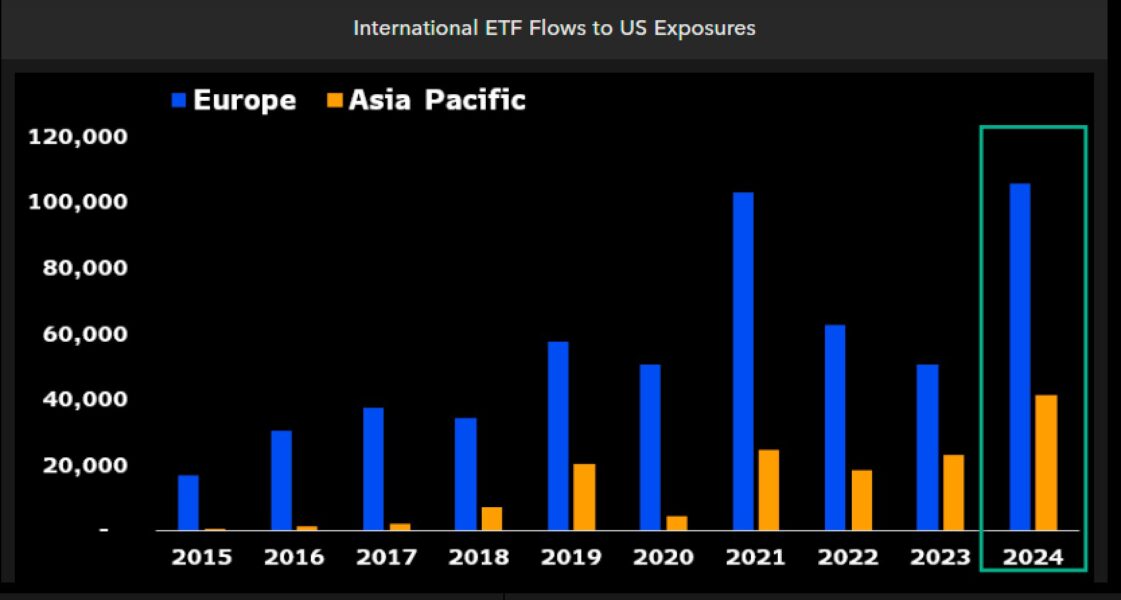

European investors have allocated a record amount of capital into spot Bitcoin exchange-traded funds (ETFs) in the United States.

Europeans have invested over $105 billion in spot Bitcoin ETFs year-to-date (YTD), marking an all-time high.

The record European ETF flows were shared by Eric Balchunas, a senior ETF analyst at Bloomberg, who wrote in an Oct. 21 X post:

“Flows into US-focused ETFs by locals in Europe is now at a record $105b YTD. And why not? $SPY is up 24% vs 10% for Europe. Asia also funneling record flows.”

Growing ETF inflows could push Bitcoin to an all-time high from its current crabwalk. Inflows into US Bitcoin ETFs accounted for about 75% of the new capital that helped Bitcoin surpass $50,000 in Feb. 2024.

Despite the record European inflows, Bitstamp data shows that Bitcoin has been unable to recover above the psychological level of $70,000, last visited on July 29.

Bitcoin price stalls below $70,000 despite ETF records and hashrate all-time high

This past week, European inflows weren’t the only record milestone for Bitcoin and Bitcoin-based ETFs.

Earlier today, on Oct. 21, Bitcoin’s hashrate — the total computing power securing the network — reached an all-time high, showcasing the network’s growing security and increasing BTC mining costs.

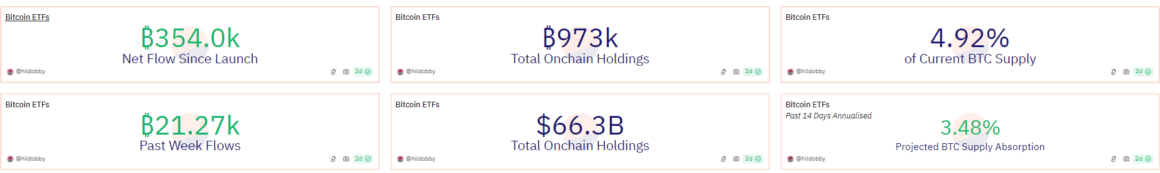

According to Balchunas, on Oct. 17, US Bitcoin ETFs crossed $20 billion in total net flows, or the “most difficult metric to grow” for ETFs. This same milestone took over five years for Gold-based ETFs to cross.

Despite multiple ETF milestones, Bitcoin’s price has been stuck under $69,500 since July. 29.

Bitfinex analysts attributed this to delayed effects of ETF inflows, which can take several days to impact spot BTC price.

The ask-heavy order book suggests that crypto traders are using ETF flows as exit liquidity for their trades, the analysts told Cointelegraph:

“Usually, this means that large ETF inflows have a muted impact for a few days and then the market reverses lower once the aggression from spot market buyers fades.

Bitcoin ETFs on a six-day winning streak

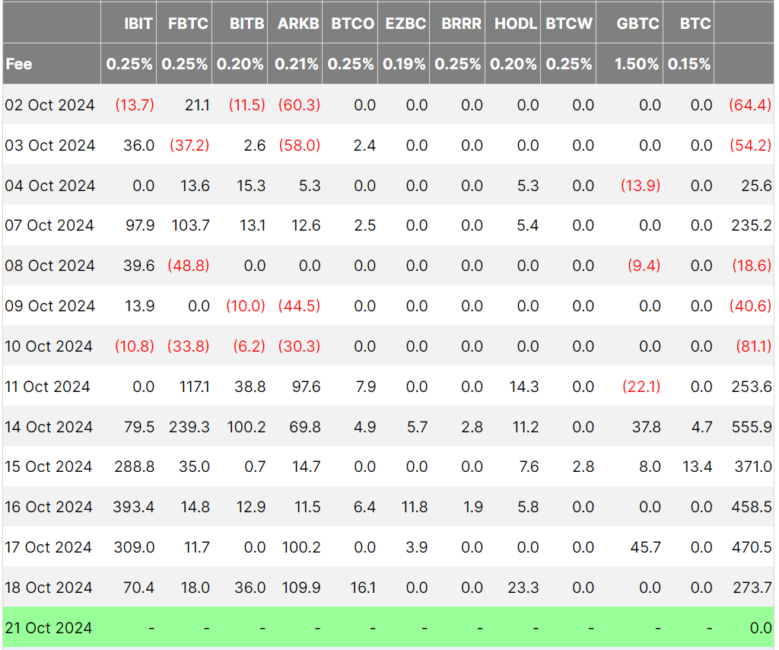

The Bitcoin ETFs have recorded six consecutive days of net positive inflows, Farside Investors data shows,

On Oct. 14, the US Bitcoin ETFs bought a cumulative $555 million worth of Bitcoin, resulting in a 5% daily increase in Bitcoin price, from $62,450 to a daily high of $66,479.

Bitcoin ETFs surpassed $66.3 billion in cumulative onchain Bitcoin holdings, representing 4.9% of the current Bitcoin circulating supply, Dune data shows.

Source: https://cointelegraph.com/news/european-investors-record-105b-us-bitcoin-etfs