NFT is a huge branch of the blockchain economy that essentially formed before our eyes in 2021. And while few people knew what “non-fungible tokens” even were a year ago, by the end of the year, the most prominent corporations were already integrating NFT solutions into their products, and the market volume amounted to tens of billions of dollars. Let’s take a look at what we can expect from NFT in 2022.

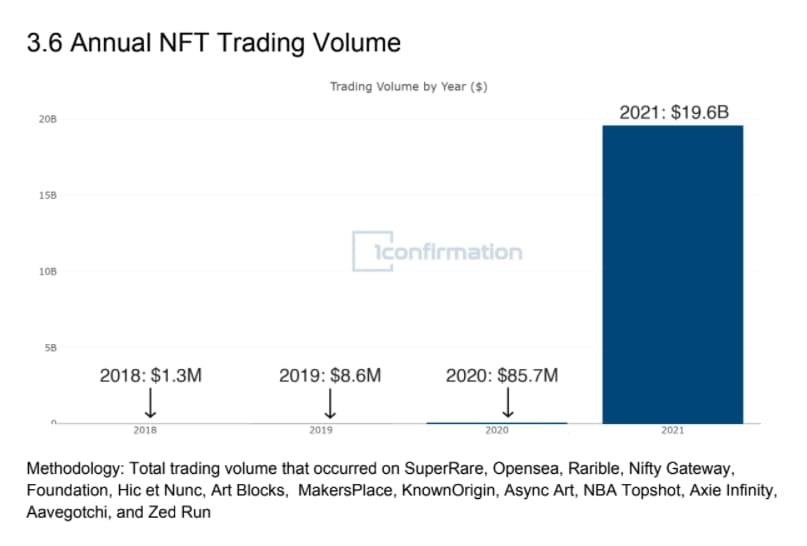

The NFT market volume in 2018 was $1.5 million, in 2019 – $8.6 million, in 2020 – $85.7 million, and in 2021 it soared rapidly to $19.6 billion. Yes, “billions” with a “b”, this is not a typo.

Almost in a blink of an eye, a powerful new branch of the blockchain industry sprung up before us, and it hasn’t stopped growing since. On January 4, the trading volume on the OpenSea NFT marketplace reached $250 million, breaking the September record. That day, 60,000 users made transactions on the site.

2021 was definitely a breakthrough year for NFT, but it seems to be just the beginning. Big brands and celebrities – Adidas, Nike, Visa, Eminem, Snoop Dogg – own NFTs or create their collections of token images. And celebrities who bought Bored Ape Yacht Club (BAYC) NFT collections have more than 500 million social media followers in total.

Dapp Radar provides another fascinating statistic: 2021 saw the sale of $22 billion worth of non-fungible tokens – 220 times more than $100 million paid for all NFTs bought in 2020. As recently as December 2020, sales of all tokens amounted to $8 million, which was a record at the time. The boom began in the first quarter of 2021, when NBA Top Shot tokens entered the market, skyrocketing in price throughout February and March. In March, the volume of NFTs sold on the OpenSea platform exceeded $100 million.

Q1 of 2021 also introduced the world to the first major token creator names. Digital artist Beeple released his “Everydays” collection of 5,000 images, later sold for $69 million. The sale was a sensation that put a huge spotlight on the entire NFT sector. The new phenomenon got the auction houses’ attention: in the first half of 2021, Christie’s began selling NFTs in the form of digital lots. From January to June, sales reached $2.5 billion compared to only $13.7 million during the same period in 2020.

Soon, the Binance exchange realized that it couldn’t allow someone else makes all the money off a new blockchain direction. In June 2021, the exchange launched its major marketplace, starting with selling digital works of 100 authors, including Andy Warhol and Salvador Dali. Following Binance, Huobi and OKEX established their own NFT marketplaces.

The sector expanded like wildfire. By the second half of 2021, search queries on the topic of cryptocurrencies were dominated by the terms “NFT” and later – the “metaverse”. Corporations have also begun to invest in NFTs, seeking to emphasize their involvement with the latest digital world trends. For instance, Visa in August acquired tokens from the CryptoPunks collection.

Around the same time, the gaming industry corporations began actively exploring the new field: the concept of non-fungible tokens was perfect for their products. NFTs have been adopted by Ubisoft, Electronic Arts, Epic Games, and others. The NFT-based game Axie Infinity [AXS] became a massive hit, as it provided an opportunity to earn money by playing, which attracted users from all over the world. In-game transactions reached huge sizes.

NFT-related startups popped up by the hundreds, half of them with their own NFT trading platform. At first, Ethereum hosted most of the marketplaces, but soon they started appearing on other networks that required lower transaction fees and operated faster. Very quickly, many decentralized applications for working with NFTs were launched in Solana, Polygon, and Avalanche.

At one point, the Polygon [MATIC] network also began to slow down due to overload. As it turned out, it had been caused by Sunflower Farmers – an NFT game with the possibility of earning money. Because of it, transaction fees began to rise, and users sometimes were charged 20 times more than usual.

Meanwhile, conventional businesses have also been trying to keep up with the NFT trend. Samsung, for one, decided to add an NFT platform to its new TV models. The users will be able to view works of crypto-art directly on a large TV screen and immediately purchase these pixels if they like them.

At CES 2022, Samsung unveiled its 2022 TV lineup. The new Neo QLED 2022 and selected Smart TV models will later this year get a special section dedicated to gaming. The new models will add support for cloud gaming services, as well as a platform for users to trade NFTs.

Shortly thereafter, we finally got the previously missing link integrating NFT and traditional finance. Decentralized lending platform Credefi announced the launch of NDS (NFT Default Swap) – a tool designed to secure investments on the platform and create a secondary market for asset-backed lending. NDS is intended for all platform participants who wish to hedge their lending activities against credit defaults, allowing them to take riskier positions both in Credefi portfolios and individually.

So far, the cream of the crop has been taken off the market by the OpenSea NFT marketplace, which recently announced the successful completion of a $300 million Series C funding round. It put OpenSea at more than $13 billion.

It hasn’t been smooth sailing all the way through, though: Nate Chastain, the former OpenSea Head of Product, purchased NFTs from authors on the cheap just a few hours before they received permission to place their works on OpenSea. He then sold them at a much higher price. Unsurprisingly, the disclosure of insider trading resulted in Chastain getting fired.

To be continued…