The Reserve Bank of India (RBI) is seeking to expand its cross-border payments platform — which will allow instant settlement — by adding new trading partners in the Asia and Middle East regions.

According to Bloomberg, India already has an agreement with neighboring Sri Lanka, Bhutan, and Nepal, with plans to add the United Arab Emirates (UAE) to its cross-border settlement program.

India is also exploring using central bank digital currencies (CBDCs) as the primary settlement mechanism within its cross-border payment solution.

The Reserve Bank of India’s CBDC is currently a bank-to-bank solution — not a widely adopted consumer-facing central bank digital currency. However, the bank may expand the CBDC to include most retail consumers in the future but has not provided any timeframe for a mass retail CBDC.

India’s CBDC development

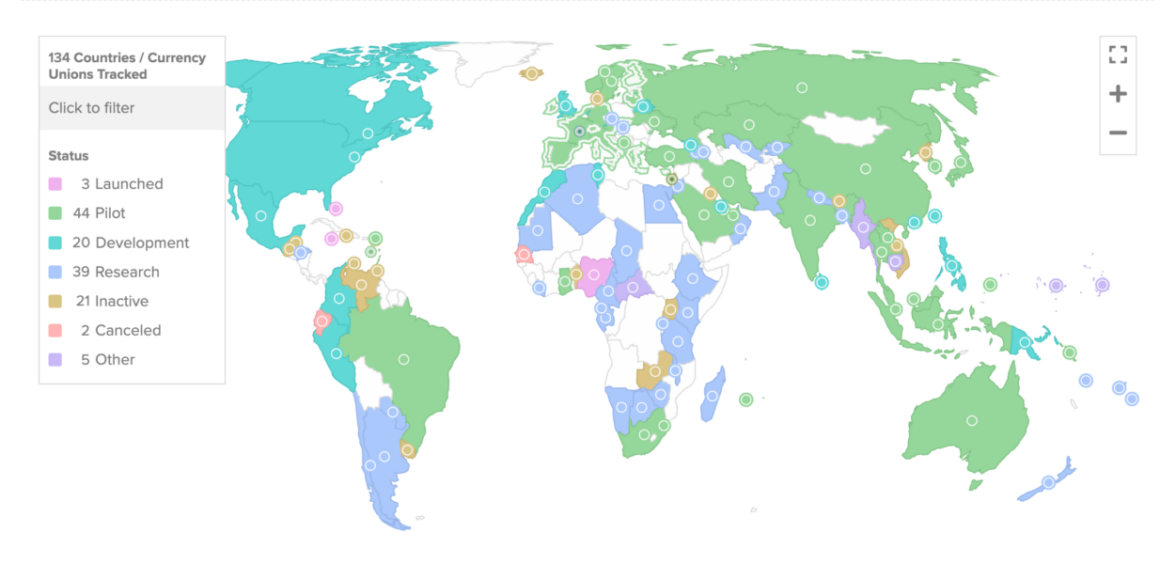

India continues to be one of the biggest proponents of CBDCs globally, along with fellow BRICS members China and Russia. India started exploring the possibility of CBDC settlement in 2020, and in 2022, the Reserve Bank of India began testing CBDC development through pilot programs.

In February 2024, Reserve Bank of India governor Shaktikanta Das said that the bank was working on offline solutions for the digital rupee to encourage the use of the CBDC in the many rural parts of India without robust online connectivity.

India later announced that it amassed approximately 5 million users for its digital rupee pilot program in August 2024. Speaking at the Global Conference on Digital Public Infrastructure and Emerging Technologies, Shri Shaktikanta Das said there was no rush to turn the digital rupee pilot program into a standardized, system-wide CBDC for the Indian population.

During the conference, Das also revealed plans to make sovereign CBDC schemes more interoperable by adopting a “plug-and-play” system that would allow seamless and efficient transactions between different systems.

The push to develop central bank digital currencies has come under heavy criticism from privacy advocates, human rights activists, and liberty-minded individuals. Critics say the dangers of centrally controlled digital ledgers and the potential of abuse by governments far outweigh any cost or efficiency benefits.

Source: https://cointelegraph.com/news/india-expanding-cbdc-cross-border-payments-platform