Growing confidence in Bitcoin and the broader cryptocurrency market has led most institutional investors to plan increased long-term allocations in crypto.

In its annual Future Finance survey, Swiss crypto bank Sygnum found a higher appetite for crypto assets among institutional investors. The survey report, released on Nov. 14 and shared with Cointelegraph, highlighted shifting interests and positive market sentiment toward cryptocurrencies.

Martin Burgherr, Sygnum Bank’s chief clients officer, said more explicit regulations globally were aiding the positive market sentiment among institutional investors. He added:

“Among the most important is perhaps the approval and the subsequent launch of the US Bitcoin Spot ETFs, which has the potential to accelerate the institutional adoption of digital assets.”

A generally positive outlook on crypto

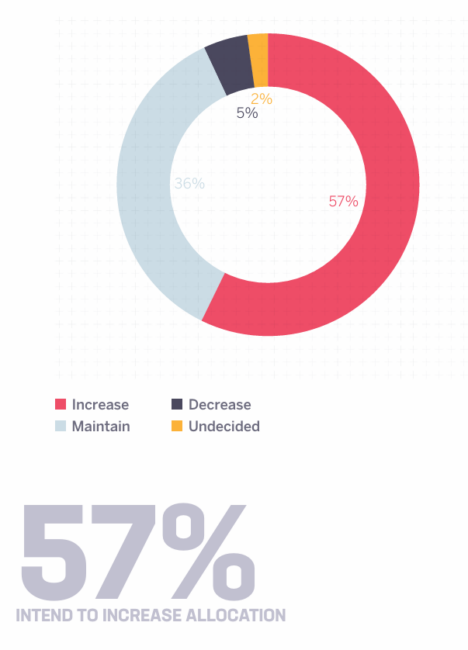

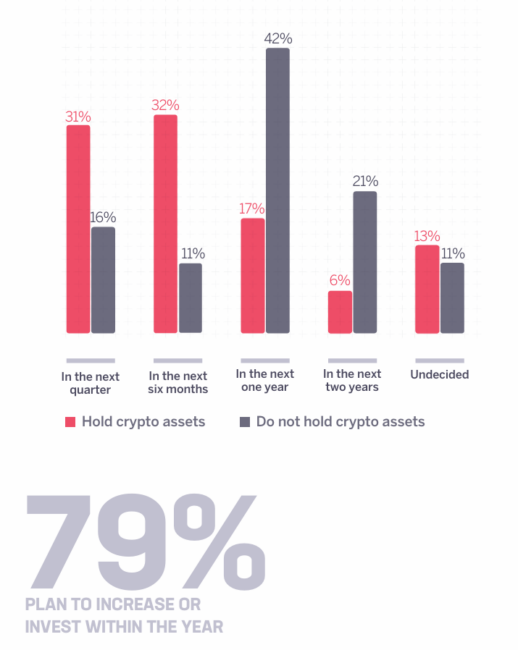

The survey, which included responses from 400 institutional investors across 27 countries, found that 57% — or 228 respondents — plan to increase their crypto allocations, with 31% expecting to do so in the next quarter and 32% within six months.

Demonstrating a generally high-risk appetite among institutional investors, only 5% of the respondents plan to decrease their crypto allocations, while 2% have yet to decide.

Still, 44% of institutions that plan on increasing their crypto exposure will stick with single-token investments. In comparison, 40% opted for an actively managed exposure as their go-to investment strategy.

According to Sygnum, 36% of the institutions that plan on holding their current positions may be awaiting further market confirmation or optimal market entry timing before deciding to increase their crypto allocations.

Regulatory clarity paves the way for increased crypto exposure

Historically, unclear regulations and restrictive investment mandates have been major barriers for traditional investors considering digital assets. As pro-crypto regulations emerge, Sygnum noted that high market volatility, security and custody concerns remain primary obstacles for institutions.

Most institutional investors (81%) said better information on crypto will lead them to invest more — signaling a shift from regulatory concerns to market-specific risks, strategic planning and technology deep dives.

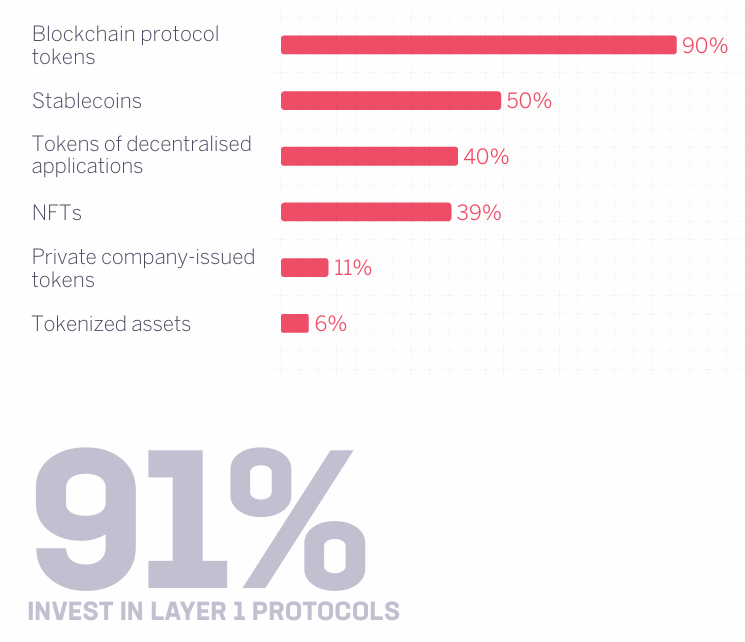

Crypto investment preferences remain high for scalable layer-1 solutions, heavily influenced by Bitcoin, Solana and stablecoins. In addition to exposure to crypto assets, institutional investors have shown a growing interest in Web3 infrastructure, “propelled by the growth of Decentralised Physical Infrastructure (DePIN) and artificial intelligence,” Sygnum noted.

In contrast, interest in decentralized finance has declined owing to constant high-volume hacks that cumulatively drained about $2.1 billion from the ecosystem.

Compared to 2023, the interest of institutional investors has shifted from real estate to equity, corporate bonds and mutual funds.

Source: https://cointelegraph.com/news/institutional-investors-increase-crypto-allocations-sygnum-survey