According to a prominent pro-crypto attorney and Senate candidate, the Securities and Exchange Commission’s (SEC) excessive intervention in the cryptocurrency industry has resulted in retail investors losing over $15 billion.

The US securities regulator has often been criticized for its enforcement-heavy regulatory regime over the cryptocurrency industry.

The SEC should be held accountable for its actions, as its “gross overreach” cost investors $15 billion, according to John Deaton, lawyer and Republican US Senate candidate.

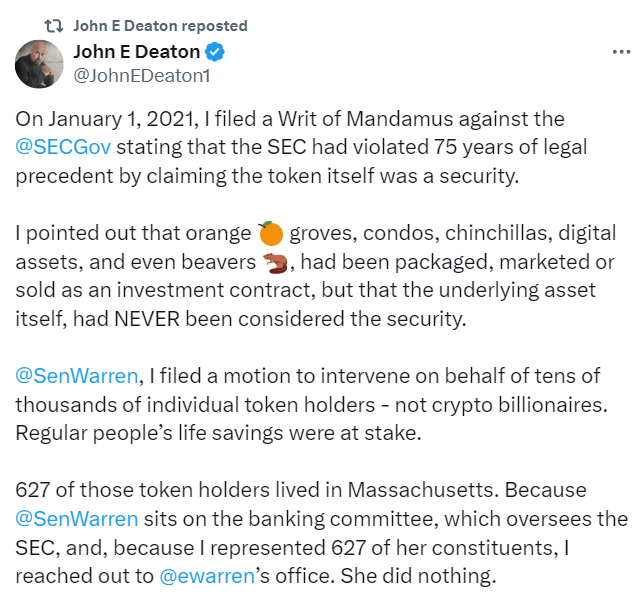

The pro-XRP lawyer wrote in a Sept. 13 X post:

“The SEC’s misconduct and gross overreach caused small investors over $15 billion. On behalf of those 75K small investors I represented, we do not accept the SEC’s apology.”

Deaton added that he intends to hold the SEC accountable for its regulatory actions since Senator Elizabeth Warren “won’t do it.”

Deaton’s statement comes two weeks after the pro-XRP lawyer won the nomination for the US Senate in the Massachusetts primary election and is set to face off against Democratic Senator Elizabeth Warren in November.

SEC no longer views cryptocurrencies as securities: Court filing

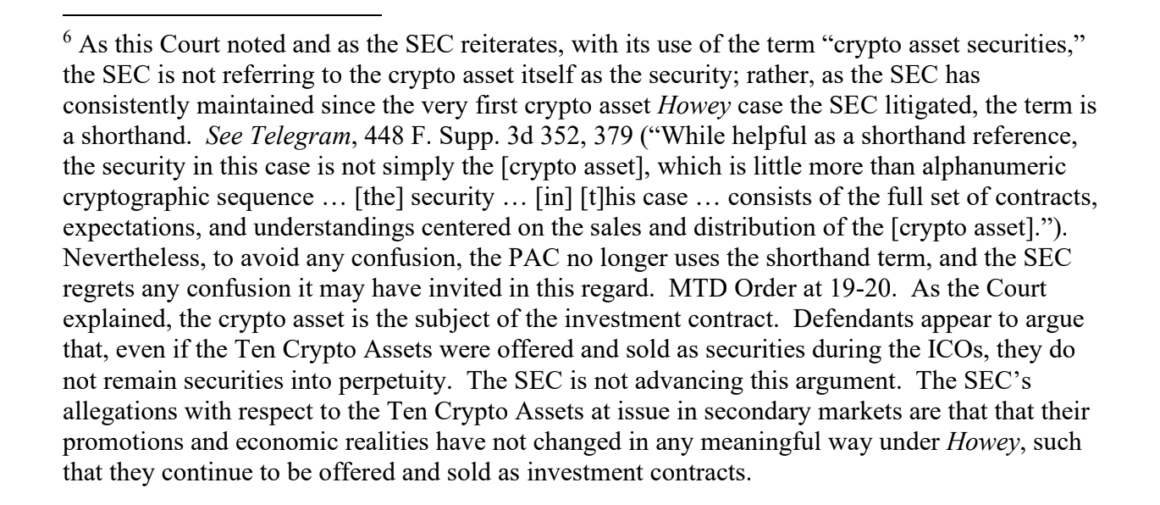

In a drastic shift, the SEC is seemingly backing down from its previous stance that cryptocurrencies are securities.

The SEC clarified that cryptocurrencies themselves are not viewed as securities, according to a court filing shared by Coinbase’s chief legal officer, Paul Grewal, in a Sept. 13 X post.

The SEC wrote in its amended complaint against Binance in the court filing:

“The SEC regrets any confusion it may have invited” by falsely and repeatedly stating that tokens themselves are securities.”

Industry participants saw the statement as an ironic shift, considering that the SEC has previously maintained that the XRP token was a security, which was also highlighted by Deaton:

“All I asked, was for the SEC to honor the law and make clear that the token itself (XRP) was NOT the security. The lawyers at the SEC not only refused to do so, but they attacked me personally.”

On Sept. 12, the SEC settled with eToro, forcing the trading platform’s US wing to cease trading for nearly all crypto assets and pay a $1.5 million fine.

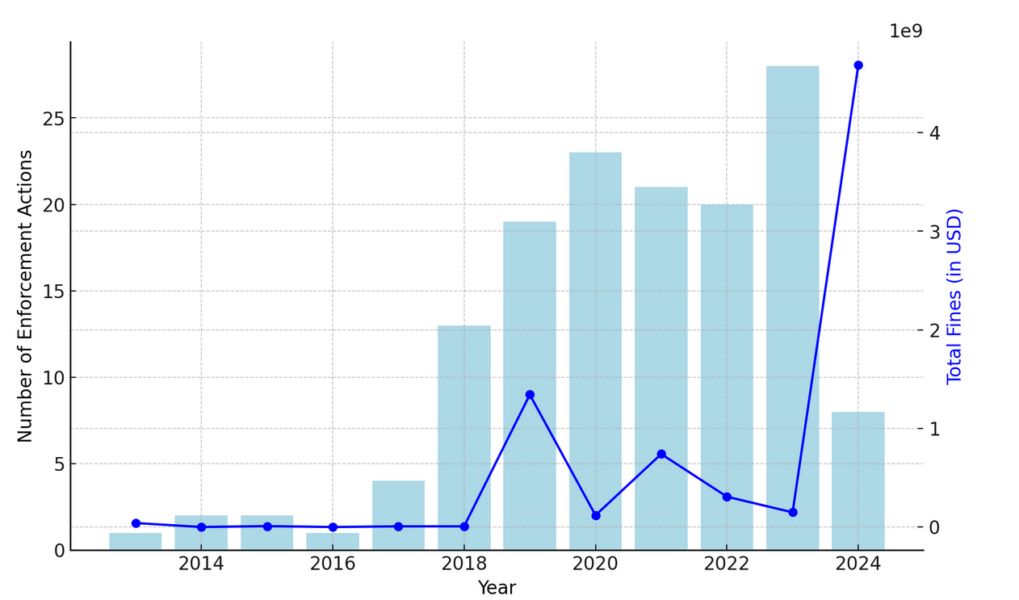

SEC crypto enforcement up over 3,000% since 2023

The US SEC had a record-breaking year for crypto enforcement, even before the eToro settlement.

As of Sept. 10, the SEC imposed nearly $4.7 billion of enforcement actions against crypto firms and executives in 2024, an over 3,000% jump from 2023.

The SEC’s record-setting year was mostly boosted by its massive $4.47-billion settlement with Terraform Labs and its former CEO, Do Kwon, in June — its “largest enforcement action to date,” according to a Sept. 9 report from Social Capital Markets.

The regulator’s 11 enforcement actions in 2024 netted a 3,018% increase from its $150.3 million worth of fines in 2023 despite taking 19 fewer actions against crypto firms.

Source: https://cointelegraph.com/news/sec-crypto-overreach-investors-15b-deaton