For a lucky few, memecoins can provide a “path to wealth,” but for others, they’re simply a “risky gamble,” Matrixport’s Markus Thielen tells Cointelegraph.

Memecoin buyers are playing the crypto-equivalent of Powerball — with many “playing” in the hopes of scoring “life-changing money,” yet only a few will walk away with the jackpot, says Matrixport’s head of research.

Memecoins have seen a huge resurgence over the last week. Crypto tokens such as Pepe (PEPE) and Milady (LADYS) have boasted staggering price surges despite each having little to no discernable utility.

Speaking to Cointelegraph on May 10, Matrixport’s Markus Thielen suggested some buyers of memecoins bear resemblance to those that participate in the lottery.

“There are numerous studies done on how most people in lower socio-economic classes play the lottery […] as that is their way to get out of their lower economic class,” he said, adding:

“The people that speculate in the lottery are trying to make money lightning fast, and I think that’s very similar with crypto.”

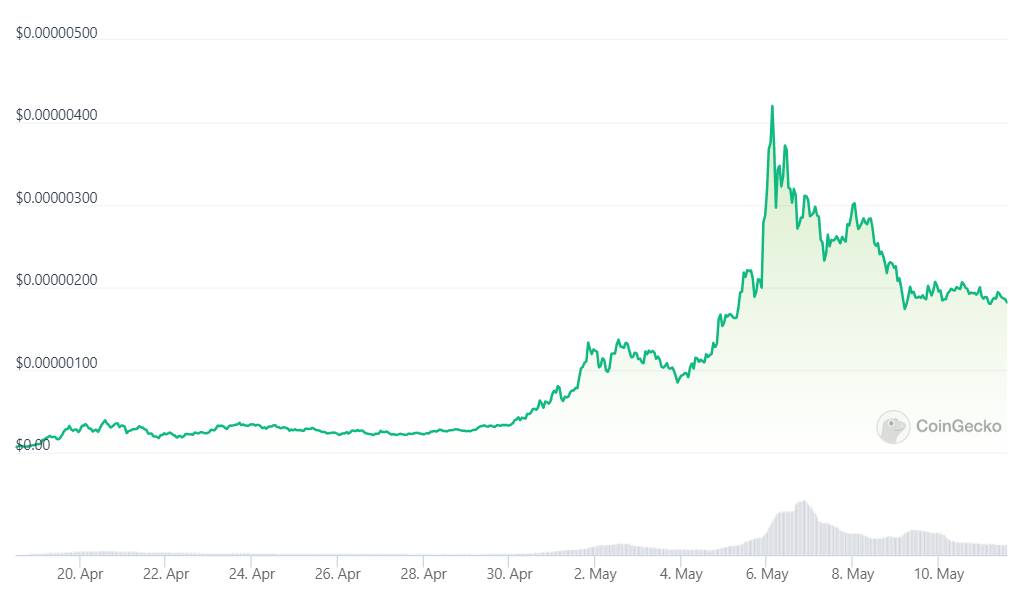

One memecoin that recently gained the attention of enthusiasts is PEPE, a cryptocurrency cashing in on the “Pepe the frog” meme. It launched on April 14 and hit its peak $1.83 billion market cap only weeks later on May 5.

The price of the token plummeted almost as quickly as it rose, however, falling 57% from its peak in just five days, according to CoinGecko, which puts its market cap now well below a billion dollars.

One should not discount the “entertainment” factor of buying memecoins, however.

Dr. Anastasia Hronis, a clinical psychologist who specializes in gambling addiction, believes younger investors are more likely driven by the “fun, entertainment element” of memecoins.

“Many crypto investors might buy memecoins to be a part of a community or for entertainment value.”

However, for the many hoping to gain from their investments, Hronis cautioned:

“Memecoins like PEPE might be fun, but they generally are highly risky investments and can end up holding no intrinsic value in the long run […] Investors are essentially gambling on its popularity, which undermines the principles involved in investing.”

In an emailed statement, Lucas Kiely, chief investment Officer at digital wealth platform Yield App, argued that unlike Bitcoin, Ether and stablecoins, memecoins don’t have the same fundamentals. Their prices are driven solely by “arbitrary factors” such as community sentiment and are “almost impossible to predict.”

“Even the most sophisticated models have been unable to discern any clear patterns,” said Kiely.

Pros and whales still get FOMO too

The unpredictability of memecoins doesn’t mean there isn’t an opportunity for outsized returns. Professional investors and “crypto whales” have been participating in trading them, and will continue to do so

According to data from blockchain analytics firm Lookonchain, “Machi Big Brother,” the online persona of former tech entrepreneur Jeffrey Huang, purchased a total of 73.4 ETH — equivalent to roughly $137,000 — of Pepe in the past few days.

Three other whales also started to buy PEPE on May 9 after prices dropped.

3 whales started to buy $PEPE after the price dropped.

0x50C1 withdrew 1.4T $PEPE($2.76M) from #Binance when the price was $0.000002054.

0x2Baa bought 212B $PEPE($429K) with 223 $ETH($412K) at $0.000001942.

0x3AE8 bought 424B $PEPE($864K) with 450 $ETH($831K) at $0.000001957. pic.twitter.com/Y3wFOshkDI

— Lookonchain (@lookonchain) May 9, 2023

“When the prices are big, it can make sense,” said Thielen. “If it suddenly makes a lot of news and a lot of stories, then I think these people need to be invested as well.”

Thielen, however, cautioned investors in memecoins such as PEPE, where the development team is anonymous, and there is no discernable roadmap.

“The task is to be ahead of others and get out once the momentum is turning. This is why it is important to work with stop loss and stops when trading risky assets,” he said.

“Everybody wants to dunk (sell) on someone in memecoin land […] The question is only who is then holding the bag?”

Source: https://cointelegraph.com/news/memecoins-are-basically-powerball-for-crypto-fans-matrixport-exec