We seem to have forgotten that cryptocurrencies were created and put into the public spotlight by the same people who had achieved such incredible progress in the IT industry. That is to say, crypto is really the product of IT, not the financial world – a point that many cryptocurrency market forecasters miss.

2022 met the crypto community with intense instability. Bitcoin has almost halved its price, the market as a whole has also dipped heavily, DeFi projects are losing funding, and the regulatory pressure is increasing. I start every morning with fresh stock market reports, and each time I see the unsteadiness continue. Cryptocurrency prices rise or drop at a whim, as the Fear& Greed Index fluctuates around the point of extreme fear.

However, the market for industrial stocks behaves in much the same way, despite the commodity prices not only increasing but for many items setting historical records. So, if the industry is operating at full force, what causes instability of such indices as VIX, DJIA, S&P 500, Nikkei225, Nasdaq 100, or Euro Stoxx 50? The answer is simple: the overvaluation of IT companies, which were also kind of forerunners of digital money as a modern phenomenon.

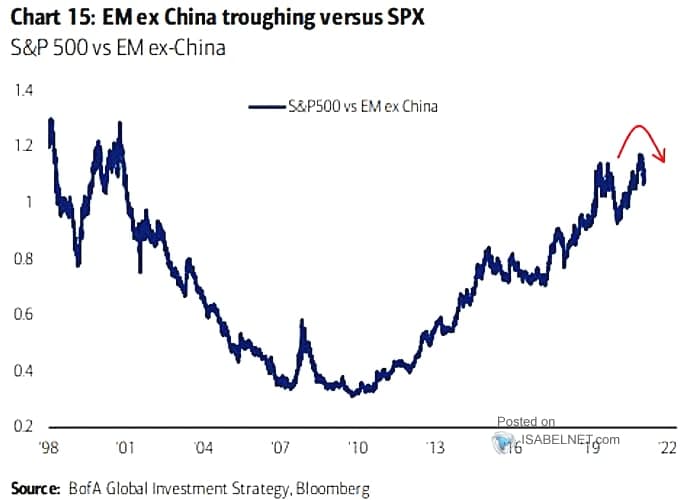

But since the conversation turned to macroeconomics, let’s start from afar. Here is one very important and informative chart:

It shows the S&P 500 compared to emerging markets, excluding China. Has the ratio peaked, as before the market crash in 2001? If this cycle is to continue, the US stock market should decrease to half its current size. Either that or emerging markets will double theirs, which is, to put it mildly, less likely. There is also the third option: the pattern no longer applies, since the central banks of developed countries (especially the Fed) by injecting money into markets (QE, quantitative easing) created an entirely new economy with new rules.

That being said, the US authorities no longer intend to pump the economy with money. During a recent press conference, the FRS Chair Jerome Powell designated the fight against inflation, which has already exceeded 7%, as their primary objective. Powell said that he would probably increase rates at every Fed meeting to follow, but kept them in the same 0-0.25% range for the time. They also reduced the bond-buying program, which is to shut down completely in March. In response, the markets expectedly fell, with the crypto market dropping by about 4% on the day.

Why bring it all up? A large-scale economic stimulus program to oppose the effects of the pandemic helped avoid a major financial crisis but created a different problem – an overflow of money. That is what launched the rapid stock market and cryptocurrency market growth. Simply put, people began to pour excess cash into the most profitable tools to be guaranteed to stay ahead of inflation and make a profit.

Nevertheless, there is no such thing as endless growth, and now we are seeing the first signs that the economic pendulum is about to swing in the opposite direction: a massive wealth gap, declining purchasing power, supply chain breakdown. The market drop was another confirmation, although I do not think it’s here to stay. Such problems today are usually solved by yet another infusion of fiat money into the market, which further reduces their real value.

For the first time since the start of the pandemic, coronavirus has dropped out of the top 3 top market risks, according to the Bank of America’s January survey of fund managers. Only 6% of respondents named COVID a critical threat with unpredictable consequences for the global economy – behind rising interest rates (44%), inflation (21%), a market bubble (9%), and a slowdown in growth (7%). Another emerging fear among investors is asset overvaluation.

Yet, if the money supply goes into a rapid decline (which everything points to), cryptocurrency prices won’t be the only thing to collapse. The impact will affect corporate stocks as well. And while we can assume the industrial companies will endure it quite painlessly, as the real sector is currently operating at max capacity, IT businesses more and more often hear comparisons of the current situation with the dot-com bubble.

More than 220 U.S.-listed businesses with a market capitalization of over $10 billion (including Disney, Netflix, Salesforce, and Twitter) are down at least 20% from their peaks. This list also includes companies that went public in 2021 – Rivian and Coinbase, whose shares have already fallen by 18% and 48%, respectively, since the placement.

The value of nearly 40% of the stocks included in the Nasdaq Composite index, which has a high proportion of fast-growing IT companies, has fallen to half of what was their highest point. At the same time, the index itself dropped only 7%. Such combination has not been seen since 1999, a year before the dot-com crash.

In their 2022 strategy, BofA analysts write how the parallels between the current situation and what was happening before the 2001 crisis are already too many to ignore. When the 1990s bubble of the Internet companies brought down the markets, the S&P 500 index fell by 47% from its peak in March 2000 to September 2003.

What’s more, by some overvaluation metrics, the current market has long surpassed the late 1990s levels: the ratio of stock market capitalization to US GNI (an indicator popularized by Warren Buffett) exceeded 2.8 in Q2 2021, far higher than the 1.9 figure at the height of the dot-com bubble. Another red flag: Of the 309 companies that went public in 2021, three-quarters went unprofitable in the 12 months following the IPO, the same number as during the 2001 crisis.

Finally, today’s stock market is full of “hamsters” – small amateur private investors and traders (a common occurrence in the cryptocurrency market). They were the ones using the money, some of which came from the state, to buy “meme” shares, like AMC and Gamestop, whose capitalization soared several times over, and “dog” cryptocurrencies. Afterward, those private investors rushed to trade options, and now they seem to be looking for a new trendy target for investment.

It is yet another similarity with the late 1990s the analysts detect in the current situation. Back then, private investors also started buying shares of tech companies, and every taxi driver could give you stock market recommendations. Now, many investors are guided by the advice they get from online forums and social networks. The result, however, is predictable: “hamsters” will be “shorn”.

And considering that many of these “hamsters” work in IT companies, if the global IT business this year sees the rerun of the dot-com crash, the industry revenues will fall, and many of them will be left without a job. For cryptocurrencies, this is both bad and good news. The bad news is that crypto investments will decline, as people who have lost income will start withdrawing money into fiat.

The good is that the blockchain industry will quicken its turn from crypto speculation to comprehensive infrastructure projects. And the cost of developers’ labor will decrease, making the project more attractive to investors.