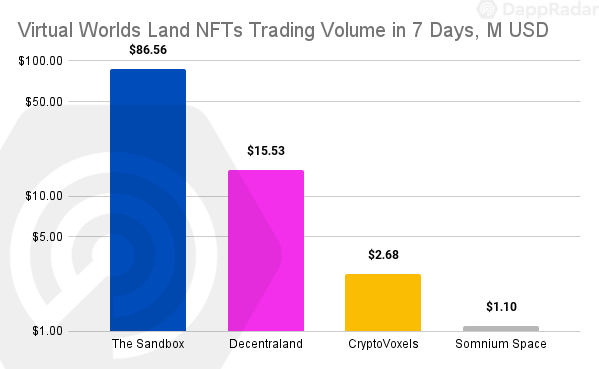

Interest in Metaverse and associated features, like virtual lands and real estate, is in hot demand, available data from DappRadar shows. Over $100 million was spent on purchasing these virtual properties last week, including the Sandbox grossing over $80 million and Decentraland above $15 million.

According to DappRadar, Metaverse-related projects like The Sandbox, Decentraland, CryptoVoxels, and Somnium Space attracted around 6000 traders who cumulatively spent over $100 million on these platforms.

It continued that Sandbox virtual lands grossed the highest amount of investment as $86 million was spent on lands in this virtual world. Its closest competitor was Decentraland who saw investments of more than $15 million for virtual lands, while CryptoVoxels and Somnium Space had relatively lower transactions and traders than their rivals.

(Source: DappRadar )

The price for metaverse land continues to increase as well. Last week, five of the ten most expensive NFT sales were of metaverse land plot NFTs in different virtual worlds.

An exciting revelation from DappRadar’s report is that the metaverse project, despite its relative newness, has been steadily outperforming big NFT-related projects.

“The Sandbox is currently the second most traded NFT collection for the week,” the report said. “Decentraland follows close behind at eighth place. In the meantime, big names in the crypto space like Bored Ape Yacht Club and CryptoPunks are trailing behind, especially in terms of the number of traders interacting with the collections.”

Meantime, Facebook’s rebranding to Meta is attracting attention to the metaverse. While many of these projects had been in existence for the best part of this year, interest in them did not start until Facebook revealed that it would be refocusing its business to the metaverse while renaming its parent company into Meta. Thus, the little-known cryptocurrency Mana, which is the native token of Decentraland, has surged by 400% over the weekend after Facebook announced changing its name.

This move, according to DappRadar, began a “wave of attention towards virtual worlds like The Sandbox and Decentraland.” Already, we have started witnessing big businesses like Adidas already partnering with metaverse-related projects to get a toe into the industry.

In the meantime, digital asset investment firm Grayscale argued in a recent report that Metaverse could become “a trillion-dollar revenue opportunity across advertising, social commerce, digital events, hardware, and developer/creator monetization,” but it did not specify the time frame within which this growth could take place.

Michael Gord, COO at the virtual real estate company Metaverse Group, told The New York Times that skeptics should take account of the trends catalyzed by the ongoing pandemic and that it was “inevitable that the metaverse will be the No. 1 social network in the world.”

“Imagine if you came to New York when it was farmland, and you had the option to get a block of SoHo,” Gord said. “If someone wants to buy a block of real estate in SoHo today, it’s priceless, it’s not on the market. That same experience is going to happen in the metaverse.”