Arbitrum is making moves to become the hub of decentralized derivatives trading and DeFi activity within the layer-2 space.

The total value locked (TVL) in decentralized finance applications on Arbitrum, the layer-2 Ethereum network blockchain, has doubled since the start of 2023.

While investors’ hope of an ARBI token airdrop is a major factor attracting activity to the Ethereum scaling network, the ecosystem’s DeFi growth is also showing robust growth.

Arbitrum has become a major hub for decentralized derivatives trading and offers high yields for crypto yield hunters, reminiscent of wild west DeFi days of 2020.

GMX and Gains Network takeover decentralized derivatives trading

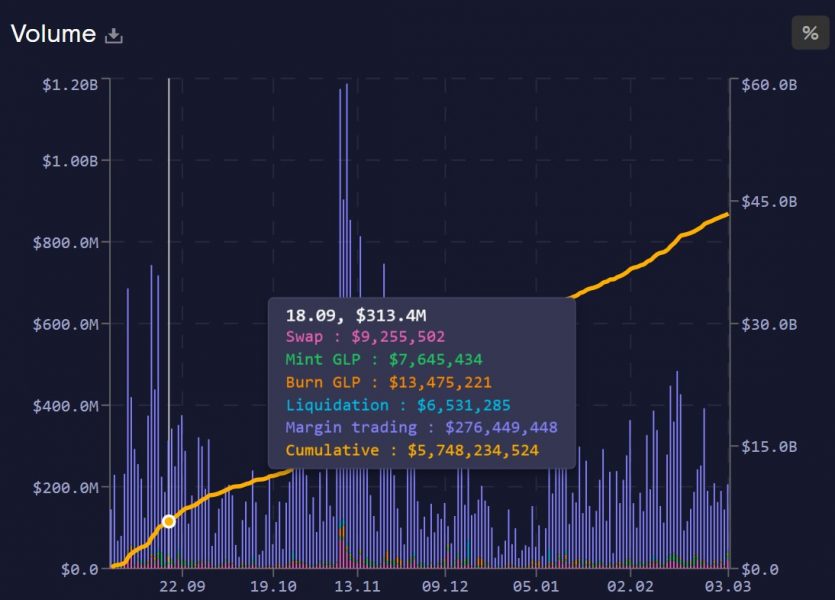

GMX is the leading DApp on Aribitrum, comprising 25% of the network’s total TVL. The perpetual swap trading platform pits traders and liquidity providers against one another. The liquidity providers own GLP tokens, an index of cryptocurrencies and stablecoins that act as trader counterparties. Meanwhile, stakers of GMX tokens earn 30% of the protocol’s fees, so the platform offers real yields without diluting the token’s supply.

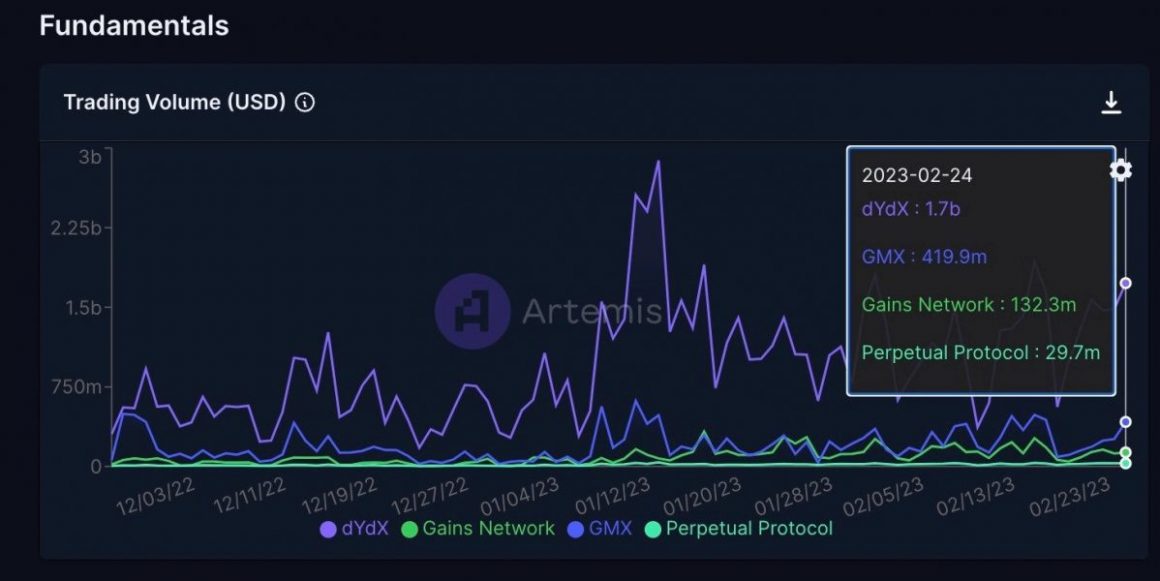

While the trading volume of GMX is nearly five times less than the leading decentralized exchange dYdX, it has started to threaten dYdX’s lead. Interestingly, despite having larger trading volumes, the TVL of dYdX is half that of GMX, possibly due to dYdX inadvertently incentivizing wash trading through DYDX token emissions.

Currently, the GMX platform is limited by the number of tokens traded on the platform, which includes only BTC, ETH, UNI and LINK, whereas dYdX offers perpetual swaps in 36 cryptocurrencies. This will change after the launch of synthetic tokens on GMX, enabling synthetic mints for numerous tokens.

GMX also offers spot trading for specific pairs, making it ideal for integration across other platforms that want to use leverage trading or exchange liquidity. For instance, JonesDAO recently deployed a liquidity provider vault by leveraging GMX’s design.

Gains Network, a synthetic paper trading platform originally on Polygon, added its platform to Arbitrum on Jan. 31, 2022. Since then, the trading activity on Gains has spiked significantly, possibly due to the numerous assets available for trading, including various cryptocurrencies, stock market indexes and gold.

Crypto analytics firm Delphi Digital recently found that Gains Network is close to reaching parity with GMX in terms of trading volume. The feat is commendable because similar to GMX, Gains Network does not incentivize trading activity through token emission. Instead, the platform follows a real yield concept.

The report added that Gains Network had the fourth-highest protocol earnings since September 2022. It will be interesting to see how these platforms compete after the launch of synthetic token trading on GMX.

What is notable is that both platforms are creating a competitive environment for derivatives trading on Arbitrum. The Ethereum layer-2 is slowly positioning itself as the leading platform for decentralized paper trading. Current leader dYdX enjoys a first-mover advantage in this space, but the time spent developing the V2 Cosmos SDK-based version clearly provides an opportunity for a liquidity-rich ecosystem like Arbitrum to prosper.

Arbitrum harbors high risk, high reward plays

Besides derivatives trading, the TVL and token price of many other dApps in the Arbitrum ecosystem have surged since the start of 2023.

Camelot, a decentralized exchange with an efficient revenue-sharing token mechanism, was one of the top gainers in the market in the last few months. The price of Camelot’s native token, GRAIL, jumped 15x since the start of the year, with the protocol’s TVL rising to a record high at $50 million.

Camelot’s token launchpad for public fundraising for Arbitrum ecosystem projects has been an astounding success. Five projects in the ecosystem raised over $20 million in a short period as high yield seekers flocked to the platform for quick gains.

Radiant Network, a cross-chain lending platform whose TVL has increased from $20 million to $120 million year-to-date, also plyed a significant role in expanding Arbitrum TVL. Radiant’s success can be attributed to the platform’s upgrade and improved tokenomics.

The Radiant community smoothened the vesting schedule for tokens and added a 5% liquidity provision requirement to RDNT trading pairs on decentralized exchanges of a user’s total liquidity to earn RDNT emissions. Beyond that, Radiant will also bring to life its cross-chain money market facility with expansion to five more chains.

There’s also evidence of funds accumulating Arbitrum ecosystem tokens. Reportedly, Arca Investments, a digital asset firm, is accumulating Arbitrum ecosystem tokens like GMX, Dopex (DPX), and Radiant Capital (RDNT). Data from Nansen also shows a significant increase in balances for RDNT tokens among smart money wallets identified by the analytics firm.

The DeFi ecosystem development on Arbitrum shows promise for sustainable growth, especially in the decentralized derivatives trading space. There’s a strong possibility that some users could be using Arbitrum only for the ARBI token airdrop. However, the recent Optimism and Blur token airdrops have shown that user activity doesn’t necessarily subside after an airdrop. Instead, it gives an opportunity for platforms to incentivize additional usage.