ETHPoW, a fork of the proof-of-work Ethereum blockchain, was down over 61% in 24 hours following The Merge. Meanwhile, Grayscale Investments said to an SEC it has the rights to ETHPoW tokens due to The Merge.

The native token of EthereumPoW, a proof-of-work hardfork of the Ethereum blockchain, was trading down over 60% on Sept. 16, just a day following ETHW mainnet launch.

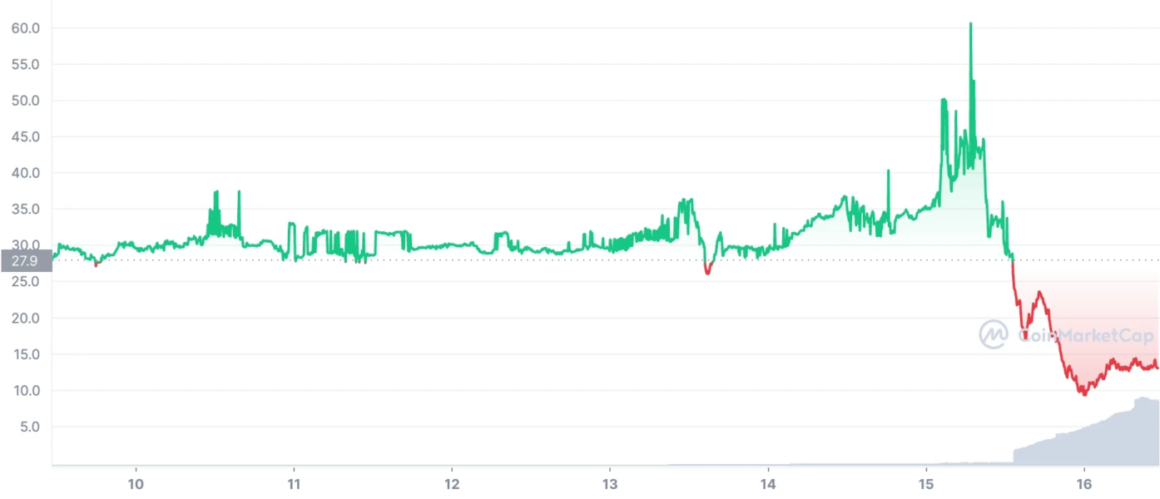

In early Thursday morning, ETHW spiked as high as $60.68 following The Merge and then crashed back to $30 shortly after. The miner-backed blockchain launched its mainnet on Sept. 15, but this had little impact as the price of ETHPoW continued its downward trend. It’s now trading at $8.21 for a loss of 61% over 24 hours, according to CoinMarketCap.

(Source: CoinMarketCap )

Planned ahead of Ethereum’s upgrade, ETHPoW is led by a miner called Chandler Guo, who hoped to split away from Ethereum after The Merge. Earlier, Guo was warned by the ETC Cooperative, an Ethereum Classic community, that his fork would not succeed and that miners should simply migrate to Ethereum Classic.

Ethereum Classic (ETC) recorded a massive spike in hash rate on Thursday as miners moved over to the network, soaring 280% at once. The network reached 307 terahashes per second (TH/s) on Sept. 16. Currently, the hash rate is around 234.41 TH/s, according to data from mining pool 2Miners.

As per CoinMarketCap data, Ethereum Classic was trading at $34.33, down 8.05% in the past 24 hours.

Meanwhile, Grayscale Investments said it has the rights to Ethereum proof-of-work tokens as a result of The Merge and may or may not distribute them to holders in the form of a cash disbursal, as it said in an SEC filing on Sept. 16.

As a result of the fork, the Grayscale Ethereum Trust and the Grayscale Digital Large Cap Fund received the rights to ETHPoW tokens. The former received the rights to approximately 4 million, while the latter holds rights to approximately 41,000 ETHPoW coins. However, how much those assets are worth is not clear.

“There is uncertainty as to whether digital asset custodians will support ETHPoW tokens or if trading markets with meaningful liquidity will develop,” the filing read.

Trading venues for ETHPoW tokens are not broadly established because the Ethereum PoW network is so new, the filing noted. The price of ETHPoW tokens will expectedly fluctuate further.