $21.3 billion worth of cryptocoins in staking, and there is nothing to indicate the slowing down of the trend. However, the Ethereum “reboot” is a multi-faceted project, still a long way from demonstrating its full potential.

So what makes crypto fans and financial institutions so enthusiastic about staking? First, staking allows ETH holders to earn more crypto depending on how much they accumulate. Anyone who has reserved a certain Ethereum amount (starting from 32 ETH) becomes a validator and gets the opportunity to participate in the Ethereum 2.0 network. It attracts long-term investors who wish to receive passive income from their tokens. You could earn substantial rewards for Ethereum accumulation – the current expected return from staking is 7.23% per year.

The PoS model has numerous advantages, including being much more environmentally friendly – mining requires an unreasonably large amount of energy. Just as importantly, ETH 2 staking offers consistent positive annual returns, outperforming various traditional asset classes such as bonds, making it appealing to various institutions – non-profit organizations, private companies, pension funds – looking for fruitful investments in the cryptocurrency space.

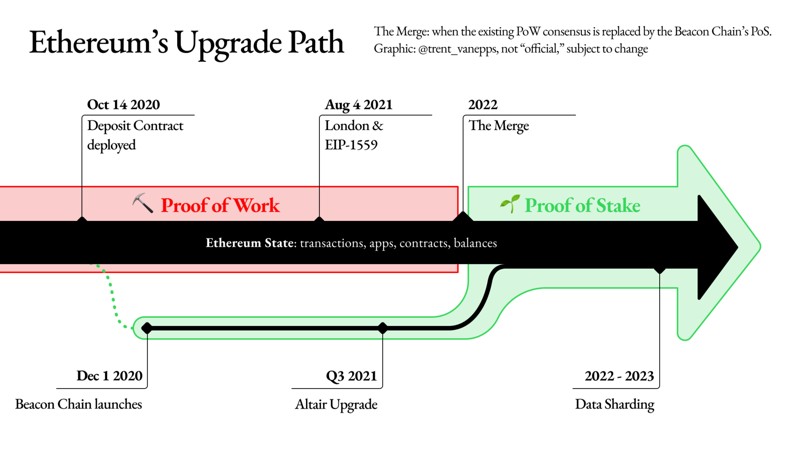

However, there are still ways to go before we get the full-fledged Ethereum 2.0. At the end of December 2021, the cryptocurrency developers launched the Kintsugi testnet to test the transition process from the Proof-of-Work to Proof-of-Stake consensus mechanism – one of the last stages before Ethereum 2.0 goes live.

Originally, “Kintsugi” is the name of the traditional Japanese art of repairing broken pottery by mending the areas of breakage with lacquer dusted or mixed with powdered gold, silver, or platinum. This way, the damage to dishes is emphasized instead of being concealed.

“We encourage the community to start using Kintsugi to get familiar with Ethereum as it will look after the transition. For developers, nothing really changes. A toolkit that interacts with only one consensus or runlevel also remains largely unaffected. Infrastructure that depends on both layers may need to be modified to support the transition”, – stated the developers.

After the results of Kintsugi’s work are in, there will be the launch of the final series of test networks, followed by a transition to an updated consensus on the main Ethereum network. Still, we don’t know when it might actually happen.

At the end of January 2022, the architects of Ethereum 2.0 concluded that after switching to the Proof-of-Stake algorithm, the Ethereum network wouldn’t change so dramatically as to call it ETH 2. The roadmap for switching to POS remains the same, but now it doesn’t mention a new version of the network (which was, admittedly, a rather vague concept), focusing on the future merger of ETH 1 (execution layer) and ETH 2 (consensus layer) instead.

The decision was made in part because many users mistakenly believed that ETH 1 would cease to exist after the transition to ETH 2. “As the network roadmap has evolved, the term Ethereum 2.0 has become an inaccurate representation of the process. Caution and precision in choosing a definition will allow the widest possible audience to understand the content of Ethereum, – says the statement. – Changing the terminology will also help prevent fraud cases when criminals offer users to exchange their ETH for non-existent ETH 2.”

Now, what used to be Ethereum 2.0 is called “Consensus Layer”, whereas Ethereum 1 is “Execution Layer”. The merger of ETH 1 and ETH 2 into one, more complex network is still scheduled for 2022.

The consensus and execution layers are supposed to link up in the first or second quarter of the year. In the project papers, the moment is dubbed “Merge”. According to Vitalik Buterin, the development is coming to a close, and merge may well occur in due time. However, more than enough skeptics point out that the transition to a qualitatively new level has been postponed multiple times already, which shows a lot of uncertainty in the Ethereum community.

Meanwhile, ordinary users primarily look forward to changes in the structure and size of commissions. Mining will become impossible, but they will be able to earn money running nodes on the Ethereum network, which only requires you to have 32 ETH. Existing applications will continue to work in the updated network, and all transaction history will be saved. Users and decentralized applications will enjoy low fees and faster work speed.

As for the value of Ethereum crypto coins in 2022, the issue is not that simple. Most market analysts agree that 2022 is likely to bring new price highs, but only in case new use cases are developed, and new users come to the network. Until the problem with expensive transactions is solved and the viability of the PoS version of the network is not proven, other blockchain platforms with cheap transactions and high speed will continue conquering the market.

But if the transition to Proof-of-Stake is successful, Ethereum’s availability and demand will increase dramatically. In that case, the capitalization of Ethereum could potentially grow ten times – although, of course, the actual number will probably be much lower.

In any case, even after transitioning to the PoS algorithm, Ethereum will not be the only blockchain platform for smart contracts. Consequently, it no longer enjoys complete market dominance, which makes the area more diverse – and more interesting.