Several macroeconomic indicators suggest that bearish headwinds could strengthen during the remainder of 2023 and possibly negatively impact the crypto market.

It’s been a whipsaw 2023 for investor sentiment, and even though equities markets have defied expectations, a recent report from ARK Invest highlights reasons why the remainder of 2023 could present several economic challenges.

ARK manages $13.9 billion in assets, and its CEO, Cathie Wood, is a strong advocate for cryptocurrencies. In partnership with the European asset manager 21Shares, ARK Investment first applied for a Bitcoin exchange-traded fund (ETF) in June 2021. Its most recent request for a spot BTC ETF, which is currently pending review by the United States Securities and Exchange Commission, was initially filed in May 2023.

Long-term bullish, short-term bearish?

Despite ARK’s bullish view on Bitcoin, which is supported by its research on how the fusion of Bitcoin and artificial intelligence could transform corporate operations by positively impacting productivity and costs, the investment firm doesn’t foresee a straightforward path for a Bitcoin bull run given the current macroeconomic conditions.

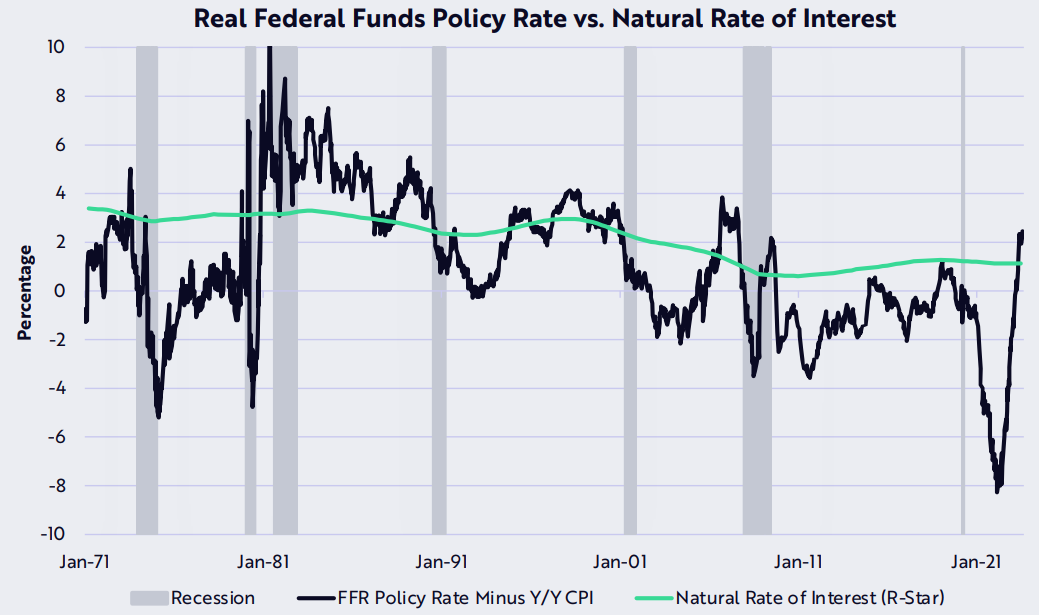

In the newsletter, ARK cites several reasons for its less-than-optimistic scenario for cryptocurrencies, including interest rates, gross domestic product (GDP) estimates, unemployment and inflation. One point is that the Federal Reserve is implementing a restrictive monetary policy for the first time since 2009, as indicated by the natural rate of interest.

The “natural rate of interest” is a theoretical rate at which the economy neither expands nor contracts. ARK explains that whenever this indicator exceeds the real federal funds policy rate, it puts pressure on lending and borrowing rates.

ARK anticipates that inflation will continue to slow down, which would drive up the real federal funds policy rate and increase the gap above the natural rate of interest. Essentially, the report holds a bearish macroeconomic view due to this indicator.

The analysts also focused on the divergence between real GDP (production) and GDI (income). According to the report, GDP and GDI should closely align, as income earned should equal the value of goods and services produced.

However, the most recent data shows that real GDP is approximately 3% higher than real GDI, indicating that downward revisions in production data should be expected.

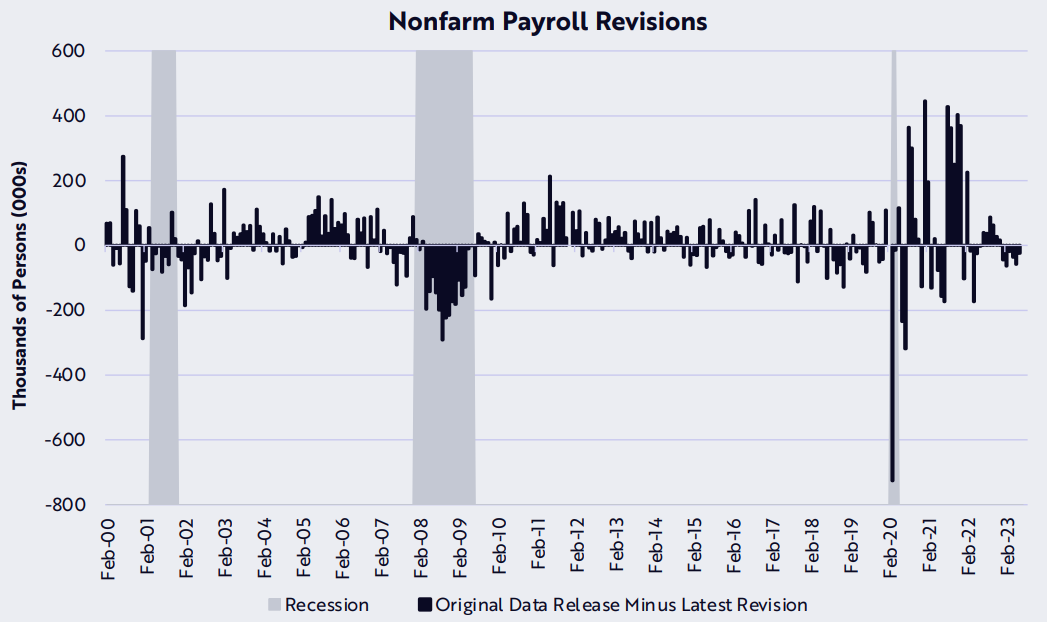

Another focal point was U.S. employment data, and the analysts note that the government has revised these figures downward for six consecutive months.

The chart above highlights a labor market that appears weaker than initial reports indicated. The fact that the last time six consecutive months of downward revisions occurred was in 2007, just before the onset of the Great Financial Crisis, is also notable.

“Stagflation” is usually bearish for risk-on assets

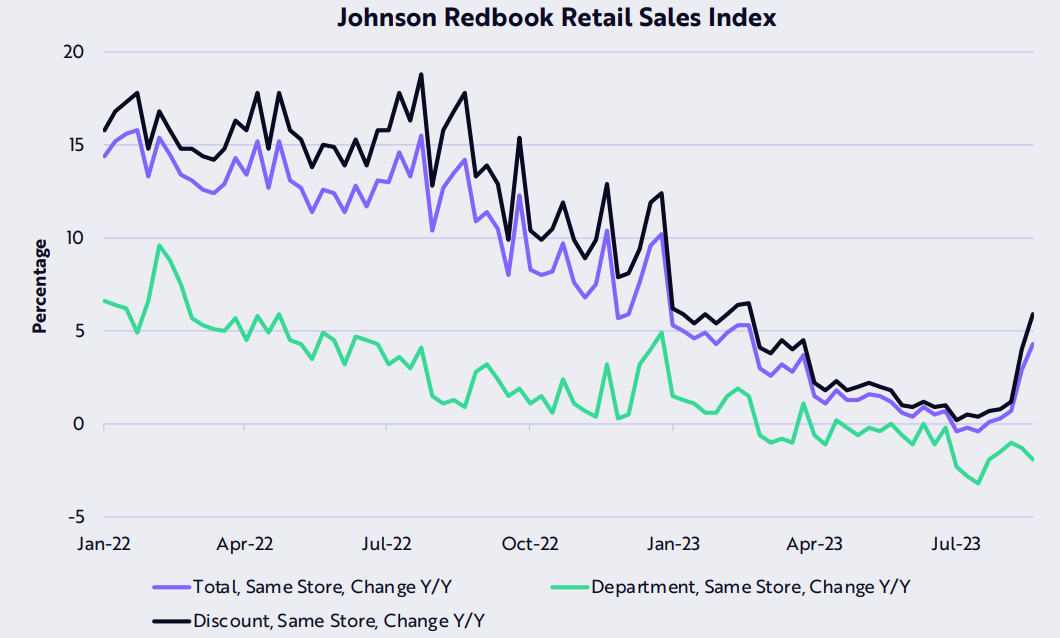

Another bearish development to keep an eye on is “stagflation.” The writers highlight the reversal of the yearlong trend of price discounts driven by increased consumer spending. Referencing the Johnson Redbook Index, which encompasses over 80% of the “official” retail sales data compiled by the U.S. Department of Commerce, it becomes clear that total same-store sales rebounded in August for the first time in 12 months, suggesting that inflation may be exerting upward pressure.

The metrics suggest that ongoing macroeconomic uncertainty could continue in the coming months. However, it does not provide a clear answer regarding how cryptocurrency investors might react if this trend confirms lower economic growth and higher inflation — a scenario typically considered highly unfavorable for risk-on assets.

Source: https://cointelegraph.com/news/persistent-macro-headwinds-could-delay-bitcoin-bull-market-ark-invest