How effective is Bitcoin as a hedge against inflation? Dilip Kumar Patairya on Cointelegraph studied what inflation is and how useful Bitcoin and the other means are to deflate it.

- Why do you need a hedge against inflation?

How effective is Bitcoin as a hedge against inflation? Let us first understand what inflation is and how useful the other stuff is to deflate it.

With inflation in fiat-based economies a given, experts and even regular people have been looking for an investment or a tool that works as a hedge. Gold, stocks and real estate have long brought respite to investors who are ever afraid of losing value to inflation. It will be apt to say that these commodities always have had their limitations as a hedge.

As of late, however, bullions, or commodities like gold and silver, have come across to be less reliable over small investment horizons. In 2021, bullion steadily lost ground. Real estate has low liquidity and higher transaction costs and requires continual management and maintenance. Regarding stocks, they require investors to have sophisticated financial skills and the majority of regular people lack the skill set for being an efficient stock manager.

- What is inflation?

Inflation is when the purchasing power of the local currency goes down. A popular metric used for measuring inflation is the Consumer Price Index (CPI).

Inflation refers to rising prices of goods and services, leading to a decline in purchasing power of the local currency. As a result, more units of a currency are needed to purchase a certain item. For instance, a fruit basket might have been priced at $5.00 a few years before. Now, the same basket carries a price tag of $8.00, indicating a drop in purchasing power.

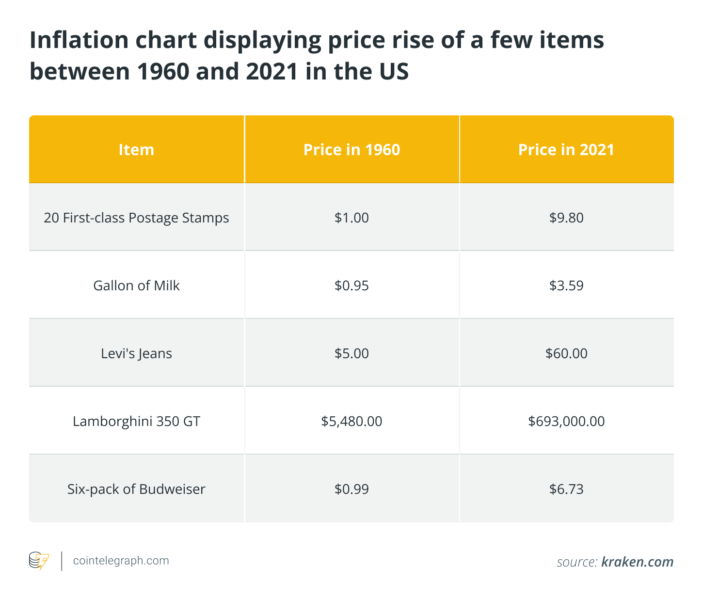

The following chart indicates how prices of a few items skyrocketed between 1960 and 2021 in the United States:

(Source: Cointelegraph / Kraken.com )

The Consumer Price Index (CPI) is a popular metric used to measure inflation, exploring the weighted average of various price baskets of goods and services. The CPI metric affects interest rates, wages, state benefits, tax allowances, pensions, maintenance, contracts and other payments.

- Ways to hedge against inflation

Putting money in store of value investments like gold, real estate, stocks and crypto helps curb inflation.

As cash loses purchasing power over time, keeping cash leads to people losing their savings. This has prompted people to put their money in store of value investments such as gold, real estate, stocks and, now, crypto. Will Bitcoin protect against inflation has been a question in the town ever since.

To be held as a store for value, an asset should be able to hold its purchasing power over time. In other words, it should increase in value or at least remain stable. Key properties associated with such assets are scarcity, accessibility and durability.

Gold as a hedge against inflation

During past inflationary periods, gold has had a mixed track record. In the 1980s, there were times when holding gold gave negative returns to owners.

Morningstar data gives a peek how gold has had a spotty track record during past inflationary periods. A commodity that is supposed to hedge against inflation is expected to rise when consumer prices are going up. During periods of high inflation, particularly in the 1980s, there were times when gold owners ended up fetching negative returns.

In recent times, gold has slowly lost its luster as a hedge. During the pandemic and even when waves have subsided, people are showing less interest in gold. It is still viewed as good enough for holding value in the long term, but for the short term, the metal is seen as less reliable now.

Real estate as a hedge against inflation

The popping of the U.S. housing bubble underlined that real estate couldn’t always be trusted as a hedge against inflation.

For a long time, real estate has been regarded as an effective hedge against inflation. This myth, however, was busted in the United States housing bubble. In March 2007, home sales and prices in the country suffered from a sharp fall. As National Association of Realtors (NAR) data reveals, sales dropped 13% to 482,000 from the peak of 554,000 in March 2006.

In America and around the world, real estate prices are closely linked with factors like government policy, political and economic stability of the country, local demographics and economy, geographical location and infrastructure, among others. Parameters are simply too many for a regular person to understand.

Stocks as a hedge against inflation

Long-term investment in stocks helps in tiding over the effects of inflation. Just make sure that the company has strong fundamentals.

Some stocks do help protect the value of your investment. Even if these stocks get hit by impatient investors in the short term, they recover well over time. But you need to factor in that not all stocks work well for hedging inflation. You need to find companies that have strong fundamentals and are more likely to draw better dividends for their shareholders.

A common thread: Link of gold, real estate and stocks to centralized entities

Traditional asset classes are controlled by centralized authorities, making them vulnerable to prejudices and pressures.

The value proposition of all conventional asset classes is invariably linked to policies of the centralized authorities such as the governments or federal banks. An asset so intrinsically associated with a system that the asset holders cannot interfere with isn’t really a reliable hedge, as the centralized authority exercises a single button control over the proceedings.

- Is Bitcoin a good inflation hedge?

Bitcoin is an effective hedge against inflation, thanks to limited supply and decentralization. These factors bring in scarcity and resilience power.

When looking into the query Can Bitcoin prevent inflation? Two major factors you need to consider are limited supply and decentralization.

Limited supply – bringing scarcity

The supply of Bitcoin (BTC) has been algorithmically capped to 21 million coins. By the end of 2021, 18.77 million BTC have already come into circulation. In other words, 83% of the Bitcoin that could come into existence had been mined within 12 years of the inception of the cryptocurrency.

Inflation happens when the state or the central bank keeps printing the currency notes exorbitantly, resulting in an excess supply of money. The economic theory lays down that inflation occurs when money supply increases faster than the real output of goods or services. This happens as households now have more cash to purchase the same amount of goods, resulting in increasing prices.

Pre-set limits on Bitcoin in circulation mean no excess supply, keeping inflation in check. Moreover, the digital coin’s annual rate of mining dips by 50% roughly every four years. Taking into account of the current supply schedule, Bitcoin’s annual rate of production will be approximately half of gold’s and will continue to go down, making it more scarce than the metal and driving up its value.

Decentralization — Powering resilience

The decentralized structure of Bitcoin takes it out of the control of a centralized authority. With thousands of nodes functioning across the globe, the network is optimally resistant to external attacks that might be seeking to alter its monetary policy, which might put the inherent scarcity of the digital coin in peril. When it comes to levels of decentralization, no other currency comes even close to Bitcoin.

In any authority or organization, coercion happens through pressure or bribe. Bitcoin, however, is immune to such factors as there is no leader to influence and no executive committee to bribe. Satoshi Nakamoto, its founder, has remained pseudonymous since Bitcoin came into being. Bitcoin remains a unique digital asset for having a super successful track record in the absence of influential leadership.

Anyone can run a Bitcoin node, verifying the transaction history and relaying transactions through the network. Extensive decentralization means the cryptocurrencies cannot be double-spent. It has also helped distribute coins and helped Bitcoin survive numerous challenges. It has helped Bitcoin prevent centralized control over information and enable all coin holders the ability to participate in decision-making.

When businesses with interests in Bitcoin attempted to change the block size to allow more transactions per block, individual node operators and developers opposed the proposal vehemently. This has underlined the inherent resilience of Bitcoin as economically powerful entities failed to impose their will on the network.

- How does a rise in inflation impact Bitcoin prices?

Since its inception, the value stored in Bitcoin has increased more rapidly than the inflation itself.

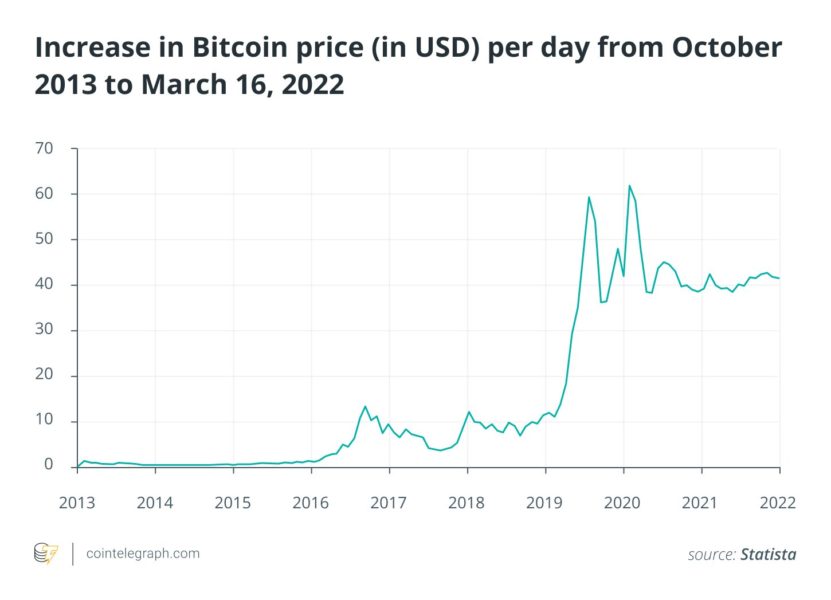

Investors view Bitcoin as a tool to beat inflation though the objective of individual investors might be different such as to book profits, grow their wealth or use it as a store of value. As the exponential increase in Bitcoin prices reveals, the value stored in the cryptocurrency has increased faster than the inflation itself. Even in 2021 — a modest year for Bitcoin — the cryptocurrency grew at 59.8%, considerably better than inflation in most countries.

The following graph explains the increase in Bitcoin price per day from October 2013 to March 16, 2022, in U.S. dollars.

(Source: Cointelegraph / Statista )

- Does Bitcoin work as a hedge against inflation?

Statistics reveal Bitcoin has worked wonderfully well against inflation, much better than assets such as gold, real estate and stocks.

As an asset, Bitcoin works amazingly well against inflation and beats it by a big margin, though you should be careful about extraneous factors like the regulatory environment. Statistics reveal that the odds are much better while storing value in Bitcoin than assets like gold, real estate, stocks and others.

Underlying strengths like limited supply and decentralization propel Bitcoin to a unique position as an asset that can keep inflation at bay.