The unprecedented current economic situation seems to increasingly prove numerous analysts’ predictions and forecasts of market behavior wrong. Let’s take a look at what is happening at the macroeconomic level and how it affects the crypto market.

As you may recall, the emergence of Bitcoin (and therefore all cryptocurrencies) was a response to the financial crisis of 2008. But, strange as it may sound, the situation then was much more straightforward than today. It was obvious to everyone at that point that the global financial system had failed them, and greedy banks (primarily American) were the real culprits of a large-scale economic emergency. Nevertheless, they were also the ones to receive government help – at taxpayers’ expense.

The alignment was clear: “us” (ordinary people and small/medium-sized businesses) against “them” (banks, governments, large corporations). And crypto became a way to ensure our independence from those by whose rules we did not want to play.

Today everything is more complicated. Coronavirus has changed the global economy a lot. Supply chains around the planet were broken up, commodities soared in price, and the central banks of most countries had to turn on the printing press and simply pour money onto the crisis. A significant part of this money eventually flowed into the stock and cryptocurrency markets, triggering major growth.

Unfortunately, it was not reinforced by a similar growth in the real sector of the economy (rather the opposite). As a result, we got an inflating bubble, doomed to eventually burst. However, even those forecasts don’t really mean much as long as the infusion of the economy with money continues.

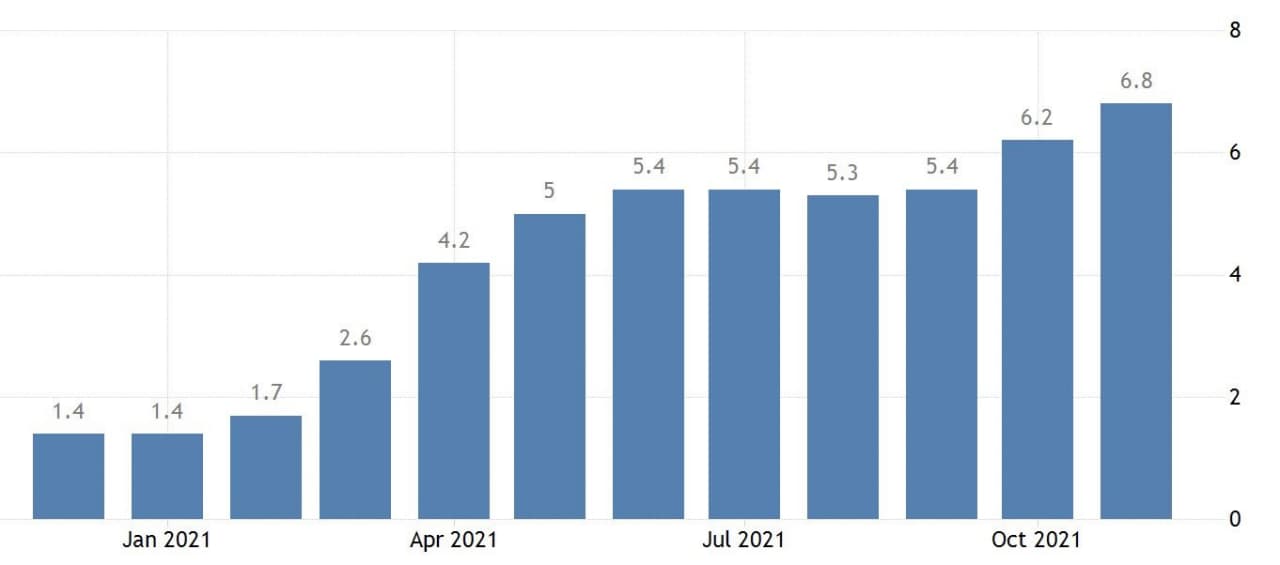

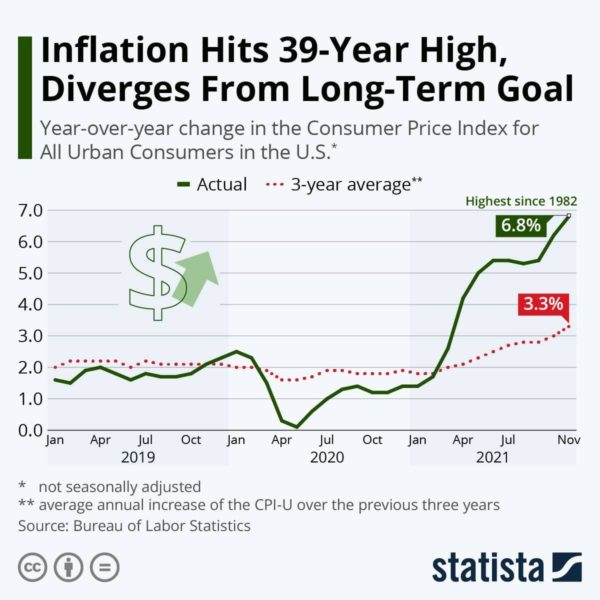

The flip side of this pumping is inflation, made worse by the United States – the world’s largest economy – being the most engaged in pouring cash into its economy. Of course, America exports much of its inflation to other countries through rising commodity costs. But even then, prices are climbing both in the US and globally. It has been especially noticeable over the past year in car rental (grew by 39.1%), energy carriers (30.2%), and used cars (26.4%) prices. Hotel rooms (22.4%), transportation (18.7%), and furniture (12%) got more expensive as well – and those are only the double-digit figures.

Gas became the biggest pressure point. America is a car-driving country, everyone owns an automobile, and public transport is not as developed as in Europe, so price tags at gas stations are an important indicator. They are visible from afar and play a massive role in determining public attitudes. Over the year, those prices have risen by 49.6% – the most of any goods and products.

In the end, the US consumer price index grew by 6.8% in November compared to the previous year – a 39-year high.

The trend is a direct precursor of imminent stagflation, marked by a simultaneous increase in inflation and unemployment. At the moment, we are seeing a decline in unemployment (4.2% in November vs. 4.6% in October) and rising prices caused by supply-side issues, as well as the continued injection of money into the economy.

But for more than a month now, the real demand for labor in the United States has lagged behind the forecasts. The thing is, an artificial increase in the amount of money in the economy has temporarily boosted the prices of housing, securities, and cryptocurrencies, bringing significant benefits to the asset holders. A small part of this wealth seeps into the real economy, but most of it simply circulates in the financial system.

And if even the powerhouse of the US economy cannot reign in the inflation, less fortunate countries end up even worse off. We see this in the example of Turkey, where the local currency has recently depreciated by more than 20% in a single day. Successful by European standards, Poland has also been hit – in November, the inflation rate there exceeded 7.7%.

So the infusion of money into the world economy persists, as weaker countries look at the United States and follow suit. John Maynard Keynes described this process way back in the day: during an economic downturn, he argued, money does not accumulate, but flows from industrial to financial circulation. Cash in the industrial sector sustains the normal production processes, while in financial circulation, it is used for “holding and exchanging existing rights to wealth, including transactions in the stock exchange and foreign exchange market”. The transition of money from industry to finance – from investment to speculation – indicates economic depression.

Throughout 2021 we have seen exactly that: the inflation of the stock market and speculative jumps in cryptocurrency prices. However, when speculation in the digital asset market is not supported by the growth of their real use in the economy, collapse becomes inevitable, as we witnessed back in the winter of 2017-2018. But since then, there has been an influx of too many young new investors into the crypto business.

Not to act as a doomsayer, but in the first half of 2022, we risk seeing a major collapse in both the stock and cryptocurrency markets. The only ones to survive (though I cannot guarantee even that) will be large infrastructure projects that have become platforms for in-demand services. The lucky owners of fast-growing meme-tokens and trendy NFTs, on the other hand, I’m afraid, will have to learn a lesson…