BitMEX co-founder Arthur Hayes believes the Federal Reserve’s recent rate cut was likely politically motivated and could impact markets and inflation.

Speaking to Cointelegraph at Token2049 in Singapore on Sept. 18, Hayes shared his thoughts on the Fed’s recent action, speculating it could be part of an effort to bolster support for the Democrats.

“I have a macro view that Jerome Powell [Federal Reserve Chair] and Janet Yellen [Treasury Secretary] want to juice financial markets to help Kamala Harris win the election.”

On Sept. 18, the US Central Bank cut the interest rate by 50 basis points in a move that was widely anticipated by investors and analysts.

Hayes says this could have significant implications for both traditional and crypto markets and potential long-term consequences for inflation and economic stability.

He pointed out a disconnect between the rate cut and current economic indicators stating that the US economy shows strong GDP growth while unemployment remains low by historical standards.

He argued that making borrowing cheaper for the government contradicts concerns about reckless government spending.

“I believe that they’re trying to get markets to go even higher, to make people feel even wealthier as they go into the ballot box in November, and inflation is going to accelerate after this point.”

On the crypto market’s reaction to the cuts, which resulted in a 4% gain, he said, “I think it’s calm before the storm,” predicting a delayed reaction that could follow the close of traditional financial markets on Friday.

“What seems to happen is you get the initial reaction and then the real reaction is going into the close on Friday for TradFi markets, and then crypto follows up either up or down over the weekend.”

Crypto markets have gained $100 billion since the Fed announcement, with reclaiming a three-week high of $62,500 during early trading on Sept. 19.

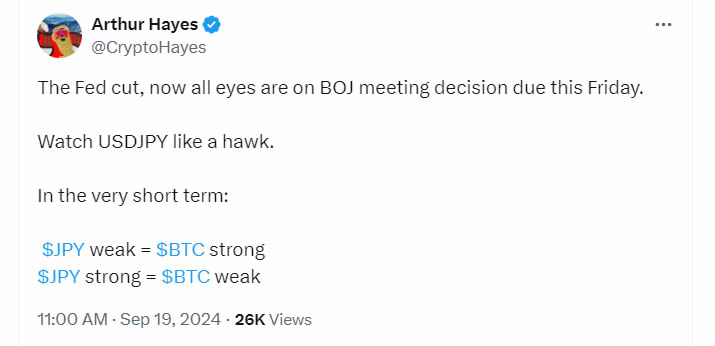

In a post on X on Sept. 19, Hayes said that all eyes are now on the Bank of Japan, which has a rate decision on Friday, Sept. 20. A weaker Japanese yen would result in a stronger BTC, he said.

However, a strengthening yen and unwinding of yen carry trades could potentially put pressure on Bitcoin and other asset prices in the near term, he told Cointelegraph.

Meanwhile, during a keynote speech at the Singapore crypto event, Hayes slammed the Fed for cutting rates amid growing US dollar issuance and increased government spending, labeling it a “colossal mistake.”

Earlier this month, Hayes said that rate cuts won’t help crypto because the flow of money has gone from US treasury bills into higher-yielding reverse repos.

He also predicted a big Bitcoin crash below $50,000 a fortnight ago, which never materialized. A few days later, Hayes predicted a Bitcoin rally after closing and profiting from a short position.

Cointelegraph contacted the Federal Reserve for comment but did not receive an immediate response.

Source: https://cointelegraph.com/news/fed-rate-cut-politically-motivated-increase-inflation-arthur-hayes