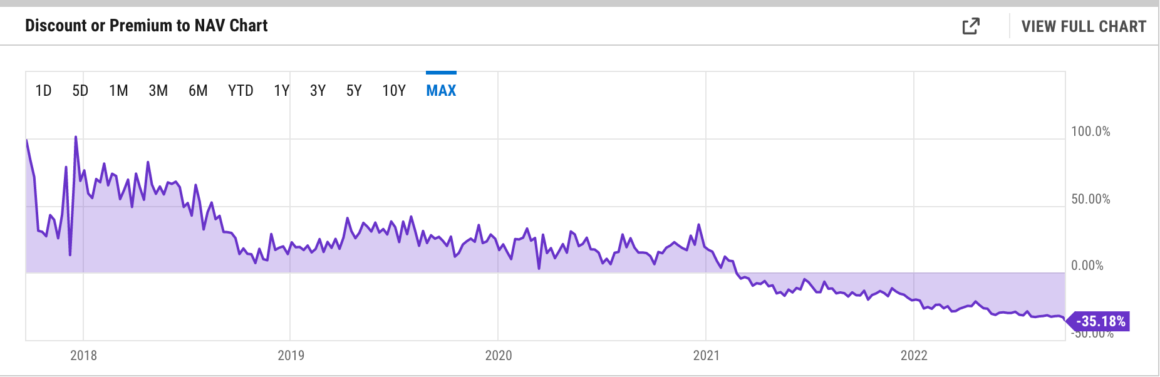

The Grayscale Bitcoin Trust (GBTC), which has been trading at a discount since the beginning of 2021, hit a record low of -35.26% on Sept. 23. This decline comes four months after its previous all-time low of 34%. Now, Grayscale is suing the SEC after rejecting its application to convert to a spot Bitcoin ETF in June.

According to The Block’s Data Dashboard, GBTC’s discount fell to its lowest point ever. This means the market price of GBTC shares is over 35% lower than its net asset value or NAV.

On June 17, GBTC hit its previous all-time low, when it reached -34%. The discount narrowed ahead of the SEC’s ruling on whether or not GBTC could be converted to a spot Bitcoin ETF.

(Source: YCharts )

Later, Grayscale’s bid to convert its product into a spot ETF was rejected based on the regulator’s conclusion that the company hadn’t shown sufficient planning to prevent fraud and manipulation. Grayscale later filed a lawsuit against the SEC after the decision.

The newest low comes amid a broader market downturn for crypto and financial markets, as Bitcoin was trading at $19,173 on Monday, according to Coinbase.

Previously, the US Federal Reserve raised the US federal funds rate by 75 basis points last week, topping a 15-year high. Although the decision to take the rate from 3% to 3.25% was expected, markets sold off sharply on the news.

Grayscale is the world’s largest passive Bitcoin investment vehicle by assets under management, but it doesn’t necessarily enjoy a strong influence on the spot BTC market after the emergence of rival ETF vehicles.

For instance, crypto investment funds have attracted a combined total of almost $414 million in 2022, according to CoinShares’ weekly report. In contrast, Grayscale has witnessed outflows of $37 million, which include its Bitcoin, Ether, and other tokens’ trusts.